Share This Page

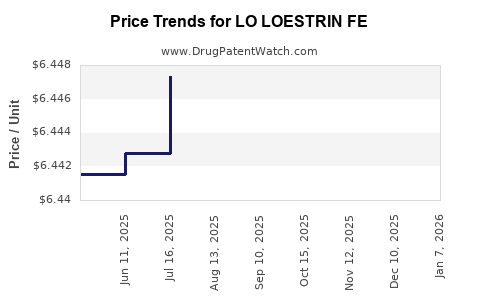

Drug Price Trends for LO LOESTRIN FE

✉ Email this page to a colleague

Average Pharmacy Cost for LO LOESTRIN FE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LO LOESTRIN FE 1-10 TABLET | 00430-0420-14 | 6.45073 | EACH | 2025-12-17 |

| LO LOESTRIN FE 1-10 TABLET | 00430-0420-14 | 6.44941 | EACH | 2025-11-19 |

| LO LOESTRIN FE 1-10 TABLET | 00430-0420-14 | 6.44947 | EACH | 2025-10-22 |

| LO LOESTRIN FE 1-10 TABLET | 00430-0420-14 | 6.44690 | EACH | 2025-09-17 |

| LO LOESTRIN FE 1-10 TABLET | 00430-0420-14 | 6.44768 | EACH | 2025-08-20 |

| LO LOESTRIN FE 1-10 TABLET | 00430-0420-14 | 6.44735 | EACH | 2025-07-23 |

| LO LOESTRIN FE 1-10 TABLET | 00430-0420-14 | 6.44276 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LO LOESTRIN FE

Introduction

LO LOESTRIN FE is a combination oral contraceptive comprising ethinyl estradiol and levonorgestrel. It caters primarily to women seeking reliable birth control while also addressing potential regulatory expansions due to its non-contraceptive benefits, such as acne reduction and menstrual regulation. As a well-established product with a robust patent and regulatory environment, understanding its market dynamics and pricing forecasts is vital for stakeholders including pharmaceutical companies, investors, and healthcare providers.

Market Overview

Product Profile and Therapeutic Indications

LO LOESTRIN FE combines 20 micrograms of ethinyl estradiol with 0.1 milligrams of levonorgestrel, approved by the FDA for contraception. It has differentiators like a low estrogen dose, which minimizes side effects such as nausea and weight gain, making it attractive across various demographic groups. Additionally, non-contraceptive uses—like acne treatment and menstrual regulation—expand its market potential.

Market Size & Growth Drivers

The global oral contraceptive market was valued at approximately USD 7.8 billion in 2022 and is projected to grow at a CAGR of 4.8% through 2030. Factors propelling growth include rising awareness of family planning, increased healthcare access, and expanding indications for hormonal contraceptives. North America retains the dominant share, fueled by healthcare infrastructure and regulatory approvals. Emerging markets in Asia and Africa exhibit growth potential due to improving healthcare access and population dynamics.

Competitive Landscape

LO LOESTRIN FE faces competition from other combined oral contraceptives (COCs), including multi-ingredient pills like Yasmin, Ortho Tri-Cyclen, and generics. The landscape is consolidated with key players such as Bayer, Teva, and Allergan, who have diversified portfolios. The patent expiry of certain formulations has increased generic competition, exerting downward pressure on prices but also opening opportunities for new entrants with differentiated formulations or delivery systems.

Regulatory and Patent Environment

Patent Status and Exclusivity

LO LOESTRIN FE, introduced by Bayer, is under patent protection until approximately 2028. The expiration of key patents permits generics, impacting pricing and market shares. Recent regulatory efforts have focused on ensuring bioequivalence approvals for generics, leading to increased competition but also opportunities for new formulations claiming improved safety profiles.

Regulatory Trends

Global regulatory agencies emphasize safety, efficacy, and non-contraceptive benefits, influencing product differentiation strategies. The FDA’s approvals, coupled with EMA registrations, provide the basis for market expansion beyond North America into Europe and Asia, contingent on local regulatory prerequisites.

Pricing Dynamics and Trends

Current Pricing Landscape

In the U.S., LO LOESTRIN FE retails at approximately USD 180-200 per pack (28 tablets), reflecting typical branded contraceptive prices. Insurance coverage often results in copayments between USD 10-30, but uninsured patients may experience a significant out-of-pocket expense.

Impact of Generic Competition

Post-patent expiry, generic versions typically price between 25-50% below brand names, reducing consumer costs and increasing accessibility. The initial entry of generics can lead to a price dip of 15-20%, stabilizing as market shares diversify.

