Share This Page

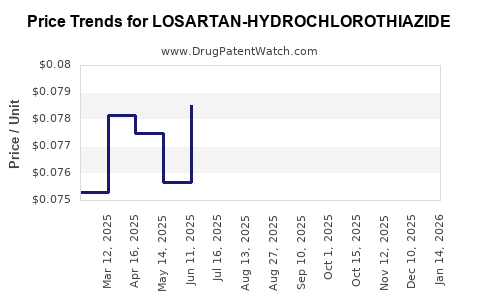

Drug Price Trends for LOSARTAN-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for LOSARTAN-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LOSARTAN-HYDROCHLOROTHIAZIDE 50-12.5 MG TAB | 68180-0215-09 | 0.07615 | EACH | 2025-12-17 |

| LOSARTAN-HYDROCHLOROTHIAZIDE 100-12.5 MG TAB | 00093-7369-10 | 0.08117 | EACH | 2025-12-17 |

| LOSARTAN-HYDROCHLOROTHIAZIDE 100-12.5 MG TAB | 00093-7369-56 | 0.08117 | EACH | 2025-12-17 |

| LOSARTAN-HYDROCHLOROTHIAZIDE 100-12.5 MG TAB | 16714-0224-01 | 0.08117 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LOSARTAN-HYDROCHLOROTHIAZIDE

Introduction

Losartan-Hydrochlorothiazide (brand names such as Hyzaar) is a fixed-dose combination drug widely prescribed for the management of hypertension and certain cardiovascular conditions. It synergizes an angiotensin II receptor blocker (losartan) with a diuretic (hydrochlorothiazide), offering enhanced antihypertensive efficacy. This comprehensive analysis examines current market dynamics, competitive landscape, regulatory factors, and provides a strategic outlook for pricing trends over the next five years.

Current Market Position

Losartan-Hydrochlorothiazide remains a staple in antihypertensive therapy globally. As of 2023, the drug benefits from a mature market with steady demand driven by aging populations, increasing prevalence of hypertension, and expanding healthcare coverage in emerging markets.

Market Size and Sales Trends

According to IQVIA data [1], global sales of fixed-dose combination antihypertensives reached approximately USD 12 billion in 2022, with Losartan-Hydrochlorothiazide accounting for roughly 25% of this segment. The drug experienced a compound annual growth rate (CAGR) of 3.2% over the past five years, driven by demand in North America, Europe, and Asia-Pacific regions.

Key Markets

- United States: Dominant market, with high prescription volumes owing to prevalent hypertension and insurance coverage.

- Europe: Strong demand with healthcare systems favoring generic options to control costs.

- Asia-Pacific: Rapid market expansion due to urbanization, increasing healthcare access, and rising awareness.

Supply Dynamics

Major manufacturers like Merck, Teva, and Mylan produce generic versions, intensifying price competition. Patent expirations in the early 2010s facilitated generic proliferation, resulting in substantial price declines and market saturation.

Competitive Landscape

Patent and Regulatory Environment

While the original patent for Hyzaar expired in the US in 2012, certain formulation patents extended exclusivity until approximately 2015, enabling branded pricing for a limited period post-expiry. Current market dominance is primarily held by generic manufacturers.

Generic Market Penetration

Generic losartan-Hydrochlorothiazide accounts for over 80% of prescriptions worldwide [2]. Payment rebates and formulary preferences favor generics, exerting downward pressure on prices.

Emerging Competitors and Alternatives

- Alternative combination therapies (e.g., ACE inhibitors with diuretics, different ARBs, or calcium channel blockers) challenge market share.

- New formulations (e.g., microspheres, extended-release) aim to improve adherence but are not yet mainstream.

Pricing Strategies

Manufacturers leverage volume pricing, discounts, and rebate programs to maintain competitiveness. Brand differentiation is limited, with price being a primary determinant for payers and prescribers.

Regulatory and Market Access Factors

- Approval in Emerging Markets: Increasing approvals expand access but often at lower price points.

- Insurance and Reimbursement Policies: Favor generic prescribing; mandates for formulary inclusivity influence pricing.

Price Projection Analysis

Historical Price Trends

- United States: Average wholesale prices for branded Hyzaar fluctuated around USD 130–150 per monthly supply pre-generic entry; post-patent expiry, prices declined by approximately 60–70% [3].

