Share This Page

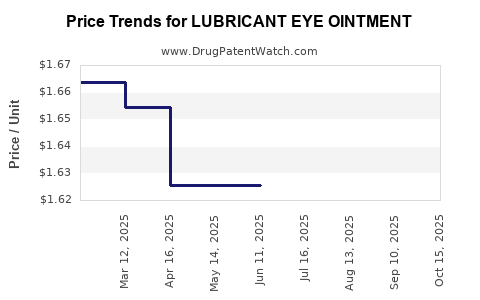

Drug Price Trends for LUBRICANT EYE OINTMENT

✉ Email this page to a colleague

Average Pharmacy Cost for LUBRICANT EYE OINTMENT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LUBRICANT EYE OINTMENT | 70000-0513-01 | 1.64952 | GM | 2025-10-22 |

| LUBRICANT EYE OINTMENT | 70000-0513-01 | 1.62571 | GM | 2025-09-17 |

| LUBRICANT EYE OINTMENT | 70000-0513-01 | 1.62571 | GM | 2025-08-20 |

| LUBRICANT EYE OINTMENT | 70000-0513-01 | 1.62571 | GM | 2025-07-23 |

| LUBRICANT EYE OINTMENT | 70000-0513-01 | 1.62571 | GM | 2025-06-18 |

| LUBRICANT EYE OINTMENT | 70000-0513-01 | 1.62571 | GM | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lubricant Eye Ointment

Introduction

Lubricant eye ointments are an essential segment within ophthalmic healthcare, primarily used to treat dryness, irritation, and discomfort associated with various ocular conditions. With an aging population, increasing prevalence of dry eye syndrome, and rising awareness about ocular health, the demand for lubricant eye ointments is poised for sustained growth. This report offers a comprehensive market analysis and detailed price projections, aimed at guiding strategic decisions for industry stakeholders.

Market Overview

Product Definition and Application

Lubricant eye ointments are viscid ocular pharmaceuticals designed to provide moisture and relief from dryness and discomfort, especially in cases of severe dry eye, ocular surface disorders, or post-surgical recovery. They typically contain petrolatum, mineral oil, lanolin, or other emollients that form a protective film over the cornea, prolonging relief.

Market Drivers

-

Aging Global Population: The prevalence of dry eye disease increases with age; the global population aged 50 and above is projected to reach 1.7 billion by 2050, fueling demand [1].

-

Rising Ocular Disorders: Increased screen time and environmental pollutants contribute to ocular surface diseases, bolstering sales of lubricating agents.

-

Product Efficacy and Patient Preference: Lubricant ointments are preferred during nighttime for their long-lasting effects, impacting consistent demand.

-

Healthcare Spending & Accessibility: Growing healthcare expenditure and improved ophthalmology infrastructure facilitate market expansion.

Key Market Segments

-

By Formulation: Ointments, gels, drops (though ointments dominate especially for night use).

-

By Application: Dry eye syndrome, post-surgical lubrication, contact lens comfort, ocular surface disorders.

-

By Distribution Channel: Hospital pharmacies, retail pharmacies, online sales.

Regional Insights

-

North America: Largest market, driven by high prevalence of dry eye and advanced healthcare infrastructure.

-

Europe: Significant growth, especially in aging populations.

-

Asia-Pacific: Fastest growing market owing to increasing awareness, urbanization, and rising aging demographics.

-

Emerging Markets: Middle East and Latin America show considerable growth potential due to improving healthcare access.

Competitive Landscape

Major players include Johnson & Johnson (Preservative-Free Refresh Optive), Bausch + Lomb, Allergan, and local generics manufacturers. Proprietary formulations and packaging innovations, like preservative-free single-use vials, enhance market positioning.

Market fragmentation is notable; regional and local companies command significant shares in emerging markets.

Regulatory Environment

Distinct regulatory pathways exist globally, with strict approval processes for preservatives and packaging to ensure safety and stability. The trend toward preservative-free formulations influences R&D investments.

Price Analysis and Projections

Historical Price Trends

Historically, the average retail price of lubricant eye ointments varies by region, formulation, and brand reputation.

