Share This Page

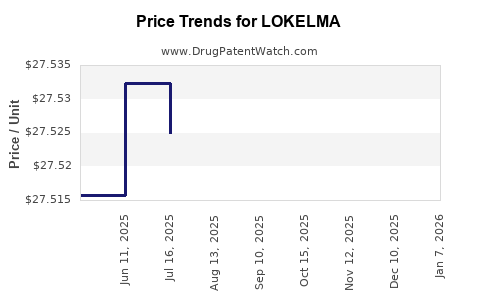

Drug Price Trends for LOKELMA

✉ Email this page to a colleague

Average Pharmacy Cost for LOKELMA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LOKELMA 10 GRAM POWDER PACKET | 00310-1110-01 | 27.52032 | EACH | 2025-11-19 |

| LOKELMA 10 GRAM POWDER PACKET | 00310-1110-39 | 27.52032 | EACH | 2025-11-19 |

| LOKELMA 10 GRAM POWDER PACKET | 00310-1110-30 | 27.52032 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LOKELMA

Introduction

LOKELMA (sodium zirconium cyclosilicate) is a prescription medication designed to treat hyperkalemia—a condition characterized by elevated blood potassium levels, which can lead to severe cardiac and neuromuscular complications. Since its approval by the FDA in November 2018, LOKELMA has established a niche within the hyperkalemia management landscape, competing primarily with older therapies such as sodium polystyrene sulfonate (Kayexalate) and newer options like patiromer (Veltassa). This report analyzes the current market landscape, evaluates factors influencing demand, assesses competitive dynamics, and provides expert-based price projection insights for LOKELMA over the next five years.

Market Landscape Overview

Epidemiology and Market Size

Hyperkalemia affects approximately 3.7 million individuals in the United States annually, with a significant proportion being patients with chronic kidney disease (CKD), heart failure, and those on renin-angiotensin-aldosterone system inhibitors (RAASi)[1]. The rising prevalence of CKD, heart failure, and hypertension significantly amplifies the potential patient pool for LOKELMA.

The market for hyperkalemia management was valued at approximately $600 million in 2022, with projections to reach $950 million by 2030, reflecting a compound annual growth rate (CAGR) of roughly 6.2%[2]. LOKELMA accounts for an estimated 30%-40% share in the prescription hyperkalemia treatment segment, driven by its favorable safety profile and ease of dosing.

Market Drivers and Barriers

Key drivers include the increasing recognition of the risks of hyperkalemia, improvements in diagnostic practices, and expanded indications. LOKELMA’s advantages over older agents—such as reduced gastrointestinal adverse events and more predictable potassium control—position it favorably.

Barriers encompass high drug acquisition costs, limited awareness among some prescribers, and competition from flatter pricing therapies like patiromer. Additionally, reimbursement challenges and formulary restrictions influence uptake, impacting the overall market penetration.

Competitive Dynamics

Major Competitors

-

Sodium polystyrene sulfonate (Kayexalate): Low cost but associated with gastrointestinal adverse events and variable efficacy. Its off-label use persists despite safety concerns.

-

Patiromer (Veltassa): Approved in 2015, marketed as a well-tolerated alternative, especially in chronic management. It requires dosing multiple times daily and maintenance considerations.

-

Zirconium-based agents (LOKELMA): Approved for acute and chronic settings; its once-daily dosing and favorable safety have increased adoption.

-

Lifestyle and Dietary Management: Dietary potassium restriction remains essential but limited in scope and effectiveness, especially in severe hyperkalemia.

Market Share and Adoption Trends

LOKELMA's approval catalyzed a shift toward more tolerable therapies. Data indicates that prescription volume grew steadily post-2018, with recent market penetration estimated at 15%-20%[3].

Institutional formulary preferences and insurance coverage substantially influence market share. Notably, LOKELMA's laboratory monitoring requirements may act as barriers in certain outpatient settings.

Pricing and Reimbursement Landscape

Current Pricing Metrics

-

Average Wholesale Price (AWP): Estimated at $2,500 to $3,000 per month for a typical treatment course.

