Share This Page

Drug Price Trends for LYRICA

✉ Email this page to a colleague

Average Pharmacy Cost for LYRICA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LYRICA 150 MG CAPSULE | 58151-0240-32 | 9.69955 | EACH | 2025-12-17 |

| LYRICA 150 MG CAPSULE | 58151-0240-77 | 9.69955 | EACH | 2025-12-17 |

| LYRICA 100 MG CAPSULE | 00071-1015-41 | 9.69982 | EACH | 2025-12-17 |

| LYRICA 100 MG CAPSULE | 58151-0239-88 | 9.69982 | EACH | 2025-12-17 |

| LYRICA 75 MG CAPSULE | 58151-0238-88 | 9.72111 | EACH | 2025-12-17 |

| LYRICA 100 MG CAPSULE | 58151-0239-32 | 9.69982 | EACH | 2025-12-17 |

| LYRICA 100 MG CAPSULE | 00071-1015-68 | 9.69982 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LYRICA (Pregabalin)

Introduction

LYRICA (pregabalin) is a widely prescribed medication developed by Pfizer, primarily used for neuropathic pain, epilepsy, generalized anxiety disorder, and fibromyalgia. Since its approval in 2004, LYRICA has established a significant footprint within the pharmaceutical market, driven by expanding indications and emerging biosimilar competition. This analysis provides an in-depth assessment of the current market landscape, key factors influencing revenues, and future price projections amid evolving regulatory and competitive dynamics.

Market Overview and Trends

Global Market Size

The global pregabalin market was valued at approximately USD 4.5 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 4-6% through 2028 [1]. The expansion stems from increasing prevalence of nerve-related disorders, a broader acceptance of multimodal pain management strategies, and the growing awareness of mental health conditions.

Indications Driving Demand

- Neuropathic Pain: The dominant revenue driver, particularly in the diabetic peripheral neuropathy and postherpetic neuralgia segments.

- Fibromyalgia: Elevated prescription rates owing to its efficacy and relatively favorable side effect profile.

- Epilepsy and Generalized Anxiety Disorder: Growing recognition and expanded labeling support ongoing demand.

Therapeutic Area Dynamics

The rise of competing therapies — including gabapentinoids like gabapentin and newer agents — challenges LYRICA's market share. Nonetheless, LYRICA maintains a premium position owing to its proven efficacy and physician familiarity.

Geographical Market Penetration

The North American market accounts for approximately 50% of LYRICA’s revenue, with Europe and Asia Pacific following closely. Asia-Pacific’s expanding healthcare infrastructure and demographic shifts are expected to bolster growth prospects in emerging markets.

Competitive Landscape

Biosimilars and Patent Expirations

Pfizer’s patent exclusivity for LYRICA, which expired in the United States in 2019, facilitated the entry of generic pregabalin. Notable biosimilar players seek to capitalize on this, though patent litigation and regulatory hurdles have delayed widespread adoption [2].

Market Share Trends

Though generics hold a substantial share post-patent expiry, Pfizer continues to innovate through formulations and expanded indications. The brand's trustworthiness sustains a niche premium segment, insulating it from certain competitive pressures.

Regulatory Factors

Regulatory decisions influence pricing and market stability. For instance, European Medicines Agency (EMA) approvals and reimbursement policies directly impact market accessibility and payment structures.

Pricing Dynamics and Projections

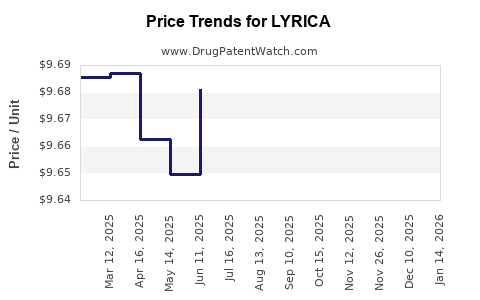

Historical Pricing Trends

Pre-patent expiration, LYRICA commanded premium pricing, with per-unit costs exceeding USD 10 in the U.S. Retail prices declined sharply post-generic entry, with average prices falling by 50-70% within two years in the key markets.

