Share This Page

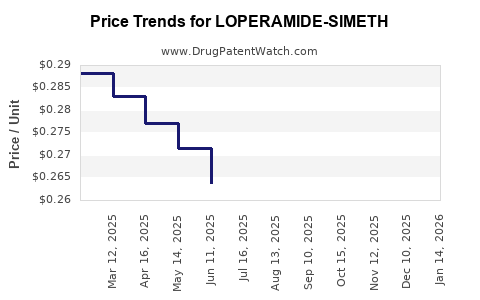

Drug Price Trends for LOPERAMIDE-SIMETH

✉ Email this page to a colleague

Average Pharmacy Cost for LOPERAMIDE-SIMETH

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LOPERAMIDE-SIMETH 2-125 MG TAB | 69230-0325-24 | 0.30728 | EACH | 2025-12-17 |

| LOPERAMIDE-SIMETH 2-125 MG TAB | 69230-0325-32 | 0.30728 | EACH | 2025-12-17 |

| LOPERAMIDE-SIMETH 2-125 MG TAB | 69230-0325-12 | 0.30728 | EACH | 2025-12-17 |

| LOPERAMIDE-SIMETH 2-125 MG TAB | 69230-0325-32 | 0.30323 | EACH | 2025-11-19 |

| LOPERAMIDE-SIMETH 2-125 MG TAB | 69230-0325-24 | 0.30323 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Loperamide-Simeth

Introduction

Loperamide-Simeth combines two pharmacologically active ingredients: loperamide, an opioid receptor agonist primarily used for diarrhea, and simethicone, an anti-foaming agent that alleviates gas and bloating. This combination is marketed primarily as an over-the-counter (OTC) remedy for gastrointestinal disturbances, targeting consumers seeking symptomatic relief for diarrhea accompanied by gas. Understanding the current market landscape and projecting future pricing trends for Loperamide-Simeth requires a comprehensive analysis of key factors—including regulatory environment, competitive landscape, patent status, market demand, and commercialization strategies.

Market Landscape Overview

Global Demand Dynamics

The gastrointestinal (GI) treatment market intensifies annually, driven by escalating incidences of acute and chronic GI disorders globally, particularly in developing economies. Key demographic segments include pediatric, adult, and elderly populations, with over-the-counter formulations increasingly popular owing to their accessibility and convenience (1). The worldwide anti-diarrheal market was valued at approximately $3.2 billion in 2022 and is projected to grow at a CAGR of around 6% through 2030, attributed to rising urbanization, travel, and lifestyle-related GI issues (2).

Loperamide, a cornerstone in anti-diarrheal therapy, holds a significant market share, especially in OTC segments. Simethicone adds value by addressing concurrent gas-related discomfort, broadening the appeal of combination products like Loperamide-Simeth. The synergistic effect enhances products' marketability, especially among consumers seeking comprehensive GI symptom management.

Competitive Landscape

Major players include Johnson & Johnson (Imodium), GlaxoSmithKline, and Perrigo, each offering various anti-diarrheal and gas-relief formulations. Generic producers also command sizable market segments due to patent expirations. Notably, the availability of similar combination OTC products affects market share and pricing strategies. Differentiators often include formulation convenience, dosage, branding, and regulatory approvals.

Regulatory Environment and Market Access

Presently, both loperamide and simethicone are widely approved as OTC agents across the US, EU, and emerging markets. However, regulatory nuances regarding combination products vary regionally; some jurisdictions require additional safety or efficacy data. The pathway to approval for Loperamide-Simeth could involve abbreviated filings if existing monographs suffice, minimizing market entry barriers.

Patent Analysis and Intellectual Property Considerations

Current Patent Status

Loperamide patents have largely expired, opening spaces for generics and alternative formulations. The combination product’s patent status is critical; if protected, it provides market exclusivity and pricing power. Recent patent filings for novel formulations (e.g., sustained-release, flavored variants) could extend market exclusivity.

Implications for Pricing

Patent expiration generally leads to price erosion due to generic competition. Conversely, innovative delivery systems or unique formulations could enable premium pricing until patent expiry. As of now, the absence of proprietary patents for Loperamide-Simeth suggests that early market entry might necessitate aggressive pricing strategies to establish market share before generics dominate.

Pricing Drivers and Market Opportunities

Consumer Demand and Price Sensitivity

OTC GI products are inherently price-sensitive, with consumers favoring low-cost, effective options. Brand recognition, product efficacy, safety profile, and marketing influence purchase decisions. In emerging markets, affordability is paramount; thus, generic or locally produced versions tend to dominate.

