Last updated: July 27, 2025

Introduction

The global lubricant market encompasses a wide range of products used across various sectors including pharmaceuticals, machinery, automotive, personal care, and industrial applications. Within the pharmaceutical domain, lubricants are specialized formulations designed to facilitate procedures such as rectal, vaginal, or ophthalmic applications, as well as used in the manufacturing of medical devices and pharmaceuticals. This report provides a detailed market analysis and future price projections for lubricants used in the pharmaceutical sector, emphasizing current trends, market drivers, competitive landscape, and pricing strategies.

Market Overview

Scope and Classification

Pharmaceutical lubricants primarily fall into two categories:

- Medical Lubricants: Used in clinical and personal care settings for procedures requiring lubrication, such as catheterization, ocular surgeries, or gynecological examinations. Common ingredients include dimethicone, mineral oils, and glycerin.

- Manufacturing Lubricants: Employed during drug production to ease tablet pressing, capsule filling, or in the machinery involved in manufacturing processes.

The segment of pharmaceutical lubricants commands a niche but growing share within the larger lubricant industry, driven by increasing demand for minimally invasive medical procedures and high-quality manufacturing standards.

Market Size and Growth

As per the latest industry reports, the global pharmaceutical lubricant market was valued at approximately USD 300 million in 2022, with a compound annual growth rate (CAGR) projected around 4–6% over the next five years. The growth trajectory hinges on rising healthcare expenditure, technological advancements, and increasing procedural volumes globally.

Regional Dynamics:

- North America: Dominates the market owing to advanced healthcare infrastructure, high procedural volumes, and regulatory standards.

- Europe: Shows steady growth with an emphasis on high-quality, sterilized lubricants compliant with stringent regulations.

- Asia-Pacific: Exhibits rapid expansion driven by increasing healthcare access, manufacturing hubs, and rising disposable incomes.

Market Drivers

Growing Healthcare Procedures

The global surge in minimally invasive procedures, including catheterizations and diagnostic diagnostics, necessitates high-quality lubricants optimized for safety and efficacy. The aging population further amplifies demand, particularly for urological and gynecological applications.

Regulatory Standards and Quality Focus

Stringent regulatory bodies such as the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency) require pharmaceutical lubricants to meet rigorous safety, biocompatibility, and sterilization standards, fostering innovation and higher quality formulations.

Technological Innovation

Advances in bio-compatible and hypoallergenic lubricants have opened markets for specialized products addressing allergic reactions, sensitivities, and compatibility with various medical devices.

Emerging Markets

Expanding healthcare infrastructure in Asia-Pacific, Latin America, and parts of Africa is creating new opportunities for lubricant manufacturers, supported by global supply chain integrations and increased demand for medical devices.

Competitive Landscape

Major players in the pharmaceutical lubricant market include:

- Johnson & Johnson

- BASF

- Hampton Products International

- Pfizer

- Mixonil

- Fresenius Kabi

These companies focus on product innovation, regulatory compliance, and strategic partnerships to bolster market share.

Market Entry Barriers

High regulatory compliance costs, the need for sterile manufacturing environments, and stringent quality control measures serve as significant barriers for new entrants. Differentiation hinges on formulation stability, biocompatibility, and sterilization efficiency.

Price Analysis and Projection

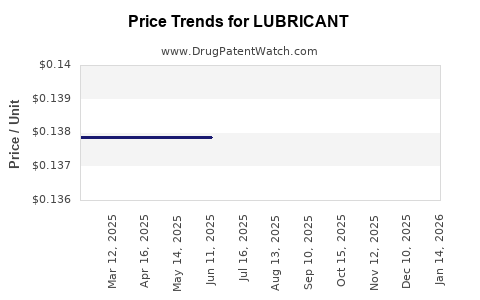

Current Pricing Trends

The price of pharmaceutical lubricants varies significantly depending on formulation complexity, packaging, and regulatory compliance. Typical retail prices range between USD 3 to USD 15 per unit (e.g., per tube or bottle), with premium products (e.g., sterile or specially formulated) commanding higher margins.

Key factors influencing current pricing:

- Formulation Complexity: Advanced, hypoallergenic, or sterile formulations command premium prices.

