Last updated: July 29, 2025

Introduction

Lithium, a soft, silvery-white alkali metal, has become an essential element in the modern technological landscape. Primarily recognized for its role in rechargeable lithium-ion batteries, lithium’s demand has surged amid the global transition toward clean energy and electric vehicles (EVs). This analysis explores lithium market dynamics, supply-demand fundamentals, key price drivers, and future price projections, providing stakeholders with insights to inform strategic decision-making.

Global Lithium Market Overview

Market Size and Growth Trends

The global lithium market was valued at approximately USD 4 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of around 10% through 2030. The key driver is the exponential increase in lithium-ion battery production, mandated by EV proliferation, renewable energy storage needs, and portable electronics.

According to the U.S. Geological Survey (USGS) 2022 report, global lithium production reached roughly 100,000 tonnes of lithium carbonate equivalent (LCE), with significant contributions from Australia, Chile, China, and Argentina. Australia dominates the supply chain, accounting for over 50% of global production, primarily via spodumene mining.

Key Industry Players

Major players include Albemarle Corporation, Ganfeng Lithium, Tianqi Lithium, SQM (Sociedad Química y Minera), and Tianqi Lithium. The upstream sector is characterized by ongoing investment in mining capacity expansion to meet surging demand, particularly for lithium carbonate and lithium hydroxide used directly in battery chemistry.

Supply Chain and Raw Material Dynamics

Mining and Extraction Technologies

Lithium occurs chiefly in two forms: brine deposits and hard-rock spodumene deposits. Brine extraction, predominant in South America, offers lower production costs but is constrained by geographic and environmental factors. Spodumene mining, mainly in Australia, requires energy-intensive processing but provides a more consistent supply.

Supply Constraints and Bottlenecks

While presently adequate, future supply hinges on expanding capacity, with project timelines often extending due to permitting, environmental concerns, and technological hurdles. Notable planned capacity increases include Tianqi Lithium's expansion and new projects like GreenTech's Alberta lithium project in Canada. However, delays could constrain supply, exerting upward price pressure.

Demand Drivers

Electric Vehicle Market

EV sales are central to lithium demand. BloombergNEF projects EVs will constitute 60% of new car sales globally by 2030, up from 10% in 2020. This growth directly correlates with lithium consumption, as batteries account for a significant proportion of EV weight and cost. Major automakers, including Tesla, Volkswagen, and BYD, are expanding battery manufacturing capacity, further amplifying lithium intake.

Energy Storage and Renewable Infrastructure

Large-scale battery storage systems, particularly in renewable energy grids, are expanding rapidly. Lithium-ion batteries constitute the core technology, anticipated to drive structural demand growth over the next decade.

Other Applications

While less significant than batteries, other sectors such as ceramics, glass manufacturing, and lubricants consume lithium. However, these are relatively stable or declining in importance compared to battery-related demand.

Market Challenges and Risks

- Price Volatility: Lithium prices have experienced significant swings, partly due to fluctuating demand, project delays, and geopolitical factors.

- Environmental and Social Concerns: Mining operations face scrutiny over ecological impacts, influencing permitting and expansion projects.

- Technological Alternatives: Battery chemistries like solid-state and sodium-ion could, in the long term, diminish lithium’s role, introducing market uncertainty.

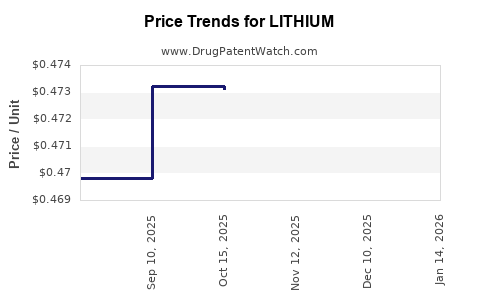

Historical Price Trends

Since 2015, lithium prices have oscillated substantially. Lithium carbonate spot prices surged from below USD 10,000 per tonne (2015) to over USD 30,000 per tonne in 2022. This reflectsthe dynamic interplay of supply constraints and rising demand, with prices driven higher during periods of capacity expansions and market tightness.

