Last updated: July 27, 2025

Introduction

Loperamide, a synthetic opioid receptor agonist, is widely used as an over-the-counter antidiarrheal agent. Market demand for loperamide has remained steady due to its broad usage in gastrointestinal disorder management, especially during global health crises like the COVID-19 pandemic when diarrhea has been a common symptom. This analysis examines current market dynamics, key players, manufacturing landscape, regulatory environment, and projects future pricing trends for loperamide.

Market Overview

Global Market Size and Growth

The global loperamide market was valued at approximately $450 million in 2022, with forecasts estimating a compound annual growth rate (CAGR) of 3-4% through 2030. This growth is driven by increasing awareness of gastrointestinal health, expanding OTC drug availability, and demand for cost-effective symptomatic treatments.

Key Drivers

- Aging populations: Greater incidence of gastrointestinal issues among elderly patients propels demand.

- Healthcare infrastructure expansion: Improving access in emerging markets enhances availability.

- OTC market growth: Regulatory shifts favoring over-the-counter availability boost sales.

- Public health emergencies: COVID-19 and other infectious outbreaks amplify the need for symptomatic relief medicines, including loperamide.

Market Segments

Loperamide is primarily sold as:

- Over-the-counter (OTC) medications (e.g., Imodium)

- Prescription formulations, albeit a minority of the total share, chiefly for severe cases or specific patient populations

Regional analysis indicates that North America currently accounts for roughly 40-45% of total sales, driven by high OTC drug consumption and strong regulation-enforcement favoring self-medication. Europe follows closely, with robust OTC markets. Emerging markets such as Asia-Pacific are witnessing rapid growth owing to urbanization and rising healthcare spending.

Major Market Players

The competitive landscape involves generic drug manufacturers and branded product producers:

- AbbVie/Johnson & Johnson (Imodium)

- Mylan (generic formulations)

- Teva Pharmaceuticals

- Sandoz

- Aurobindo Pharma

Generics dominate the market, accounting for over 85% of sales, with pricing pressures often influencing market dynamics.

Regulatory Environment

Loperamide’s OTC status in many jurisdictions, including the U.S., is maintained under strict guidelines to prevent misuse, especially neurotoxicity at high doses. Ongoing regulatory reviews in some markets on product labeling and dose limits potentially impact manufacturing and pricing strategies.

Pricing Dynamics

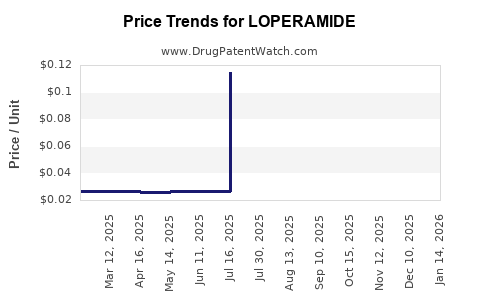

Current Pricing Landscape

The wholesale and retail prices vary significantly based on geography, formulation, and brand status:

- Brand-name Imodium: Approx. $10-$15 for a bottle of 20 capsules.

- Generic equivalents: Range from $3-$7 for similar quantities.

The price elasticity remains moderate, with consumers often choosing lower-cost generics, compelling manufacturers to limit margins to maintain competitiveness.

Factors Affecting Pricing

- Manufacturing costs: Loperamide synthesis involves cost-effective processes, contributing to generally stable prices.

- Regulatory costs: Compliance increases costs marginally but is offset by high-volume sales.

- Distribution and supply chain: Disruptions, particularly in emerging markets, can affect availability and pricing.

- Patent expirations: Since the original patent for Imodium has long expired, generic proliferation has increased price competition, leading to lower retail prices over time.

Future Price Projections (2023–2030)

Based on current trends, technological advances, and market competition, the following projections are made:

- Stable pricing in mature markets: OTC prices for generics are expected to remain within $2-$8 per course of treatment, reflecting ongoing competition.

- Premium pricing for innovative formulations: Novel delivery methods or combination products may command 20-30% premiums.

- Potential price reductions: As patent exclusivity diminishes and generics saturate markets, unit prices are projected to decrease by 2-3% annually in developed regions.

- Price increases in emerging markets: Due to logistics and regulatory hurdles, retail prices could increase by 2-5% annually until economies of scale prevail.

Impact of Emerging Trends

- Digital health initiatives: Telemedicine prescriptions could temporarily inflate prices due to added service fees.

- Regulatory tightening: Stricter labeling and dose restrictions could marginally impact manufacturing costs and, consequently, prices.

- Supply chain resilience: The Covid-19 pandemic highlighted vulnerabilities that, if unresolved, could cause short-term price volatility.

Strategic Considerations for Stakeholders

- Manufacturers should focus on differential formulations (e.g., sustained-release) to command premium pricing.

- Distributors need to monitor regulatory changes that could affect OTC status, influencing retail pricing.

- Investors should anticipate declining unit prices in saturated markets but explore growth in emerging regions and innovative formulations.

Key Market Opportunities

- Developing combination therapies integrating loperamide for broader gastrointestinal symptom management.

- Expanding distribution in emerging markets through partnerships.

- Innovating delivery mechanisms (e.g., dissolvable tablets, oral suspensions) that justify higher price points.

Conclusion

Loperamide remains a resilient and steadily growing pharmaceutical product with a mature but dynamic market. Price stability is anticipated in established markets, tempered by increasing competition, while emerging regions present opportunities for incremental price increases and volume expansion. Stakeholders must adapt to regulatory changes, technological advances, and supply chain challenges to optimize profitability.

Key Takeaways

- The global loperamide market is projected to grow at approximately 3-4% CAGR through 2030, driven by increasing OTC demand and healthcare access.

- Dominated by generics, with low-cost manufacturing, prices are expected to decline gradually in developed markets but may rise in emerging regions due to logistical and regulatory factors.

- Brand-name products like Imodium retain premium pricing, but market share faces erosion amid generic proliferation.

- Innovation in formulations and strategic geographical expansion offer key opportunities to sustain profit margins.

- Regulatory scrutiny remains critical; adherence and proactive compliance can safeguard market positioning and pricing stability.

FAQs

-

What factors influence loperamide’s market price?

Price determinants include manufacturing costs, generic competition, regulatory compliance, distribution logistics, and regional demand patterns.

-

How will patent expirations affect pricing in the future?

Patent expirations have already facilitated the entry of generics, leading to reduced retail prices. Continued generic competition is expected to keep prices stable or declining in mature markets.

-

Are there any emerging markets with significant growth potential?

Yes, Asia-Pacific and African nations, where healthcare infrastructure improves, are witnessing increased demand and could see price rises due to logistical costs and regulatory barriers.

-

Could new formulations impact loperamide’s market price?

Innovative delivery systems and combination therapies may command higher prices, creating new premium segments in the market.

-

What regulatory changes could influence future market prices?

Enhanced labeling requirements, dose restrictions, and stricter approval protocols could increase manufacturing and compliance costs, potentially influencing consumer prices.

Sources:

- Market research reports, 2022.

- Regulatory agency publications (FDA, EMA).

- Industry analyses and forecasts from pharmaceutical market consultancies.