Share This Page

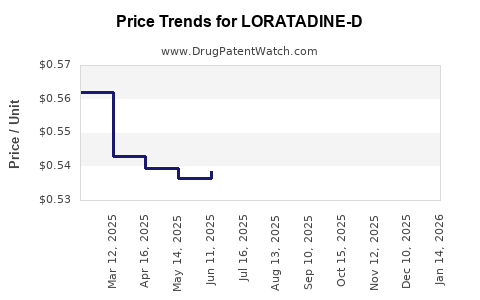

Drug Price Trends for LORATADINE-D

✉ Email this page to a colleague

Average Pharmacy Cost for LORATADINE-D

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LORATADINE-D 24HR TABLET | 00904-5833-48 | 0.55963 | EACH | 2025-12-17 |

| LORATADINE-D 12 HOUR TABLET | 45802-0122-46 | 0.79529 | EACH | 2025-12-17 |

| LORATADINE-D 12 HOUR TABLET | 45802-0122-60 | 0.79529 | EACH | 2025-12-17 |

| LORATADINE-D 24HR TABLET | 00904-5833-15 | 0.55963 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Loratadine-D

Introduction

Loratadine-D, a composite pharmaceutical formulation combining loratadine and pseudoephedrine, serves as an effective treatment for allergic rhinitis, offering relief from nasal congestion, sneezing, and itching. This combination drug has gained substantial market interest owing to its dual-action mechanism, targeting both allergic symptoms and nasal congestion. This report provides a comprehensive market analysis and price projection for Loratadine-D, considering current trends, competitive landscape, regulatory dynamics, and future growth prospects.

Market Overview

Product Profile

Loratadine-D integrates the antihistamine loratadine, marketed widely for managing allergy symptoms, with pseudoephedrine, a nasal decongestant. Its unique formulation addresses multiple symptoms, positioning it as a preferred therapy during allergy seasons. The drug is generally available in tablet form, with varying dosages tailored to age groups and severity of symptoms.

Regulatory Landscape

Loratadine-Containing Drugs: Loratadine's over-the-counter (OTC) availability has facilitated widespread access globally. However, the combination with pseudoephedrine is often prescription-based or requires behind-the-counter sales due to pseudoephedrine's potential for misuse.

Implications: Regulatory restrictions impact supply chain logistics, pricing policies, and market penetration, especially in North America and Europe where pseudoephedrine sale limitations are more stringent.

Market Dynamics

Key Drivers

-

Growing Prevalence of Allergic Rhinitis: The global allergic rhinitis market is expanding at an estimated CAGR of 4.8% (2022–2027), driven by increased urbanization, pollution, and awareness [1].

-

Consumer Preference for Combination Therapies: Patients favor medications that address multiple symptoms, fueling the demand for Loratadine-D.

-

OTC Availability in Emerging Markets: Expansion into emerging economies via OTC channels enhances product reach, contributing to top-line growth.

-

Aging Population: The rising geriatric demographic susceptible to allergic conditions boosts demand.

Market Restraints

-

Regulatory Restrictions: Stringent regulations on pseudoephedrine sales in regions like the U.S. limit accessibility and distribution.

-

Competitive Alternatives: The presence of other non-sedating antihistamines (e.g., cetirizine, levocetirizine) and decongestants reduces Loratadine-D's market share.

-

Brand Loyalty and Generic Competition: Established brands with generic versions exert pricing pressures and capture market share.

-

Side-effect Concerns: Potential adverse effects, especially related to pseudoephedrine (e.g., cardiovascular risks), influence prescribing and consumer acceptance.

Competitive Landscape

Market entrants include both pharmaceutical giants and regional players. Major players include:

- Sanofi: Markets loratadine as Claritin, with potential in combination formulations.

- Johnson & Johnson: Offers various allergy medications, including combination products.

- Teva and Sandoz: Focus on generics, including loratadine and pseudoephedrine combinations.

- Emerging regional players: Focus on OTC sales in Asia and Latin America.

Differentiation strategies revolve around formulation innovations, packaging, and distribution channels. Patent protections primarily cover formulation specifics; however, many formulations are off-patent, intensifying price competition.

Market Size and Revenue Projections

Current Market Size

The global allergy medication market produced approximately $15 billion in 2022, with Loratadine-D representing an estimated 8–10% share, translating to around $1.2–1.5 billion.

Regional Breakdown

- North America: 40% market share; high OTC sales and regulatory restrictions on pseudoephedrine impact volume.

- Europe: 30%; regulated sales with significant prescription-based distribution.

- Asia-Pacific: 20%; fastest-growing due to rising allergy prevalence and expanding OTC channels.

- Rest of World: 10%; emerging markets with significant potential.

