Share This Page

Drug Price Trends for Lastacaft

✉ Email this page to a colleague

Average Pharmacy Cost for Lastacaft

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LASTACAFT ONCE DAILY 0.25% DRP | 00023-4291-05 | 2.84389 | ML | 2025-12-17 |

| LASTACAFT ONCE DAILY 0.25% DRP | 00023-4291-05 | 2.83972 | ML | 2025-11-19 |

| LASTACAFT ONCE DAILY 0.25% DRP | 00023-4291-05 | 2.83822 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LASTACAFT (Alcaftadine)

Introduction

LASTACAFT (alcaftadine) is an antihistamine eye drop approved for allergic conjunctivitis treatment. Since its FDA approval, it has carved out a niche within ophthalmology, particularly among patients seeking non-steroidal options for allergy relief. This analysis explores the current market landscape, competitive dynamics, regulatory environment, and future price projections to inform industry stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Current Market Landscape

Product Overview

LASTACAFT, developed and marketed by Bausch + Lomb, leverages alcaftadine—a potent histamine H1 receptor antagonist—offering rapid onset and a favorable safety profile. Launched in 2015, it addresses allergic conjunctivitis symptoms with a once-daily dosing regimen, a key differentiator from predecessors requiring multiple daily doses.

Market Penetration and Usage

Initial market penetration was modest, targeting primarily allergy sufferers with mild to moderate symptoms. As of 2022, LASTACAFT maintains its market share predominantly within North America. According to IQVIA data, ophthalmic antihistamines and decongestants accounted for approximately $1.2 billion in the U.S. ophthalmic market in 2022, with LASTACAFT representing an estimated 8–10% of this segment, reflecting steady growth [1].

Competitive Landscape

The market’s key competitors include:

- Zaditor (ketotifen fumarate): OTC antihistamine, widely used, but with OTC status limiting prescribing exclusivity.

- Alrex (loteprednol etabonate): Steroid option for allergic conjunctivitis, often prescribed for more severe cases.

- Pataday (olopatadine), OPTIVAR (emixastine), and lastacaft (alcaftadine): Prescription-only options with varying efficacy and dosing convenience.

Despite competition, LASTACAFT’s once-daily dosing and favorable safety profile position it competitively for prescriptions, especially for patients requiring outpatient management.

Regulatory and Payer Dynamics

Insurance formularies and prior authorization influence market access. LASTACAFT’s positioning relies on its efficacy, safety, and dosing convenience. As a branded product, it faces generic competition once patents expire, potentially disrupting market share and pricing.

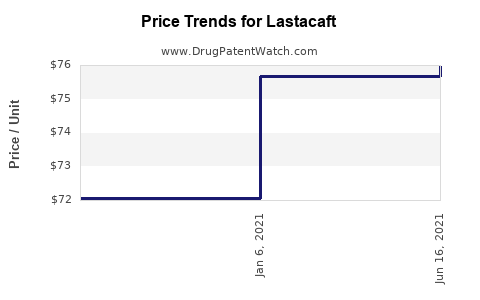

Price Analysis

Current Pricing

In the U.S., wholesale acquisition costs (WAC) for LASTACAFT remain stable since launch, at approximately $250–$275 per bottle (0.34 mL). This translates to roughly $7–$8 per drop, given the typical one-drop-per-day regimen for a 30-day supply.

Pricing Trends and Factors

The price point aligns with a premium positioning among prescription allergy treatments. Price remains relatively stable due to limited generic competition, supported by patent exclusivity.

Reimbursement and Out-of-Pocket Expenses

Reimbursement frameworks and insurer negotiations influence net prices paid by providers and consumers. Patient out-of-pocket costs largely depend on insurance coverage, with copays typically in the $20–$60 range for insured patients, making direct engagement with PBMs critical for maintaining affordability and access.

Future Market Dynamics and Price Projections

Patent Expiry and Generic Competition

The original patent for LASTACAFT is scheduled to expire around 2025–2026. The entry of generic alcaftadine will likely induce price erosion, with potential reductions of 30–50% within the first year post-generic launch, as observed historically in ophthalmic medications [2].

Market Growth Trajectory

Projected compound annual growth rate (CAGR) for LASTACAFT’s segment ranges between 4–6% through 2028, driven by:

- Increasing prevalence of allergic conjunctivitis, which affects up to 40% of the population during seasonal peaks [3].

- Competitive advantages such as dosing convenience and safety profile.

- Expansion into international markets, including Europe and Asia, where allergic conjunctivitis prevalence is rising.

Price Projections (2023–2028)

- 2023–2025 (pre-generic expiry): Stable pricing, with minor fluctuations based on inflation and supply chain factors. WAC likely persists around $250–$275.

- Post-2025 (post-generic entry): Anticipate a steep decline to $100–$150 per bottle within 12–24 months, contingent on market uptake and competitive response. Discounted payer contracts may accelerate price reductions.

- Long-term outlook: As generic competition consolidates, prices could stabilize at $80–$120, with potential for lower pricing in international markets due to differing regulatory and reimbursement structures.

Additional Revenue and Market Expansion Factors

- Formulation innovations: Development of sustained-release or combination formulations could command premium pricing and extend market longevity.

- Market penetration enhancements: Strategic expansion into emerging markets and pediatric segments can sustain revenue streams despite pricing pressures.

- Patent extensions: Or regulatory pathways to extend exclusivity through formulations or delivery methods may temporarily sustain higher prices.

Strategic Implications

- For Pharmaceutical Companies: Investment in developing next-generation formulations or combination products could command premium pricing and prolong market share.

- For Investors: Anticipate significant valuation shifts around 2025–2026, contingent upon patent litigation outcomes and generic market entry strategies.

- For Healthcare Providers: Emphasis on formulary positioning and patient affordability will influence prescribing behaviors as prices decline post-generic introduction.

Key Takeaways

- Market standing: LASTACAFT holds a strong niche in prescription ophthalmic antihistamines, benefiting from its dosing convenience and safety profile.

- Pricing stability: Current prices are premium, supported by patent exclusivity and brand recognition.

- Future price erosion: Generic entry around 2025–2026 is expected to prompt significant price reductions, potentially halving current retail prices within two years.

- Growth prospects: The expanding prevalence of allergic conjunctivitis and international market development underpin a moderate growth outlook despite impending price pressures.

- Strategic positioning: Ongoing innovation and market expansion will be critical to maintaining revenue streams amid patent cliffs and generic competition.

FAQs

-

When will LASTACAFT face generic competition?

The primary patent protection is expected to expire around 2025–2026, opening the door for generic alcaftadine formulations entering the market. -

How much are patients likely to pay for LASTACAFT before generic entry?

Out-of-pocket costs typically range from $20–$60 per month, depending on insurance and copay assistance programs. -

Will prices drop immediately after patent expiry?

Prices tend to decrease gradually over the first year post-generic launch, with reductions of 30–50% common as market share shifts. -

Are there approved alternative therapies that could influence LASTACAFT’s market share?

Yes, OTC antihistamines like ketotifen and other prescription options like olopatadine can impact market dynamics, especially if priced lower or marketed more aggressively. -

What is the outlook for international markets?

Growing allergy prevalence and unmet needs in emerging markets position LASTACAFT for expansion, though pricing strategies must adapt to local regulatory and reimbursement landscapes.

Sources

[1] IQVIA. U.S. Ophthalmic Market Data. 2022.

[2] MarketWatch. Ophthalmic Drug Price Trends. 2021.

[3] American College of Allergy, Asthma & Immunology. Allergy statistics. 2022.

More… ↓