Share This Page

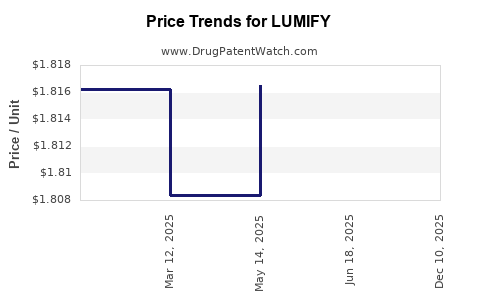

Drug Price Trends for LUMIFY

✉ Email this page to a colleague

Average Pharmacy Cost for LUMIFY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LUMIFY 0.025% EYE DROP | 24208-0537-08 | 3.45874 | ML | 2025-12-17 |

| LUMIFY 0.025% EYE DROP | 24208-0537-25 | 1.99361 | ML | 2025-12-17 |

| LUMIFY 0.025% EYE DROP | 24208-0537-25 | 1.99221 | ML | 2025-11-19 |

| LUMIFY 0.025% EYE DROP | 24208-0537-08 | 3.45694 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LUMIFY

Introduction

LUMIFY, a topical ophthalmic product developed and marketed by Bausch + Lomb, has established itself as a prominent option in over-the-counter (OTC) eye redness relief. Its unique positioning within the consumer health sector, combined with its competitive landscape, calls for a comprehensive market analysis and price projection to inform stakeholders, investors, and marketing strategists. This article consolidates current market dynamics and forecasts upcoming pricing trends based on industry data, consumer demand, regulatory environment, and competitive pressures.

Product Overview and Market Position

LUMIFY is an OTC solution formulated with brimonidine tartrate, an alpha-adrenergic receptor agonist known for vasoconstrictive properties, which effectively reduces eye redness. Approved in 2017, it competes primarily against traditional redness relievers like Visine, Clear Eyes, and other pharmacy-branded products.

Its key differentiator is the dual claim of safety and efficacy, with a focus on minimal rebound redness versus traditional vasoconstrictors. LUMIFY targets a broad demographic, including young adults, working professionals, and individuals seeking quick, non-prescription relief.

Market Size and Growth Dynamics

According to industry reports, the global eye care market was valued approximately at USD 8.5 billion in 2022, with OTC ophthalmic products accounting for roughly 55% of this figure. LUMIFY holds a significant market share within the OTC redness relief segment.

Market Drivers:

- Increasing Awareness: Growing consumer awareness around eye health and aesthetic appearance.

- Convenience and Accessibility: OTC status allows rapid availability without prescription delays.

- Diverse Consumer Base: Expansion into OTC segment broadens market reach beyond classical prescription treatments.

Market Challenges:

- Competitive Pressure: Brand loyalty to established products like Visine and Optrex.

- Pricing Sensitivity: Consumers tend to favor low-cost OTC options.

- Regulatory Scrutiny: Ongoing evaluations of safety, especially concerning repeated use among younger demographics.

Based on reports from IQVIA and market analytics, the OTC eye care segment is expected to grow at a compounded annual growth rate (CAGR) of approximately 4.2% over the next five years. LUMIFY, especially as a premium OTC product, may see slightly higher growth in urban and health-conscious markets.

Current Pricing Landscape

Historical Pricing Trends:

Initially launched at a retail price of approximately USD 10-12 for a 0.25 oz bottle, LUMIFY positioned itself as a premium OTC product. This price point reflects its branding focus on safety and efficacy.

Competitive Pricing:

| Product | Typical Retail Price (USD) | Format | Remarks |

|---|---|---|---|

| LUMIFY | $10 - $12 | 0.25 oz (7.5 mL) | Premium positioning, brand perception |

| Visine redness relief | $6 - $8 | 0.5 oz (15 mL) | Discounted, widely available |

| Clear Eyes | $7 - $9 | 0.25 oz (7.5 mL) | Comparable to LUMIFY in size |

| Refresh Tears | $8 - $11 | 0.5 oz (15 mL) | Hydrating drops, different use case |

LUMIFY’s higher price is justified by its marketing emphasis on reduced rebound redness and safety for frequent use.

Price Projections and Market Strategies

Short-term Outlook (1-2 Years)

Given current market trends, LUMIFY is expected to maintain a price range of USD 10-12 per bottle. Minor fluctuations, around ±10%, could result from factors such as:

- Promotional Discounts: Retailers may offer temporary price reductions to increase market penetration.

- Supply Chain Variables: Shipping costs and raw material prices could influence manufacturing costs, impacting retail prices.