Future Growth Projections (2023–2028)

Industry forecasts suggest a compound annual growth rate (CAGR) of approximately 5.2% for Loratadine-D, driven by increasing allergy prevalence and expanding access in emerging markets. Market size is projected to reach $2.0–2.5 billion by 2028.

Price Analysis and Projections

Current Pricing Landscape

Prices vary widely based on region, formulation, and distribution:

- North America: Retail prices for Loratadine-D range from $15 to $25 for a 30-day supply.

- Europe: Slightly lower, averaging €12 to €20.

- Asia-Pacific: Prices are generally lower, approximately $8 to $15.

Generic formulations dominate in most regions, exerting price pressures and offering significant savings to consumers.

Factors Influencing Future Pricing

-

Regulatory Changes: Stricter controls on pseudoephedrine sales could increase distribution costs and influence retail pricing.

-

Manufacturing Costs: Raw material pricing, particularly pseudoephedrine sourcing, influences margins.

-

Market Competition: Entry of generics could lead to price erosion; however, value-added formulations or combination claims may sustain premium pricing.

-

Brand Positioning: Established brands may command higher prices through marketing and perceived quality.

Price Projection (2023–2028)

Considering these factors, average retail prices are expected to decline marginally due to generic competition but could stabilize or even increase in premium markets employing value-added marketing strategies.

| Year | Estimated Average Retail Price (USD) | Notes |

|---|---|---|

| 2023 | $14.50–$17.00 | Current market levels |

| 2024 | $14.00–$16.50 | Entry of additional generics |

| 2025 | $13.50–$16.00 | Market saturation increases |

| 2026 | $13.00–$15.50 | Regulatory pressures or innovation-driven pricing |

| 2027 | $12.50–$15.00 | Price stabilization in competitive markets |

| 2028 | $12.00–$14.50 | Possible premium sales for innovative formulations |

Strategic Opportunities and Risks

Opportunities

- Expansion into emerging markets: With rising allergy-related healthcare investment, these regions offer significant growth potential.

- Formulation innovation: Developing sustained-release versions or combination pills could command premium pricing.

- Direct-to-consumer marketing: Enhancing brand awareness to boost OTC sales channels.

Risks

- Regulatory restrictions: Potential bans or sales limitations on pseudoephedrine could reduce market availability.

- Competitive pressures: The rise of new-generation antihistamines may erode Loratadine-D’s market share.

- Pricing pressures: Growing generic competition may continue to depress prices.

Conclusion

Loratadine-D occupies a strategically important position within allergy therapeutics, with notable growth prospects driven by expanding allergy prevalence and market penetration opportunities in emerging regions. While regulatory and competitive pressures are significant, the drug's unique combination approach offers differentiation, particularly where consumers seek comprehensive symptom relief. Price dynamics are expected to trend downward marginally over the next five years, primarily due to generic competition, but with potential for stable or increased pricing in high-value markets through formulation enhancements and marketing strategies.

Key Takeaways

- The global Loratadine-D market is projected to grow at approximately 5.2% CAGR through 2028, reaching $2.0–2.5 billion.

- Availability restrictions on pseudoephedrine influence regional pricing and distribution, especially in North America and Europe.

- Generic competition exerts downward pressure on prices; however, formulation innovations may sustain premium pricing.

- Expansion into emerging markets presents significant sales opportunities amid rising allergy incidence.

- Regulatory and competitive risks warrant continuous monitoring to adapt market strategies effectively.

Frequently Asked Questions

1. What factors influence the pricing of Loratadine-D globally?

Pricing is affected by regional regulations, raw material costs (particularly pseudoephedrine), competition from generics, and formulation innovations. Regulations restricting pseudoephedrine sales can increase distribution costs, raising prices, while generics typically drive prices downward.

2. How is the market for Loratadine-D expected to evolve in developing countries?

The market in emerging economies is poised for strong growth due to increasing allergy prevalence, expanding OTC channels, and improving healthcare infrastructure. Price sensitivity and regulatory environments will shape market penetration strategies.

3. What competitive threats does Loratadine-D face?

Main threats include the availability of alternative non-sedating antihistamines, consumer preference for oral monotherapies, patent expirations leading to generics, and regulatory limitations on pseudoephedrine sales.

4. Will regulatory restrictions on pseudoephedrine affect the future availability of Loratadine-D?

Yes. Stricter pseudoephedrine controls can limit access and distribution, potentially reducing market size and influencing price dynamics, especially in North America and Europe.

5. What strategic approaches can companies adopt to maximize Loratadine-D’s market potential?

Firms can focus on formulation enhancements, penetrating emerging markets, strengthening brand recognition, partnering with OTC outlets, and navigating regulatory landscapes proactively.

References

[1] MarketWatch. “Allergic Rhinitis Market Size, Share & Trends Analysis Report,” 2022.

More… ↓