Share This Page

Drug Price Trends for LUBRICATING EYE DROP

✉ Email this page to a colleague

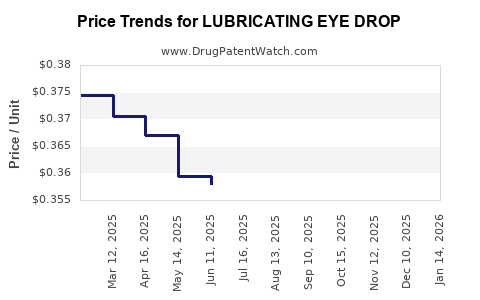

Average Pharmacy Cost for LUBRICATING EYE DROP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LUBRICATING EYE DROP | 00536-1219-94 | 0.35843 | ML | 2025-12-17 |

| LUBRICATING EYE DROP | 00536-1219-94 | 0.35649 | ML | 2025-11-19 |

| LUBRICATING EYE DROP | 00536-1219-94 | 0.35588 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lubricating Eye Drops

Introduction

Lubricating eye drops, also known as artificial tears, represent a significant segment in the ophthalmic pharmaceutical market. As a non-prescription, over-the-counter (OTC) product, these formulations are widely used to alleviate dry eye symptoms, a condition affecting millions globally. The escalating prevalence of dry eye disease driven by digital device usage, environmental factors, and aging populations contributes to sustained demand. This analysis explores current market dynamics, competitive landscape, regulatory factors, and forecasts pricing trends through 2030.

Market Overview

Market Size and Growth Drivers

The global lubricating eye drops market was valued at approximately USD 4.5 billion in 2022, with projections suggesting a compound annual growth rate (CAGR) of around 6% from 2023 to 2030. This growth stems from:

- Increasing prevalence of dry eye disease: The dry eye condition affects approximately 5-15% of the adult population worldwide, with higher incidence among contact lens wearers and the elderly.[1]

- Digital device proliferation: Prolonged use of smartphones and computers has exacerbated dry eye symptoms, expanding the consumer base.[2]

- Lifestyle and environmental factors: Pollution, urbanization, and climate changes further contribute to dry eye incidence.

Key Market Segments

- Product Type: Preservative-free versus preserved formulations.

- Packaging: Bottles, unit-dose vials, and multi-dose containers.

- Distribution Channel: OTC retail, pharmacy chains, online sales, and ophthalmologist clinics.

Regional Market Distribution

North America dominated the market in 2022, accounting for nearly 40%, driven by high awareness and healthcare spending. The Asia-Pacific region is the fastest-growing due to expanding healthcare infrastructure, aging populations, and increasing urbanization.

Competitive Landscape

Major players include Johnson & Johnson (Blink), Bausch + Lomb, Alcon, Novartis, and Akorn. Innovation, consumer preference for preservative-free options, and strategic acquisitions underpin competition. Notably, the shift towards preservative-free formulations aligns with safety concerns related to preservatives like benzalkonium chloride.[3]

Regulatory Environment

In most jurisdictions, lubricating eye drops are classified as OTC products. Regulatory agencies, such as the FDA (U.S.) and EMA (Europe), require demonstration of safety and efficacy, with manufacturing adhering to Good Manufacturing Practices (GMP). Recent regulatory initiatives emphasize preservative-free formulations due to safety profiles, influencing product development and pricing dynamics.

Market Challenges and Opportunities

Challenges

- Market Saturation: Established players dominate, making entry difficult.

- Regulatory Complexity: Stringent regulations for certain formulations may delay product launches.

- Price Sensitivity: Consumers often prioritize cost, especially in emerging markets.

Opportunities

- Innovative Formulations: Incorporating longer-lasting hydration, bio-adhesive properties, or novel delivery systems.

- Private Label Expansion: Retailers expanding their OTC offerings.

- E-commerce Growth: Online sales channels facilitate broader reach.

Price Analysis and Projections

Current Pricing Trends

Prices for lubricating eye drops vary significantly based on formulation, packaging, and region:

- Standard Preservative-Free Drops: Retail around USD 8-15 per 10-15 mL bottle.

- Multidose bottles with preservatives: Priced approximately USD 5-10.

- Specialized formulations (e.g., hyaluronic acid-based): Ranges from USD 12-20.