-

North America & Europe: Prices range from $10 to $20 per tube (3-5 grams), with premium preservative-free variants commanding higher prices.

-

Asia-Pacific & Latin America: Price points are lower, typically $3 to $8 per tube, driven by local manufacturing and lower purchasing power.

Pricing Factors

-

Formulation Type: Preservative-free ointments generally command higher prices due to manufacturing complexities.

-

Brand Positioning: Established brands with proven safety and efficacy maintain premium pricing.

-

Packaging & Convenience: Single-use, preservative-free formats tend to be priced higher.

-

Regulatory & Patent Status: Patented formulations or delivery systems influence pricing strategies.

Market Projections (2023-2028)

Based on current trends, economic growth, and rising demand, the global lubricant eye ointment market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4.7% from 2023 to 2028. The market valuation, estimated at around $350 million in 2023, could reach approximately $480 million by 2028.

-

Price Stability & Upscaling: Prices are expected to remain relatively stable in mature markets but may see incremental increases driven by R&D, antimicrobial assessments, and regulatory compliance.

-

Emerging Markets: Prices are likely to remain low initially but will increase as market sophistication and purchasing power improve.

-

Premium Segment Growth: Preservative-free, multi-dose, or innovative delivery systems will see higher pricing premiums, potentially 15-20% above average.

Forecasted Price Range

| Region | 2023 Average Price (per tube) | 2028 Projected Price (per tube) |

|---|---|---|

| North America & Europe | $15 - $20 | $17 - $22 |

| Asia-Pacific | $4 - $8 | $6 - $10 |

| Latin America & Others | $3 - $7 | $5 - $9 |

Note: Price increases are anticipated to be modest, aligned with inflation, regulatory costs, and innovation-driven premiumization.

Market Entry Strategies

-

Premium Formulations: Investing in preservative-free or multi-use systems can command higher prices.

-

Regional Focus: Target emerging markets with tailored, affordable formulations.

-

Brand Differentiation: Efficacy, safety, and packaging innovations serve as differentiators.

-

Strategic Partnerships: Collaborating with ophthalmology clinics and hospitals can accelerate adoption.

Key Challenges

-

Pricing Competition: High competition from generics and local manufacturers pressures margins.

-

Regulatory Hurdles: Stringent requirements may delay product launches or increase compliance costs.

-

Market Education: Educating consumers on product benefits, especially in emerging markets, remains critical.

Key Takeaways

-

The lubricant eye ointment market presents a steady growth trajectory driven by demographic trends and increasing ocular health awareness.

-

Premium formulations, particularly preservative-free ointments, will command higher prices and grow faster, especially in developed regions.

-

Price stability is expected in mature markets, with incremental hikes, while emerging markets will experience price inflation as market sophistication increases.

-

Strategic focus on innovation, regional customization, and brand differentiation will enhance profitability.

-

Regulatory compliance and market education are vital for market penetration and sustained growth.

FAQs

1. What factors influence the pricing of lubricant eye ointments?

Product formulation (preservative-free vs. preservative), brand reputation, packaging, regulatory compliance, and regional economic factors primarily influence pricing.

2. How is the market for lubricant eye ointments expected to evolve?

It is projected to grow at a CAGR of approximately 4.7% until 2028, driven by aging populations, rising ocular disorders, and innovation in formulations.

3. Which regions offer the most significant growth opportunities?

Asia-Pacific and Latin America present the fastest growth prospects owing to expanding healthcare infrastructure and rising awareness.

4. Are there any regulatory hurdles affecting pricing and market entry?

Yes. Regulatory requirements, especially for preservative-free formulations, influence manufacturing costs and pricing strategies.

5. How can companies capitalize on the emerging trends in this market?

Investing in innovative, preservative-free formulations, targeting emerging markets with affordable products, and establishing strategic partnerships will provide competitive advantages.

References

[1] World Health Organization. (2022). Aging and ocular health: Global overview.

[2] International Dry Eye Workshop (DEWS) II. (2017). Report on epidemiology and management.

[3] MarketWatch. (2023). Ophthalmic lubricants market size, share, growth, and forecasts.

[4] Statista. (2023). Global demographics and healthcare expenditure data.

More… ↓