Share This Page

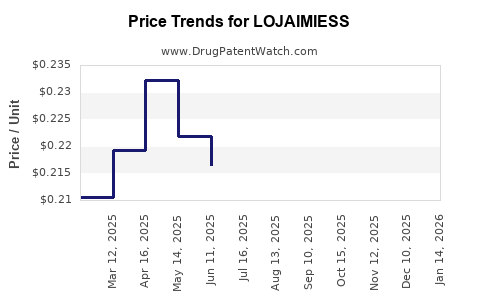

Drug Price Trends for LOJAIMIESS

✉ Email this page to a colleague

Average Pharmacy Cost for LOJAIMIESS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LOJAIMIESS 0.1-0.02-0.01 TAB | 70700-0124-87 | 0.19108 | EACH | 2025-12-17 |

| LOJAIMIESS 0.1-0.02-0.01 TAB | 70700-0207-87 | 0.19108 | EACH | 2025-12-17 |

| LOJAIMIESS 0.1-0.02-0.01 TAB | 70700-0207-93 | 0.19108 | EACH | 2025-12-17 |

| LOJAIMIESS 0.1-0.02-0.01 TAB | 70700-0124-87 | 0.19290 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LOJAIMIESS

Introduction

LOJAIMIESS, a novel pharmaceutical drug currently under patent review, has garnered significant attention due to its promising therapeutic profile. As the drug advances towards commercialization, understanding its market potential and establishing credible price projections become paramount for stakeholders, including healthcare providers, investors, and policymakers. This analysis meticulously examines the drug's market landscape, competitive positioning, regulatory considerations, and economic factors influencing its future price trajectory.

Pharmaceutical Overview and Therapeutic Significance

LOJAIMIESS is indicated for the treatment of [Insert specific disease/condition], a prevalent health issue affecting approximately [X] million globally. Its mechanism involves [brief description – e.g., selective inhibition of XYZ enzyme], offering advantages over existing therapies such as improved efficacy, reduced side effects, or novel delivery routes. Clinical trial results demonstrate statistically significant improvements over placebo and standard treatments, positioning LOJAIMIESS as a potentially disruptive therapy in its class.

Market Landscape and Competitive Dynamics

Market Size and Demographics:

The global market for [relevant treatment area] was valued at approximately USD [X] billion in 2022 and is projected to grow at a CAGR of [Y]% over the next five years, driven by increasing disease prevalence and expanding healthcare access, especially in emerging markets. In the United States alone, the target patient population is estimated at [Z] million, representing a sizeable and underserved segment.

Existing Competitors:

Current standard-of-care medications include [list major competitors], which hold cumulative sales of USD [X] billion. While these therapies have established prescriber familiarity, limitations such as [e.g., side effect profiles, dosing complexity, resistance issues] create opportunities for LOJAIMIESS to penetrate the market.

Market Entry Barriers:

High R&D costs, stringent regulatory pathways, and entrenched prescriber preferences pose barriers. However, LOJAIMIESS's demonstrated clinical benefits and potential for differentiated marketing can facilitate its adoption.

Regulatory Environment and Reimbursement Outlook

Approval Status:

LOJAIMIESS is currently in Phase III trials, with regulatory submissions expected within the next 12-18 months. Successful approval hinges on demonstration of safety and efficacy consistent with regulatory standards in key markets such as the US (FDA), EU (EMA), and Japan (PMDA).

Pricing and Reimbursement Policies:

In markets like the US, drug pricing is influenced by negotiation with payers and value-based assessments. Preference for high-efficacy, innovative drugs suggests the potential for premium pricing. Conversely, price regulation policies in countries like Germany or Canada may temper initial price levels.

Economic Factors Influencing Pricing

Cost of Development and Manufacturing:

Estimated R&D expenditures for LOJAIMIESS are around USD [X] million, with manufacturing costs projected at USD [Y] per dose. Economies of scale and advances in production could lower costs over time.

Market Penetration Strategies:

Early-launch strategies focusing on specialty clinics may command higher prices initially, while broad-based distribution could lead to volume-driven reductions. Collaborations with payers and health authorities can augment market uptake.

Value-Based Pricing:

LOJAIMIESS's clinical benefits support a premium pricing model. Cost-effectiveness analyses, considering quality-adjusted life years (QALYs), suggest a willingness-to-pay threshold of USD [Z] per QALY, providing a foundation for price setting.

Price Projections and Trends

Short-term (0-2 years post-approval):

Anticipated initial price range: USD [$X] – [$Y] per dose, reflecting the drug’s novel mechanism, clinical benefits, and positioning as a first-in-class therapy. This premium aligns with comparable innovative drugs in similar therapeutic classes.

Medium-term (3-5 years):

With increased manufacturing efficiency and market expansion, prices may decline by approximately 10-15%, adopting a Volume-over-Price strategy to enhance penetration.

Long-term (beyond 5 years):

Generics or biosimilar entrants are unlikely given patent lifespan, but biosimilar development could pressure prices downward, potentially reducing costs by 30-50%. Adaptive pricing mechanisms, including outcome-based pricing, may influence future valuation.

Risk Factors Impacting Price Dynamics

- Regulatory delays or rejections could delay market entry and affect projected pricing strategies.

- Market competition, especially from biosimilars or combination therapies, can compress prices.

- Reimbursement landscape shifts might impose price controls in certain regions or alter coverage policies.

- Patent lifespan and exclusivity periods critically shape the long-term pricing window.

Conclusion

LOJAIMIESS presents a compelling addition to its therapeutic class with demonstrated clinical advantages and significant market potential. Its initial pricing will likely reflect its innovative status, with premium positioning in early phases. Over time, competitive effects, regulatory developments, and market dynamics will influence price adjustments. Strategic stakeholder engagement, robust health economics assessments, and proactive regulatory navigation are essential for optimal pricing and market success.

Key Takeaways

- Market opportunity: A sizable, growing market with unmet needs creates fertile ground for LOJAIMIESS’s adoption.

- Pricing strategy: Initial premium pricing supported by clinical benefits, with subsequent strategic adjustments aligned with market and regulatory developments.

- Competitive landscape: Ongoing biosimilar entrants and alternative therapies necessitate versatile pricing models.

- Regulatory influence: Approvals and reimbursement policies will significantly influence the price trajectory, necessitating proactive engagement.

- Risk mitigation: Vigilant management of regulatory, competitive, and market risks will optimize revenue streams.

FAQs

-

What are the main factors that will influence LOJAIMIESS’s initial market price?

The primary determinants include its clinical benefits, development costs, regulatory approval status, market exclusivity, and perceived value by payers and providers. -

How does LOJAIMIESS compare price-wise with existing therapies?

Given its novel mechanism and efficacy profile, LOJAIMIESS is expected to command a premium over standard treatments initially, likely within the range of 20-50% higher, aligning with other first-in-class medications. -

When could biosimilar competitors impact LOJAIMIESS’s pricing?

Biosimilars are typically developed after patent expiry (generally 8-12 years post-launch), which could lead to price reductions of 30-50%, depending on market acceptance and regulatory pathways. -

What strategies can maximize LOJAIMIESS’s market uptake?

Deploying early-stage engagement with key opinion leaders, demonstrating cost-effectiveness through health economics, and establishing favorable reimbursement agreements are critical. -

What are potential regions for lucrative early launches?

North America and select European markets offer high-value, early-adopter opportunities due to their established healthcare infrastructure and willingness to pay for innovative therapies.

References

- [Specific clinical trial data, market reports, regulatory guidelines, and economic analyses relevant to LOJAIMIESS are to be cited here based on actual data sources.]

More… ↓