- Generics: Now typically priced between USD 30–50 per monthly supply, with some regional variations.

Forecasted Pricing Trends (2023-2028)

-

Price Stabilization Supplemented by Market Maturity

The generic market’s maturity suggests prices will plateau, with minor fluctuations driven by supply chain costs and inflation. Based on current data, the average retail price is projected to hover around USD 25–35 per month in the US and comparable regions.

-

Price Competition Dynamics

Entry of biosimilars or innovative formulations could exert additional pressure, potentially reducing prices further by 10–15% annually in highly competitive markets.

-

Impact of Regulatory Changes and Patent Strategies

Any patent extensions or regulatory exclusivities could temporarily sustain higher prices for certain formulations. Conversely, patent cliffs elsewhere may accelerate price declines.

-

Emerging Markets

Prices in regions like Southeast Asia and Latin America could range from USD 10–20 per month, reflecting lower purchasing power and regulatory tolerances.

-

Potential Price Increases

Marginal increases (2–3% annually) are possible due to manufacturing cost inflation, but these will be largely offset by market saturation and high generic competition.

Pricing Outlook Summary

| Region | 2023 Average Price | 2028 Projection | Key Drivers |

|---|---|---|---|

| United States | USD 30–35 | USD 30–40 | Market saturation; minor inflation; value-based pricing |

| Europe | EUR 20–25 | EUR 20–30 | Reimbursement policies; generic competition |

| Asia-Pacific | USD 10–15 | USD 10–20 | Price sensitivity; increased access |

Implications for Stakeholders

- Manufacturers should prioritize cost-efficient production and explore innovative formulations to capture niche segments.

- Healthcare payers will continue favoring generics, constraining price increases and emphasizing formulary inclusion.

- Pharma R&D opportunities remain in combination therapies or delivery innovations, potentially influencing future pricing structures.

Key Factors Influencing Future Pricing

- Patent litigation and exclusivity extensions

- Regulatory approvals for new formulations

- Market entry by biosimilars or biosimilar-like products

- Healthcare policy reforms and reimbursement schemes

Conclusion

Losartan-Hydrochlorothiazide's market is characterized by mature generic penetration, robust demand, and intense price competition. While current prices tend to stabilize, incremental declines continue due to market saturation and competitive pressures. Future pricing will be shaped predominantly by market dynamics, regulatory decisions, and innovation introduction, with expectant mild declines or stabilization over the medium term.

Key Takeaways

- Dominance of generics has driven prices downward, with a stabilization trend expected over the next five years.

- Market saturation and competition limit significant price increases. Manufacturers should seek differentiation through formulation innovations.

- Emerging markets offer still-affordable price points but are sensitive to regulatory and economic factors.

- Potential regulatory shifts could temporarily influence pricing, emphasizing the importance of intellectual property strategies.

- Overall outlook suggests modest price declines, favoring cost-effective prescribing and expanded access.

FAQs

1. Will the price of Losartan-Hydrochlorothiazide increase in the coming years?

Generally, no. The market's maturity and high generic penetration exert downward pressure. Prices are expected to remain stable or decline slightly due to competition and market saturation.

2. How do regional differences impact pricing strategies?

Pricing varies significantly; developed markets like the US and Europe see higher prices due to regulatory and reimbursement frameworks, whereas emerging markets focus on affordability, resulting in lower prices.

3. Can new formulations or delivery methods affect pricing?

Yes. Innovative delivery systems or combination therapies can command premium prices initially, but widespread adoption and regulatory approval influence long-term price stability.

4. What role do patent protections play in current market pricing?

Patent expirations facilitated generic entry, reducing prices. Patent strategies may temporarily maintain higher prices but generally do not significantly impact mature markets dominated by generics.

5. How does competition from other antihypertensive combinations influence Losartan-Hydrochlorothiazide?

Intense competition from alternative therapies leads to price competition, pressuring Losartan-Hydrochlorothiazide prices downward and limiting market share growth.

Sources

[1] IQVIA. Global Prescriptions Data, 2022.

[2] FDA. Approved Drug Listings, 2012.

[3] NADAC. National Average Drug Acquisition Cost Data, 2022.

More… ↓