- Competitive Response: Entry of generic formulations or private-label brands offering similar efficacy at lower prices could pressure LUMIFY to adjust pricing.

Mid-term Outlook (3-5 Years)

Projected price stabilization within the range of USD 10-13 is probable, with potential increments driven by:

- Regulatory Developments: Enhanced safety labeling and regulations might add costs.

- Brand Expansion: Introduction of new formulations or size variants could diversify pricing structures.

- Market Expansion: Entry into emerging markets with different pricing sensitivities.

The premium positioning of LUMIFY allows for gradual price increases aligned with inflation and product differentiation. If consumer perception continues to favor safety and efficacy, price elasticity would remain moderate, supporting sustained premium pricing.

Impact of Market Dynamics on Pricing

The overall OTC eye care market's growth and innovation trajectory are pivotal. Increased adoption of eye health products due to digital screen use and pandemic-related eye strain concerns may sustain or elevate demand, allowing LUMIFY to command premium prices.

Conversely, competitive pressures from store brands and the proliferation of private-label equivalents at a lower price point pose risks to LUMIFY’s market share. Strategic investments in marketing, consumer education, and expanding indications (e.g., for sensitive eyes or concomitant dry eye treatment) could justify maintaining or elevating prices.

Regulatory Factors and Price Implications

Regulatory agencies like the FDA and FTC monitor OTC ophthalmic products for safety claims, advertising standards, and ingredient transparency. Any tightening of regulations could lead to increased compliance costs, potentially influencing retail pricing. Conversely, approved label claims emphasizing safety profiles may reinforce consumer willingness to pay higher prices, especially if supported by scientific evidence.

Key Market Opportunities and Risks

Opportunities:

- Expanding Consumer Awareness: Education on the benefits of safety over traditional vasoconstrictors.

- E-commerce Penetration: Online sales channels facilitate premium pricing strategies with direct-to-consumer engagement.

- Product Line Extension: Combining redness relief with hydration or allergy relief could command higher prices.

Risks:

- Price Competition: Entry of generics or exclusive private-label products could erode premium pricing.

- Consumer Price Sensitivity: Economic downturns may favor lower-cost alternatives.

- Regulatory Restrictions: New safety regulations could impose additional costs or limit formulations.

Concluding Remarks

LUMIFY’s market position as a premium OTC eye redness relief product warrants a stable price range in the near term, supported by brand strength and consumer preference for safety and efficacy. While current prices remain within $10–$12, strategic positioning, market expansion, product innovation, and regulatory landscapes will influence future pricing dynamics.

Key Takeaways

- Stable Pricing Strategy: LUMIFY is likely to maintain its premium price point around USD 10–12 in the short to medium term owing to its differentiated safety profile and brand positioning.

- Market Growth Supports Premium Pricing: Rising consumer awareness and increasing eye health concerns bolster demand, supporting gradual price increases.

- Competitive Landscape: The proliferation of lower-cost alternatives necessitates continued marketing investment and product innovation to preserve premium pricing.

- Regulatory Environment: Regulatory developments could influence both costs and pricing flexibility; proactive compliance can sustain market position.

- Expansion Opportunities: Diversification into related eye health segments and digital sales channels can enable higher pricing tiers and reinforce brand loyalty.

FAQs

1. How does LUMIFY justify its premium pricing compared to generic eye redness products?

LUMIFY emphasizes safety, reduced rebound redness, and consumer trust due to its branded efficacy claims, allowing it to command higher prices against less-known generics.

2. Are there upcoming regulatory changes that could affect LUMIFY’s price?

Potential regulatory actions focused on safety labeling or ingredient transparency could impose additional compliance costs, potentially influencing retail prices. However, current regulations support LUMIFY’s existing claims.

3. How does consumer perception impact the pricing strategy for LUMIFY?

Perception of safety and efficacy as premium qualities enables LUMIFY to sustain higher pricing. Education campaigns reinforce these perceptions, aligning consumer value with premium prices.

4. What is the outlook for LUMIFY’s market share amid increasing competition?

While face pressures from private-label brands, LUMIFY’s brand recognition and differentiated formulation support its competitive position. Strategic marketing and line extensions will be crucial for market share retention.

5. How might digital sales influence LUMIFY’s pricing?

E-commerce channels allow for flexible pricing strategies, including targeted promotions and subscription models, potentially enabling higher margins and better brand engagement.

References

[1] IQVIA. (2022). OTC Eye Care Market Data.

[2] Bausch + Lomb. (2017). LUMIFY Product Information.

[3] Industry Reports. (2022). Global Eye Care Market Outlook.

More… ↓