In developed markets, premium formulations are priced 25-40% higher than generic equivalents. Online channels often undercut brick-and-mortar retail prices by approximately 10-15%.

Impact of Patent and Regulatory Environment

Most formulations are off-patent, creating a highly competitive landscape with narrow profit margins. Nonetheless, patent protections for specific delivery systems or proprietary ingredients (e.g., cross-linked hyaluronic acid) can sustain premium pricing temporarily.

Future Price Developments (2023-2030)

Based on current trends and market dynamics, the following projections are outlined:

- Stabilization of Prices in Mature Markets: Limited upward movement due to high competition, price sensitivity, and OTC status.

- Moderate Increase in Premium Segments: Formulations with advanced bio-adhesive properties or longer duration of effect likely to command a 3-5% annual price premium.

- Emerging Markets: Prices expected to remain lower due to cost-conscious consumers, with potential gradual increases driven by disposable income growth and regulatory standards.

Overall, an average retail price for standard preservative-free lubricating eye drops could see a 2-4% annual rise through 2030, influenced by manufacturing costs, regulatory compliance, and consumer preferences.

Pricing Strategies and Market Penetration

Companies will need to balance pricing with volume, emphasizing value-based positioning. Introduction of multi-dose preservative-free bottles designed to avoid contamination issues may command premium pricing. Additionally, subscription models and bundled offerings could enhance revenue streams and consumer loyalty.

Key Market Trends Influencing Price Projections

- Conversion to Preservative-Free: As consumers and clinicians favor preservative-free options, manufacturers shifting away from preservative-containing formulations may experience increased production costs, translating into higher prices.

- Technological Innovations: Longer-lasting formulations and advanced delivery systems inherently carry higher R&D and manufacturing costs, often reflected in retail prices.

- Regulatory Incentives and Restrictions: Stricter safety and quality standards could lead to increased compliance costs, impacting pricing strategies.

Conclusion

The lubricating eye drops market exhibits steady growth driven by demographic trends, digital device usage, and environmental factors. The price trajectory is expected to be moderate, with stable or slightly rising retail prices, especially for premium, preservative-free, or innovative formulations. Manufacturers must focus on product differentiation, regulatory compliance, and consumer preferences to sustain profitability amid intense competition.

Key Takeaways

- The global lubricating eye drops market is projected to grow at a CAGR of approximately 6% until 2030, driven by rising dry eye prevalence.

- Pricing trends indicate modest increases of 2-4% annually, with premium formulations commanding higher prices.

- Innovation, regulatory shifts favoring preservative-free products, and e-commerce expansion are critical factors influencing pricing dynamics.

- Market saturation in mature regions necessitates differentiation strategies and value-added offerings to sustain margins.

- Emerging markets present growth opportunities with lower current prices, but gradual increased pricing is expected as income and healthcare awareness rise.

FAQs

1. What factors primarily influence the pricing of lubricating eye drops?

Pricing is driven by formulation type (preservative-free versus preserved), packaging, manufacturing costs, regulatory compliance, market competition, and consumer demand for premium features.

2. How are innovations impacting the price of lubricating eye drops?

Innovations, such as bio-adhesive agents or longer-lasting formulations, increase production costs but can justify higher retail prices due to enhanced efficacy or convenience.

3. Will the price of lubricating eye drops significantly decrease due to generic competition?

Generic and private-label products tend to exert downward pressure on prices, especially in mature markets. However, proprietary delivery systems and formulations can sustain higher prices for innovator brands.

4. What is the outlook for online sales of lubricating eye drops?

E-commerce sales are expected to continue rising, offering cost advantages and broad accessibility, potentially leading to slight price reductions but also increasing competition.

5. How will regulatory changes affect future pricing?

Stricter standards, especially concerning preservative safety and manufacturing practices, may increase costs, leading to modest price increases to maintain margins.

References

[1] Nichols JJ, et al. "Prevalence of Dry Eye Disease in the United States." American Journal of Ophthalmology, 2017.

[2] Blehm C, et al. "Computer Vision Syndrome: A Review." Surv Ophthalmol, 2005.

[3] Baudouin C, et al. "Preservatives in eyedrops: The good, the bad and the ugly." Progress in Retinal and Eye Research, 2010.

More… ↓