- Regulatory Compliance: Products meeting stricter standards (e.g., CE marking, FDA approval) tend to be priced higher.

- Packaging: Single-use sterile packages increase production costs but are preferred for safety.

Price Drivers

- Need for high biocompatibility and stability.

- Quality assurance protocols and sterilization processes.

- Packaging innovations that enhance safety and convenience.

- Regulatory and compliance costs.

Future Price Projections (2023-2028)

Based on current market dynamics, the following projections are anticipated:

| Year |

Expected Market Price Range (per unit) |

Notes |

| 2023 |

USD 3.50 – USD 16.00 |

Market remains competitive; premium products maintain higher margins. |

| 2024 |

USD 3.75 – USD 17.00 |

Incremental price increases driven by inflation and regulatory investments. |

| 2025 |

USD 4.00 – USD 18.50 |

Growing demand for specialized lubricants; price differentiation persists. |

| 2026 |

USD 4.25 – USD 20.00 |

Adoption of advanced bio-based and hypoallergenic formulations expands. |

| 2027 |

USD 4.50 – USD 21.50 |

Increased regional demand, especially in emerging markets. |

| 2028 |

USD 4.75 – USD 23.00 |

Market consolidation and higher quality expectations push prices upward. |

Factors Influencing Price Trends

- Regulatory Evolution: Stricter standards may increase R&D and compliance costs, reflecting in product prices.

- Raw Material Costs: Fluctuations in basic chemical prices impact formulation costs.

- Innovation and Differentiation: Introduction of novel ingredients with added functionalities could command premium pricing.

- Supply Chain Constraints: Disruptions (e.g., raw material shortages) could temporarily inflate prices.

Market Challenges

- Stringent regulatory requirements inflating development and compliance costs.

- Price sensitivity in emerging markets due to healthcare budget constraints.

- Counterfeit and substandard products threatening brand reputation and safety standards.

- Competition from alternative lubricants or substitute materials.

Opportunities and Strategic Outlook

- Development of high-performance, hypoallergenic, and biodegradable formulations.

- Expansion into emerging markets leveraging local manufacturing.

- Strategic alliances and collaborations with healthcare providers and regulatory bodies.

- Emphasis on sterilization-friendly formulations to meet evolving clinical standards.

Key Takeaways

- The pharmaceutical lubricant market is modest but steadily growing, driven by increased procedural volumes, regulatory standards, and innovation.

- Price points are likely to escalate gradually over the next five years, with premium products maintaining higher margins owing to quality and compliance benefits.

- Companies investing in bio-compatible, hypoallergenic, and sterilization-optimized lubricants will capture higher-value segments.

- Regional expansion into emerging markets offers significant growth potential but requires navigating diverse regulatory landscapes.

- Cost management, regulatory agility, and innovation are critical for market competitiveness and profit maximization.

FAQs

Q1: What factors influence the pricing of pharmaceutical lubricants?

A: Factors include formulation complexity, regulatory compliance, packaging types, raw material costs, and technological advancements.

Q2: How is the market for pharmaceutical lubricants expected to evolve in the next five years?

A: It will see gradual price increases, driven by rising procedural needs, technological innovation, and stricter regulations, with continued growth in emerging markets.

Q3: What are the main challenges faced by manufacturers in this market?

A: Challenges include high compliance costs, supply chain disruptions, strict regulatory standards, and competition from substandard or counterfeit products.

Q4: Which regions present the highest growth opportunities for pharmaceutical lubricant suppliers?

A: Asia-Pacific, Latin America, and parts of Africa are poised for rapid growth due to expanding healthcare infrastructure and manufacturing capacity.

Q5: What innovations are shaping the future of pharmaceutical lubricants?

A: Developments include bio-based, hypoallergenic, and sterilization-compatible formulations, along with packaging innovations that enhance safety.

References

[1] Industry reports on global lubricant market, 2022.

[2] Pharmaceutical manufacturing standards and regulatory frameworks.

[3] Market intelligence on emerging healthcare markets, 2023.

[4] Price trend analyses from major pharmaceutical lubricant producers.

[5] Technological advancements in biocompatible lubricants, 2023.