Last updated: August 2, 2025

Introduction

LOPRESSOR, a leading beta-adrenergic blocker marketed by AstraZeneca and known generically as metoprolol, remains a cornerstone in cardiovascular therapy. It primarily treats hypertension, angina pectoris, and prevents secondary myocardial infarction. This analysis explores the current market landscape for LOPRESSOR, considers the impact of generics, assesses competitive dynamics, and projects future pricing trends based on patent status, regulatory developments, and market demand.

Market Overview

Pharmacological Profile and Usage

Metoprolol’s efficacy in managing hypertension and ischemic heart disease has cemented its position within the cardiovascular drug class. Its safety profile, combined with widespread clinical approval, ensures continued usage. The drug is available in various formulations, including immediate-release (Lopressor) and extended-release (Toprol-XL), expanding its market reach.

Market Size and Demand Drivers

The global antihypertensive market was valued at approximately USD 25 billion in 2022 and is projected to reach USD 33 billion by 2027, with beta-blockers accounting for a significant share. The aging population, increasing prevalence of hypertension, and the acceptance of metoprolol as first-line therapy drive demand. Additionally, strategic shifts toward preventive cardiology bolster sustained consumption.

Competitive Landscape

Patent Status and Generic Entry

Originally protected by patents expiring around 2004 in the U.S., the market for metoprolol is now predominantly driven by generic manufacturers. The availability of cost-effective alternatives has eroded branded market share but has also intensified price competition. However, patented formulations such as controlled-release versions (e.g., Toprol-XL) often retain exclusivity longer, supporting premium pricing.

Market Competition

Major players include Pfizer, Teva, Mylan, and Sandoz, among others. The high degree of generic penetration constrains the pricing power of originators. Nonetheless, branded versions maintain a niche owing to physician preference, patient compliance, and perceived efficacy.

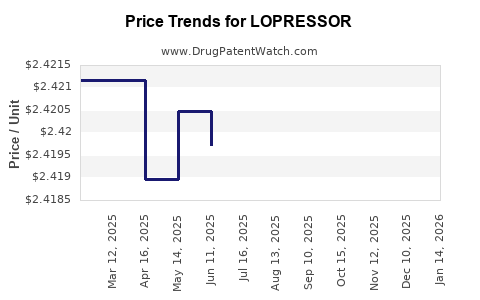

Price Dynamics and Historical Trends

Historically, the entry of generics precipitated a steep decline in LOPRESSOR’s market price. Prior to patent expiry, the drug's price in the U.S. ranged from USD 4 to USD 8 per tablet, depending on dosage. Post patent expiration, prices for generics plummeted to USD 0.20–0.50 per tablet, representing an approximate 85-90% reduction.

In recent years, branded formulations like Toprol-XL have maintained a premium, with prices averaging USD 1.50–USD 3.00 per tablet in the U.S., owing to extended-release advantages. This differential underscores the importance of formulation-specific patent protection.

Current Market Conditions and Price Projections

Factors Influencing Future Pricing

-

Patent and Exclusivity Status: No longer protected in most jurisdictions, signifying that market share is dictated predominantly by price competition.

-

Regulatory Developments: The entry of biosimilar and generic versions continues, exerting downward pressure.

-

Market Penetration and Litigation: Patent litigations, if any, can temporarily influence prices for certain formulations, but generally do not alter long-term trends.

-

Healthcare Policy and Reimbursement: Payers favor generics, leading to reimbursement caps that further suppress prices.

-

Demand Stability: Chronic conditions ensure consistent demand; however, evolving guidelines favor newer combinations or alternative therapies, potentially dampening growth.

Price Projection Model

-

Immediate-Release Metoprolol (Lopressor): In mature markets like the U.S., prices will likely remain near generic levels, averaging USD 0.20–USD 0.50 per tablet over the next five years.

-

Extended-Release Formulations (Toprol-XL): Given patent protections extending until at least 2025 and brand loyalty, prices are projected to decline marginally, stabilizing around USD 1.50–USD 2.50 per tablet. Post-patent expiry, expect a sharp decline toward generic pricing.

-

Regional Variability: Prices in emerging markets such as India and Brazil tend to be substantially lower—USD 0.05–USD 0.10 per tablet—due to local manufacturing and price controls.

Emerging Trends and Impact on Pricing

-

Consolidation of Generics Manufacturers: Increased competition results in further downward pressure.

-

Introduction of Biosimilars and Baseline Therapies: While biosimilars are more relevant for biologics, their emergence signals a broader industry trend toward price erosion.

-

Value-Based Pricing Models: Payers' shift toward value-based contracts may impact future reimbursement rates, indirectly influencing drug prices.

Regulatory and Patent Outlook

Patent cliffs for the core molecule in key markets reduce the likelihood of new proprietary formulations, reinforcing the dominance of generics and consistent low pricing. However, controlled-release versions that rely on secondary patents may escape immediate generic competition, sustaining premium pricing opportunities.

Conclusion

The price landscape for LOPRESSOR (metoprolol) is characterized by significant declines following patent expiration, with generics accounting for the majority of the market. Future price projections show continued stability at low generic prices in mature markets, with marginal declines as market penetration deepens. Branded versions will likely maintain a premium until patent protections expire or alternative formulations evolve.

Key Takeaways

-

Market Penetration: Generics dominate, exerting downward pressure on pricing, with prices expected to remain close to wholesale generic levels over the next five years.

-

Pricing Trends: Post-patent expiry, prices may decline by up to 90%, with branded versions maintaining premiums until patent expirations.

-

Regional Differences: Prices vary widely; emerging markets offer significantly lower prices than developed markets due to local manufacturing and regulatory controls.

-

Strategic Considerations: Companies should monitor patent expiry timelines, formulation-specific protections, and evolving regulatory policies to anticipate pricing shifts.

-

Market Stability: Despite aggressive generic competition, the chronic nature of indications ensures steady demand, supporting volume sales despite low unit prices.

FAQs

1. When will patent protections for branded formulations of LOPRESSOR expire?

Most primary patents for immediate-release metoprolol have expired globally since 2004. Extended-release formulations like Toprol-XL benefit from secondary patents extending exclusivity until approximately 2025-2027, after which generics will dominate.

2. How does the presence of generics impact the price of metoprolol?

Genetic entry causes a sharp decrease in the drug's price—often by over 85%. Branded formulations retain higher prices due to formulation advantages and patent protections but generally decline ahead of patent expiry.

3. What are the prospects for brand-name maintenance in the coming years?

Brand names will likely maintain a pricing premium until patent expirations or loss of regulatory exclusivity. Post-expiry, they will face steep price reductions, similar to current generic pricing levels.

4. How do regional differences influence metoprolol pricing?

In developing markets, prices are substantially lower due to local manufacturing, price controls, and lower purchasing power, whereas in developed markets, prices remain higher but are under pressure from generic competition.

5. Are there emerging therapies likely to impact the metoprolol market?

Yes. Newer antihypertensive agents and combination therapies may influence future demand. Additionally, novel formulations or delivery systems could provide therapeutic advantages, potentially impacting pricing strategies.

References

[1] MarketWatch, “Global Antihypertensive Drugs Market,” 2022.

[2] IMS Health Data, “Cardiovascular Drugs Market Trends,” 2022.

[3] AstraZeneca, “LOPRESSOR Product Information,” 2022.

[4] U.S. Patent Office, “Patent Expirations for Metoprolol,” 2004-2025.

[5] IQVIA, “Generic Drug Market Analysis,” 2022.