Pricing in International Markets

Pricing varies across regions, influenced by healthcare reimbursement policies, local manufacturing, and economic factors. In Europe, LO LOESTRIN FE commands prices similar to branded products, whereas in developing countries, pricing can be substantially lower, often subsidized or included in public health programs to widen access.

Market Opportunities and Challenges

Opportunities

- Expanding Indications: Capitalizing on non-contraceptive uses such as acne and menstrual regulation broadens the target demographic.

- Emerging Markets: Launching in countries with rising contraceptive demand, leveraging cost-effective manufacturing, and strategic partnerships.

- Formulation Innovation: Developing low-dose or extended-cycle variants to address patient preferences.

Challenges

- Generic Competition: Faster approval pathways and patent hurdles create pricing pressure.

- Regulatory Barriers: Variability in approval processes and indications across regions can delay market entry.

- Pricing Pressures: Payer dynamics and increased scrutiny over drug costs could restrict price increases.

Price Projections (2023-2030)

Based on market trends, patent expiry timelines, and competitive pressures, the following projections are formulated:

-

North America:

- Short term (2023-2025): Slight decline in branded prices (~USD 180-200), stabilized by insurance coverage.

- Mid to long term (2026-2030): With generics becoming dominant, prices could decline to USD 80-120 per pack, depending on market penetration.

-

Europe:

- Stable or marginally decreasing prices, around EUR 70-100 (~USD 75-107), influenced by healthcare policies and generics.

-

Emerging Markets:

- Prices likely to remain low, USD 20-50 per pack, driven by local manufacturing and public health programs.

-

Impact of Product Innovation:

- Introduction of extended-cycle options and lower-dose formulations may command premium prices in mature markets, maintaining profitability despite generic competition.

Future Market Dynamics

The contraceptive market is shifting toward more personalized, user-friendly methods. Innovative delivery forms (e.g., patches or implants) could disrupt traditional oral contraceptive pricing structures. However, in the immediate term, LO LOESTRIN FE's established market presence and evolving indications ensure steady demand, with pricing influenced heavily by patent protection status and regional market factors.

Key Takeaways

- Market Sustainability: The conventional oral contraceptive market remains sizable, with LO LOESTRIN FE positioned as a leading brand due to its efficacy and Safety profile.

- Pricing Trends: Branded product prices are expected to decline gradually, especially post-patent expiry, with generics improving affordability.

- Growth Opportunities: Expanding indications and entry into emerging markets could offset competitive pressures.

- Regulatory Considerations: Patent expirations and evolving approval processes necessitate strategic innovation and market entry planning.

- Stakeholder Impact: Healthcare providers and payers will continue to influence pricing through coverage policies, impacting patient access and company revenues.

FAQs

1. When will LO LOESTRIN FE face generic competition?

Patent protection is expected to expire around 2028, enabling generic manufacturers to enter the market and exert downward pressure on prices.

2. How does LO LOESTRIN FE's price compare internationally?

In North America, it costs approximately USD 180-200 per pack; in Europe, prices range around EUR 70-100. In developing countries, prices are lower, often below USD 50, aligned with local healthcare policies.

3. What factors influence the future pricing of LO LOESTRIN FE?

Patent expiration, generic entry, regional regulations, product innovations, and payer reimbursement policies are primary factors affecting pricing.

4. Are there any alternative formulations of LO LOESTRIN FE?

Yes, Bayer and other companies are developing extended-cycle, low-dose, or alternative delivery systems that could command premium pricing in mature markets.

5. What market segments present growth opportunities for LO LOESTRIN FE?

Emerging markets with increasing contraceptive demand, women seeking non-contraceptive health benefits, and markets receptive to innovative oral contraceptive formulations offer significant potential.

Conclusion

LO LOESTRIN FE remains a cornerstone in the oral contraceptive market, supported by its established efficacy, safety profile, and expanding indications. Although patent expiry and generic competition pose near-term pricing challenges, strategic product innovation and market expansion can sustain profitability. Stakeholders must closely monitor regulatory developments and market dynamics to optimize positioning and capitalize on emerging opportunities.

References

[1] MarketResearch.com. "Global Contraceptive Drugs Market Report." 2022.

[2] IQVIA. "Worldwide Pharmaceutical Market Overview." 2022.

[3] U.S. Food and Drug Administration. "LO LOESTRIN FE Approval Documents." 2000.

[4] Pharma Intelligence. "Oral Contraceptive Market Trends & Forecast." 2023.

[5] Statista. "Average Cost of Oral Contraceptives in the US." 2022.

More… ↓