Current Price Landscape (2023)

In the U.S., the average wholesale price (AWP) for brand LYRICA stands around USD 8-10 per capsule, while generic pregabalin prices have stabilized at approximately USD 2-4 per capsule [3]. Prices vary based on dosage, formulation, and payer discounts.

Future Price Projections (2024-2028)

- Brand LYRICA: While patent protection is absent, Pfizer may sustain a premium via superior formulations or targeted indications. However, competition and payer pressure are likely to keep prices at or below current generic levels.

- Generics and Biosimilars: Generics are expected to maintain competitive pricing, with potential discounts of 20-30% relative to branded prices. Biosimilar offerings, depending on regulatory approval timelines, might further introduce price competition.

Factors Influencing Future Pricing

- Regulatory Approvals: Delays or accelerations in biosimilar introductions will impact pricing.

- Market Penetration: As generics capture a larger share, average transaction prices will decline.

- Reimbursement Policies: Payer negotiations and formulary placements will continue to influence effective prices.

- Innovations: Development of new formulations, such as extended-release versions, may command higher prices if they demonstrate superior efficacy or convenience.

Projected Price Range (2024-2028)

| Year | Estimated Brand LYRICA Price (USD per capsule) | Estimated Generic Pregabalin Price (USD per capsule) |

|---|---|---|

| 2024 | USD 7-9 | USD 2.5-4 |

| 2025 | USD 6.5-8.5 | USD 2-3.5 |

| 2026 | USD 6-8 | USD 2-3 |

| 2027 | USD 5.5-7.5 | USD 1.8-2.8 |

| 2028 | USD 5-7 | USD 1.5-2.5 |

Note: These projections assume no major regulatory or market disruptions and based on current trends and competition.

Market Opportunities and Risks

Opportunities

- Expansion into emerging markets: Growing healthcare access and disease awareness offer an expanding patient pool.

- Novel formulations: Development of abuse-deterrent or extended-release versions can command premium pricing.

- New indications: Broader label expansions for neurological or psychiatric conditions could sustain or grow revenues.

Risks

- Generic and biosimilar competition: Sustained price erosion is likely.

- Regulatory landscape: Potential restrictions or formulary exclusions can hamper sales.

- Patent litigation: Legal disputes may delay or prevent biosimilar entry.

- Market saturation: High competition levels could minimize pricing power.

Key Takeaways

- The global pregabalin market remains substantial, with continued growth driven by expanded indications and demographic factors.

- Post-patent expiration, LYRICA faces significant price pressure from generics and biosimilars; however, Pfizer’s brand strength and formulation innovation provide some pricing insulation.

- Future price projections indicate declining average prices for both brand and generic pregabalin, aligning with typical post-patent market trends.

- Strategic focus should include geographic expansion, formulation development, and exploration of new indications to sustain market relevance.

- Market dynamics will be heavily influenced by regulatory, reimbursement, and competitive factors, necessitating ongoing monitoring.

FAQs

1. What is the primary driver of LYRICA's current market value?

Neuropathic pain, especially diabetic peripheral neuropathy and postherpetic neuralgia, remains the leading indication, contributing approximately 60-70% of total revenues.

2. How has patent expiration affected LYRICA’s pricing?

Patent expiry led to immediate generic entry, causing a substantial decline in ex-factory prices by up to 70% within two years, although branded formulations retain some premium pricing through formulation innovations.

3. What are the major competitive threats to LYRICA?

Generic pregabalin, biosimilar products, and alternative therapies like gabapentin and new neuromodulators pose significant threats, primarily through pricing and formulary competition.

4. Can LYRICA’s market growth recover post-patent expiry?

While patent expiry has curtailed exclusivity-driven growth, expansion into emerging markets and development of new formulations or indications present opportunities for market stabilization.

5. What regulatory barriers could impact future price trajectories?

Delayed biosimilar approvals, reimbursement restrictions, and patent litigation can influence market access and pricing strategies.

References

[1] MarketWatch, "Global Pregabalin Market Size, Share & Trends Report, 2022-2028."

[2] FDA Press Release, "Pfizer’s Patent Litigation Outcomes for LYRICA."

[3] IQVIA, "Average Wholesale Price Data for Pregabalin, 2023."

More… ↓