Last updated: July 30, 2025

Introduction

Loteprednol etabonate (LE) is a corticosteroid used predominantly in ophthalmology to treat inflammatory conditions such as allergic conjunctivitis, post-operative inflammation, and keratitis. Approved formulations include eye drops, ointments, and gels, with key brands like Lotemax leading the market. This analysis explores current market dynamics, competitive landscape, regulatory environment, and future price projections for LE, providing stakeholders with strategic insights.

Market Overview

Global Market Size and Segmentation

The global ophthalmic corticosteroids market, including loteprednol etabonate, was valued at approximately USD 1.2 billion in 2022, with projections reaching USD 1.6 billion by 2028, growing at a CAGR of 5.3% [1]. LE's share within this segment is significant due to its targeted efficacy and favorable safety profile.

Segmentation:

- By formulation: Eye drops (~75%), ointments (~15%), gels (~10%)

- By indication: Post-surgical inflammation (~40%), allergic conjunctivitis (~35%), keratitis (~15%), others (~10%)

- Geography: North America (~50%), Europe (~25%), Asia-Pacific (~15%), ROW (~10%)

North America remains the dominant market, driven by high prescription rates, robust healthcare infrastructure, and regulatory approvals.

Key Players and Market Share

Leading brands include Lotemax (EyePoint Pharmaceuticals), Alrex (GlaxoSmithKline) (now discontinued in some markets), and generic versions supplied by multiple manufacturers. The patent landscape significantly affects market dynamics; LE's patent protections in U.S. expired in 2022, facilitating generic entry and intensifying price competition.

Regulatory Landscape and Patent Expirations

The expiration of patent protection in key jurisdictions has spurred generic proliferation, reducing prices but increasing competition. Regulatory approvals for generic LE formulations have facilitated market expansion, satisfying demand for more affordable options while intensifying competitive pressures [2].

Market Drivers

- Favorable Safety Profile: Compared to other corticosteroids, LE’s reduced intraocular pressure elevation risk favors its use in sensitive populations.

- Retail and Hospital Prescriptions: A surge in ophthalmic procedures and allergy cases supports consistent demand.

- Emerging Markets: Increasing ophthalmic disease prevalence and expanding healthcare access in Asia-Pacific and Latin America are expanding the market.

Market Challenges

- Pricing Pressures: Post-patent expiration, generic options have driven down prices significantly.

- Competitive Pipeline: Introduction of new corticosteroids and non-steroidal anti-inflammatory drugs may encroach upon LE's market share.

- Regulatory Hurdles: Variability across regions impacts the pace of new approvals and formulations.

Price Trends and Projections

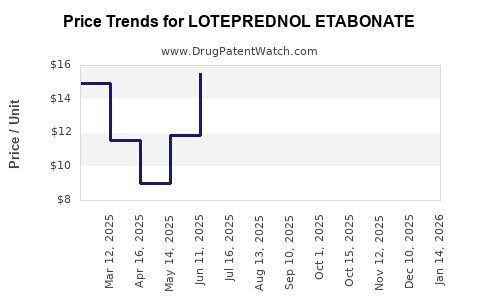

Historical Pricing Dynamics

Prior to patent expiry, branded LE eye drops retailed at approximately USD 150–USD 200 per bottle (10 mL), with premium pricing justified by brand recognition and marketing. Following patent expiration in 2022, generic versions entered the market, causing prices to decline sharply—currently averaging USD 50–USD 80 per bottle in the U.S., representing a 50–60% reduction [3].

Future Price Projections

Considering current market conditions:

- Short-term (1–2 years): Prices of LE generics are expected to stabilize around USD 45–USD 65 per bottle, driven by manufacturing efficiencies and increased competition.

- Mid-term (3–5 years): As patent protections continue to expire globally, further price declines of 10–20% are anticipated, especially in emerging markets.

- Long-term (5+ years): Market saturation and potential entry of biosimilars or alternative therapies could compress prices further, potentially averaging USD 30–USD 50 per bottle.

Factors influencing these projections include inflation, manufacturing costs, regulatory shifts, and payer dynamics.

Pricing Strategies and Market Penetration

Manufacturers may adopt tiered pricing models, offering lower prices in emerging markets to spur adoption, while maintaining premium prices in developed economies. Volume sales, reimbursement policies, and formulary placements will be critical in determining real-world pricing trajectories.

Strategic Outlook for Stakeholders

- Pharmaceutical Companies: Investing in formulation innovations, such as preservative-free options or long-acting formulations, could command premium pricing.

- Payers and Healthcare Providers: Emphasizing cost-effective generic options will influence prescribing behaviors.

- Investors: Monitoring patent landscapes and regulatory pathways will be vital for assessing market growth opportunities.

Conclusion

The LE market faces a mature phase characterized by patent expirations and increasing generics presence, exerting downward pressure on prices. While market penetration remains robust due to clinical efficacy and safety advantages, future price points will likely stabilize at lower levels, especially in cost-sensitive regions. Companies that differentiate through formulation innovations or targeted indications may sustain higher margins.

Key Takeaways

- Patent expiry has significantly reduced LE prices; generics dominate the market, with prices expected to decline further.

- North America and Europe remain primary revenue sources; Asian markets offer growth potential due to rising ophthalmic demands.

- Price stabilization around USD 45–USD 65 per bottle in the short term seems probable, with further declines in the mid to long term.

- Innovation and strategic market positioning will be essential to navigate competitive pressures.

- Stakeholders must adapt to cost pressures by optimizing supply chains and exploring value-added formulations.

FAQs

1. How does patent expiration impact the pricing of Loteprednol Etabonate?

Patent expiration allows generic manufacturers to produce cheaper versions, leading to increased competition and significant price reductions—generally 50% or more—making LE more accessible but reducing revenue margins for original developers.

2. Are there upcoming formulations or delivery systems that could influence LE's market?

Yes, innovations such as preservative-free drops, sustained-release implants, and combination therapies could reshape prescribing patterns, potentially commanding higher prices and expanding market share.

3. Which regions are expected to see the fastest growth in LE demand?

Emerging markets in Asia-Pacific and Latin America are poised for growth due to rising ophthalmic disease prevalence, expanding healthcare coverage, and increased procedural volumes.

4. What are the primary factors influencing future price declines?

Major factors include generic market saturation, manufacturing efficiencies, regulatory approvals, and payer negotiations—all contributing to downward pricing pressure.

5. How can manufacturers remain competitive amid declining prices?

Focusing on formulation innovation, expanding indications, optimizing supply chains, and strategic pricing can help sustain profitability in a mature market.

References

- MarketResearch.com, "Global Ophthalmic Corticosteroids Market Analysis," 2022.

- U.S. FDA, "Patent Expirations and Generic Entry," 2022.

- IQVIA, "Pharmaceutical Pricing and Market Trends," 2022.