Future Price Projections

Short to Medium Term (2023-2025)

Market analysts project lithium prices will remain elevated amid constrained supply and expanding demand. Prices are expected to range between USD 25,000 and USD 35,000 per tonne for lithium carbonate, with periodic fluctuations. Supply-side expansion may alleviate some pricing pressures but likely will not fully offset rapid demand growth, sustaining high prices.

Long-Term Outlook (2026-2030)

By 2030, prices could stabilize or decline if supply projects reach fruition. However, given the scale of estimated demand (some forecasts suggest annual lithium requirements could reach 1 million tonnes LCE by 2030), prices are likely to stay above pre-2020 levels, averaging USD 20,000–25,000 per tonne. Technological innovations differing from current battery chemistries, as well as potential recycling breakthroughs, could influence prices downward.

Market Considerations and Investment Implications

- Supply Chain Diversification: Strengthening supply security through geographic diversification and technological innovation is key.

- Investment in Upstream Capacity: Stakeholders investing in mining projects may benefit from sustained high prices during capacity ramp-up years.

- Price Hedging and Long-term Contracts: Companies engaged in lithium procurement may increasingly leverage contracts to hedge against volatility.

Regulatory and Geopolitical Influences

Lithium-rich countries are contemplating resource nationalism and export controls, impacting global supply dynamics. China’s dominant position in processing and battery manufacturing amplifies geopolitical considerations, requiring strategic sourcing assessments.

Conclusion

Lithium’s market trajectory is characterized by surging demand driven by EV proliferation and energy storage needs, juxtaposed against supply expansion challenges. Price volatility reflects these dynamics, with projections indicating sustained high prices in the near to medium term, tapering if new supply effectively meets demand over the longer horizon.

Key Takeaways

- The lithium market is poised for significant growth through 2030, primarily fueled by electric vehicle adoption.

- Supply-side constraints, environmental concerns, and geopolitical factors critically influence current and future prices.

- Prices are expected to remain elevated through the mid-2020s, with potential stabilization or decline contingent upon successful capacity expansions.

- Investors should monitor project developments, technological shifts, and regulatory landscapes to adapt to market dynamics.

- Diversification across supply sources and investment in innovation (e.g., recycling, alternative chemistries) are strategic avenues for mitigating risks.

FAQs

Q1: What are the main factors that influence lithium price volatility?

A1: Demand surges from EV and energy storage markets, supply disruptions from project delays, geopolitical tensions, environmental regulations, and innovations in battery technology significantly impact lithium prices.

Q2: Which regions dominate global lithium production?

A2: Australia leads, accounting for over half of global production, primarily through spodumene mining. South America (Chile and Argentina) dominates brine extraction, while China also plays a substantial role.

Q3: How might technological advances affect lithium demand?

A3: Breakthroughs such as solid-state batteries or alternative chemistries could reduce lithium dependency, potentially lowering future demand and prices. Conversely, increased recycling efficiency may offset raw material needs.

Q4: What are the environmental challenges related to lithium mining?

A4: Lithium extraction can threaten water resources, cause habitat disruption, and generate waste. These challenges often lead to regulatory hurdles and community opposition, impacting supply expansion.

Q5: When might lithium prices decline significantly?

A5: Prices could decline if supply exceeds demand due to successful capacity additions, technological replacements for lithium-based batteries, or increased recycling reducing raw material needs.

Sources:

- U.S. Geological Survey (USGS) Lithium Market Report, 2022.

- BloombergNEF, Battery Metals Market Outlook, 2022.

- Benchmark Mineral Intelligence, Lithium Price Analysis, 2022.

- International Energy Agency (IEA), Global EV Outlook 2022.

- Mining Journal, Lithium sector updates, 2022.