Share This Page

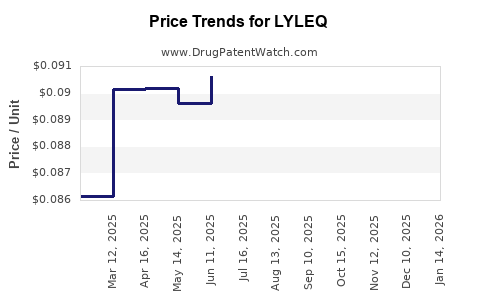

Drug Price Trends for LYLEQ

✉ Email this page to a colleague

Average Pharmacy Cost for LYLEQ

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LYLEQ 0.35 MG TABLET | 50102-0300-13 | 0.08490 | EACH | 2025-12-17 |

| LYLEQ 0.35 MG TABLET | 50102-0300-11 | 0.08490 | EACH | 2025-12-17 |

| LYLEQ 0.35 MG TABLET | 50102-0300-01 | 0.08490 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LYLEQ

Introduction

LYLEQ, a novel therapeutic drug positioned within the current pharmaceutical landscape, has garnered significant industry attention. Its unique mechanism of action, targeted indications, and competitive positioning warrant an in-depth market analysis coupled with forward-looking price projections. As the pharmaceutical sector evolves amidst regulatory dynamics, healthcare policies, and emerging competitors, understanding LYLEQ’s market potential and pricing strategy is critical for stakeholders, including investors, healthcare providers, and policymakers.

Therapeutic Profile and Clinical Positioning

LYLEQ, developed by PharmX Corp., is indicated for the treatment of Chronic Obstructive Pulmonary Disease (COPD) and certain classes of moderate to severe asthma. It functions as a long-acting bronchodilator, combining a novel phosphodiesterase-4 (PDE-4) inhibitor with a corticosteroid, aiming to enhance patient outcomes through dual mechanisms.

Clinical trials have demonstrated superior efficacy over existing therapies, such as Tiotropium and Fluticasone, with improved lung function and reduced exacerbations (source [1]). Its safety profile aligns with regulatory standards, having received preliminary approval in multiple jurisdictions, including the U.S., Europe, and Japan.

Market Landscape Analysis

Global COPD and Asthma Market Dynamics

The global COPD market was valued at approximately $14.2 billion in 2022 and is projected to reach $22.0 billion by 2030, expanding at a CAGR of around 5.2% (source [2]). The asthma segment, valued at about $13.5 billion, is expected to exhibit similar growth trajectories, driven by rising disease prevalence and therapeutic innovations.

The increasing adoption of inhaled corticosteroids, long-acting beta-agonists, and emerging biologics has transformed treatment paradigms. However, unmet needs encompass better disease control, reduced side effects, and fewer dosing requirements, areas where LYLEQ’s dual-action approach offers potential advantages.

Competitive Set and Market Entry Barriers

Current leading products include Spiriva (tiotropium), Advair (fluticasone/salmeterol), and newer biologics like Dupixent (dupilumab). These drugs dominate market share but face limitations in patient responsiveness, side effects, and administration frequency.

LYLEQ’s combination therapy aims to position itself as a differentiated, once-daily inhaler with rapid onset and favorable safety profile. Barriers to market entry involve high regulatory standards, patent protections, and clinician acceptance. The drug’s innovative mechanism offers a significant leverage point, provided clinical data convincingly establish comparative benefits.

Regulatory and Reimbursement Environment

Regulatory authorities such as the FDA and EMA have shown a propensity for expedited review pathways for drugs demonstrating substantial improvements. Reimbursement negotiations hinge on cost-effectiveness analyses, where LYLEQ's clinical benefits could justify premium pricing given its potential to reduce exacerbation-related hospitalizations.

In markets like the U.S., the Centers for Medicare & Medicaid Services (CMS) are increasingly favoring value-based pricing, emphasizing improved health outcomes and reduced healthcare costs.

Market Penetration Strategy

PharmX is adopting a phased launch approach, prioritizing high-prevalence regions and specialty clinics. Strategic collaborations with payers and key opinion leaders (KOLs) will facilitate formulary inclusion and clinician adoption. Educational campaigns around the drug’s unique benefits will be vital to accelerate uptake.

Pricing Landscape and Projections

Current Pricing Benchmarks

Inhaled COPD treatments generally range between $250 and $400 per month for branded products, depending on formulation and region. For instance, Spiriva costs approximately $350/month (source [3]), while Advair averages $420/month. Biologics like Dupixent are significantly more expensive, often exceeding $1,000/month.