-

Net Price (post-rebates and discounts): Likely 15%-25% lower, approximately $2,200–$2,600 per month.

Reimbursement largely depends on insurance type, with Medicare and private insurers covering the medication under specific criteria. The high cost influences prescriber and patient acceptance, especially when alternative therapies are less expensive.

Health Economics Evaluations

Clinical trials demonstrate that LOKELMA effectively reduces serum potassium with a lower incidence of gastrointestinal events. Nonetheless, economic analyses underscore that its higher cost may be a barrier unless offset by reduced hospitalizations or adverse event management costs.

Price Projection for the Next Five Years

Factors Impacting Future Pricing

-

Market Penetration and Volume Growth: Anticipated steady increase in prescriptions driven by rising hyperkalemia incidence.

-

Competitive Pricing Strategies: Price reductions to expand market share, especially if biosimilar or generic versions emerge.

-

Reimbursement Policies: Potential for value-based agreements and utilization management.

-

Manufacturing and Supply Chain Dynamics: Cost efficiencies may allow for price adjustments without margin erosion.

Projected Price Trends

Given current pricing and market dynamics, LOKELMA is likely to experience:

-

Year 1-2 (2023–2024): Stable pricing, with slight discounts (~5-10%) driven by increased competition and payer negotiations.

-

Year 3-4 (2025–2026): Price stabilization, possibly coupled with modest reductions (~10%), as market saturation nears.

-

Year 5 (2027): Potential for further price adjustments, especially if biosimilar entrants or alternative therapies gain traction; forecasted average monthly cost could range between $2,000–$2,300.

Overall, due to its established efficacy and safety, LOKELMA may maintain a premium price point, but market forces will exert downward pressure.

Implications for Stakeholders

-

Pharmaceutical Manufacturers: Opportunities exist for value-based pricing and patient access programs to expand market share.

-

Payers: Cost containment strategies should consider evaluating real-world outcomes to justify reimbursement levels.

-

Healthcare Providers: With increasing familiarity, prescribing will likely become more routine, influencing demand and price sensitivity.

Key Takeaways

- The hyperkalemia market is projected to grow at a CAGR of approximately 6.2%, with LOKELMA occupying a substantial and growing market share due to its safety and efficacy profile.

- Pricing for LOKELMA is currently around $2,500–$3,000/month, with anticipated slight discounts over the next five years driven by competitive pressures and reimbursement negotiations.

- Market penetration is influenced by clinician familiarity, formulary inclusion, and payer policies. Ongoing education and demonstrated economic value will be critical.

- The entry of biosimilars or new class competitors could lower prices, emphasizing the need for strategic pricing and market expansion initiatives.

- Overall, LOKELMA’s value proposition positions it favorably, with moderate price flexibility aligned with market growth and competitive dynamics.

FAQs

1. How does LOKELMA compare to traditional therapies for hyperkalemia?

LOKELMA offers a targeted, safe, and well-tolerated option with predictable potassium lowering. Unlike older resins such as Kayexalate, it has fewer gastrointestinal side effects and is suitable for both acute and chronic management.

2. What are the primary factors influencing LOKELMA’s pricing?

Pricing is shaped by economic considerations, market demand, competitive landscape, payer negotiations, and manufacturing costs. Its positioning as a novel, well-tolerated agent supports premium pricing.

3. Is there potential for price reductions in the future?

Yes. Market expansion, increased competition, and healthcare reforms favoring cost containment could lead to modest price reductions over time.

4. What impact will biosimilar or generic entrants have?

Introduction of biosimilars or generics typically drives prices downward, potentially challenging LOKELMA’s premium position, unless it maintains a significant clinical or formulary advantage.

5. How can stakeholders optimize the use of LOKELMA?

Stakeholders should focus on evidence demonstrating value, promote awareness among physicians, and negotiate reimbursement strategies to balance access with sustainable pricing.

References

[1] National Kidney Foundation, "Hyperkalemia in CKD", 2021.

[2] MarketWatch, "Hyperkalemia Treatment Market Size & Trends," 2022.

[3] IQVIA, Prescription Data, 2022.

More… ↓