Manufacturing and Distribution Factors

Manufacturing costs for Loperamide-Simeth hinge on raw material prices, formulation complexity, and regulatory compliance. Economies of scale, especially in large-scale OTC production, can facilitate competitive pricing. Distribution channels, including pharmacy chains, supermarkets, and online platforms, significantly affect retail pricing strategies and consumer accessibility.

Pricing Benchmarks

Current market prices for comparable Loperamide and Simethicone products range between $4 to $12 for a 20-30 pill pack, depending on brand, region, and formulation specifics (3). Premium formulations, such as flavored or sustained-release variants, command higher prices. The combination product, if positioned as a superior or comprehensive solution, could justify a slight premium over standard offerings.

Price Projection Models

Short-Term (0-2 Years)

Initially, Loperamide-Simeth may be launched at a competitive price point, approximately $6 to $8 per pack, targeting the mid-range segment to gain market entry. Given the absence of patent protections and existing generic competition, aggressive introductory pricing can help capture market share swiftly. Margins will depend on manufacturing efficiencies, marketing expenses, and distribution logistics.

Medium to Long-Term (3-5 Years)

As market penetration stabilizes and brand recognition solidifies—potentially augmented by clinical data demonstrating added benefits—prices may stabilize or slightly increase, aligning with inflation and inflation-adjusted manufacturing costs. Assuming patent protections or proprietary formulations (if applicable), premium pricing around $10 to $12 per pack could be feasible.

Impact of Competition and Innovation

Introduction of generics would likely drive average prices downward, compressing margins. Conversely, formulation innovations—such as extended-release formulations or combination of additional actives—could preserve or elevate pricing power. Strategic partnerships, branding, and marketing will influence the trajectory and optimal pricing points.

Regulatory and Market Entry Considerations

Compliance with regional health authorities (FDA, EMA, etc.) affects launch timelines and costs, directly impacting revenue forecasts. Successful navigation of regulatory pathways and possible patent protections could entrench market position, enabling pricing strategies aligned with demand elasticity.

Conclusion & Key Takeaways

The market for Loperamide-Simeth is poised for growth within the expanding GI therapeutic sector. The product's success hinges on strategic market entry, manufacturing efficiencies, and competitive positioning. Given the current patent landscape and existing generic competition, initial pricing should be affordable—around $6 to $8 per pack—to penetrate the OTC market effectively. Long-term success and profitability can be achieved through formulation differentiation, branding, and compliance with regulatory standards, potentially enabling premium pricing. Vigilant monitoring of patent activities, competitor launches, and consumer preferences will be essential for adapting price strategies.

Key Takeaways

- Market Potential: The global anti-diarrheal market is expanding, with increased consumer demand for combination GI products like Loperamide-Simeth.

- Competitive Edge: Patent expirations make generics predominant, emphasizing cost competitiveness and formulation innovation.

- Pricing Strategy: An initial price point of $6–$8 aligns with market expectations, with potential to elevate prices through differentiation and brand building.

- Regulatory Pathways: Gaining regulatory approval relies on existing monographs and demonstrating safety/efficacy in combination; delays impact pricing and market entry.

- Forecasts: Prices may stabilize or slightly rise over 3–5 years, contingent upon patent status, competition, and product innovation.

FAQs

1. What are the primary factors influencing the pricing of Loperamide-Simeth?

Pricing depends on manufacturing costs, competition, patent status, regulatory approval complexity, and consumer demand. Patent protections allow premium pricing, while generics tend to drive prices down.

2. How does patent expiration impact market entry and pricing?

Patent expiration typically leads to increased competition from generics, reducing prices and squeezing margins. Innovating formulations or securing new patents can maintain pricing power.

3. What regions offer the most growth opportunities for Loperamide-Simeth?

Emerging markets in Asia, Africa, and Latin America present significant growth due to rising GI disorder prevalence, larger OTC consumer bases, and less saturated markets.

4. How significant is consumer perception in determining the success of Loperamide-Simeth?

Consumer perception of efficacy, safety, and brand trust heavily influence purchasing decisions, especially in OTC markets where buyers are price-sensitive.

5. What strategies can extend the product’s market life despite patent expiration?

Developing novel formulations, obtaining additional patents, increasing brand recognition, and expanding indications can sustain market relevance beyond initial patent protections.

Sources

- MarketResearch.com, “Global Gastrointestinal Treatment Market,” 2022.

- Grand View Research, “Anti-Diarrheal Market Size & Trends,” 2023.

- Consumers’ Price Check, OTC GI Product Pricing Data, 2023.

More… ↓