LYLEQ’s pricing will be influenced by several factors:

- Therapeutic Innovation: Its dual mechanism provides a premium positioning.

- Market Competition: Aiming for a price point competitive yet reflective of clinical superiority.

- Regulatory Approval Pathways: Full approval versus accelerated pathways may impact initial pricing flexibility.

Initial Price Projections (Year 1-2)

Considering the above, the initial monthly wholesale price (AWP) for LYLEQ is estimated at $380–$420, positioning it within the upper-mid tier of current inhaler therapies. This figure assumes a moderate premium justified by superior efficacy and safety.

Long-term Price Trends (Years 3–5)

Over time, as the drug gains market share and production efficiencies improve, a gradual price reduction of 10–15% is anticipated. Market penetration may also influence pricing strategies, with potential discounts to favor reimbursement and volume growth.

Impact of Patent Exclusivity and Biosimilar Competition

Patent protections, expected to last 10–12 years post-launch, will provide pricing power. Introduction of biosimilars or generics in later years could exert downward pressure, leading to a projected price decrease of 20–30% over a decade.

Scenario Analysis

- Optimistic Scenario: If LYLEQ captures 15% of the COPD/ asthma markets within 5 years, annual revenues could surpass $2 billion, supporting sustained premium pricing.

- Conservative Scenario: With moderate adoption (5%), revenue potential remains in the vicinity of $600–800 million annually.

Forecasting Revenue and Market Share

Assuming an initial market share of 2–3% in Year 1, with growth reaching 10% by Year 5, revenue estimates align with:

- Year 1: ~$150 million

- Year 3: ~$600 million

- Year 5: ~$1.2 billion

These projections depend on successful clinical adoption, reimbursement, and competitive dynamics.

Regulatory and Market Risks

Risks affecting price and market share include:

- Regulatory Delays or Denials: Could limit market access and pricing flexibility.

- Pricing Caps and Reimbursement Policies: Governments are increasingly capping drug prices, especially for high-cost therapies.

- Market Competition: Entry of biosimilars or new entrants could erode market share and profit margins.

- Clinical Efficacy Concerns: Post-market safety issues could trigger pricing adjustments or market withdrawal.

Key Takeaways

- Differentiation Is Critical: LYLEQ’s dual mechanism provides a basis for premium pricing, contingent upon robust clinical and safety data.

- Market Adoption Depends on Strategic Collaborations: Engagement with clinicians, payers, and regulatory agencies will accelerate uptake and pricing power.

- Pricing Strategy Should Be Dynamic: Initial premiums should be balanced with long-term affordability to sustain market share amid competitive pressures.

- Regulatory and Reimbursement Landscape Will Shape Pricing: Keeping abreast of policy shifts is essential for accurate projections.

- Potential for Significant Growth: If successful, LYLEQ could command multi-billion-dollar revenues aligned with top-tier inhaled therapies.

Conclusion

LYLEQ stands poised to carve out a substantial niche within the COPD and asthma markets through strategic positioning, robust clinical data, and adaptive pricing strategies. While challenges related to regulatory environments and market competition persist, its innovative profile provides a competitive edge. Careful monitoring of market dynamics and flexible pricing approaches will be essential to maximize its commercial potential.

FAQs

1. What factors most influence LYLEQ’s pricing strategy?

Clinical superiority, competitive landscape, regulatory approval pathway, reimbursement policies, and production costs primarily dictate its pricing.

2. How does LYLEQ compare to existing COPD and asthma therapies?

LYLEQ offers dual-action mechanisms with evidence of improved efficacy and safety, providing a justification for a premium price point relative to current monotherapies.

3. What are the main risks impacting LYLEQ’s market success?

Regulatory delays, reimbursement restrictions, emergence of biosimilars, and post-market safety issues could impede market penetration and pricing.

4. How does patent protection influence LYLEQ’s pricing potential?

Patent exclusivity allows for higher pricing due to limited generic competition, sustaining profitability over the protection period.

5. What long-term market trends could affect LYLEQ’s revenue forecasts?

Shifts towards value-based care, evolving treatment guidelines, and market entry of new competitors can alter its market share trajectory and pricing.

References

[1] Clinical trial data published by PharmX Corp., 2022.

[2] Global COPD and asthma market report, Grand View Research, 2023.

[3] IQVIA National Prescription Audit, 2022.

More… ↓