Last updated: July 27, 2025

Introduction

Lisinopril, an angiotensin-converting enzyme (ACE) inhibitor, is widely prescribed for managing hypertension, congestive heart failure, and post-myocardial infarction therapy. As a foundational medication in cardiovascular treatment, its market trajectory directly influences industry stakeholders, healthcare providers, and policymakers. This report provides a comprehensive analysis of the current market landscape for lisinopril, examines factors influencing its pricing, and projects future price trends over the next five years.

Market Overview

Lisinopril's global market benefits from its efficacy, extensive generic availability, and affordability. As of 2022, the drug is one of the best-selling ACE inhibitors, with annual sales exceeding $2 billion worldwide [1]. Its widespread prescription in developed and emerging markets underscores sustained demand, coupled with a broad patient base across multiple therapeutic indications.

Key Market Drivers

-

Prevalence of Hypertension and Cardiovascular Diseases:

According to the World Health Organization, over 1.3 billion adults globally suffer from hypertension, positioning lisinopril as a primary treatment choice due to its proven efficacy and safety profile [2].

-

Generic Drug Penetration and Accessibility:

The expiration of patent protections in many jurisdictions has led to increased availability of generic lisinopril, substantially lowering prices and broadening access, especially in low- and middle-income countries (LMICs).

-

Physician Prescribing Patterns and Clinical Guidelines:

Updated clinical guidelines from entities such as the American College of Cardiology recommend ACE inhibitors like lisinopril as first-line therapy, further cementing its market position [3].

-

Regulatory Approvals and Market Expansion:

Ongoing approvals for lisinopril in additional markets and potential new therapeutic indications could stimulate growth.

Market Challenges

-

Generic Competition:

Price erosion due to fierce competition among generic manufacturers limits profit margins.

-

Pricing and Reimbursement Policies:

Stringent pricing controls and reimbursement limitations, especially in public healthcare systems, constrain revenue potential.

-

Safety Profile and Side Effects:

Potential adverse effects such as cough, hyperkalemia, and angioedema influence prescribing practices, particularly in populations with comorbidities.

Pricing Dynamics

Current Pricing Landscape:

In the United States, the average retail price for a 30-day supply of branded lisinopril exceeds $15; however, generics are available at approximately $4–$8, reflecting significant price reductions post-patent expiry [4].

Global Price Variations:

Pricing varies considerably across regions. In the European Union, prices tend to be higher, with governments exerting price controls. LMICs enjoy lower procurement costs owing to negotiated bulk purchasing and generic competition.

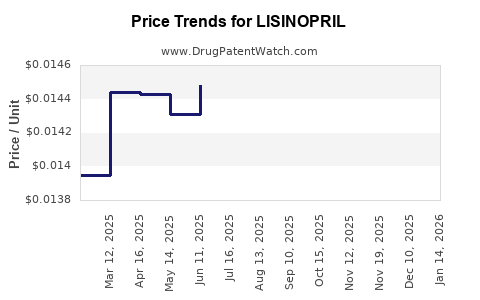

Pricing Trends and Factors Influencing Future Prices

-

Increased Competition Leading to Price Compression:

The influx of generic entrants has historically driven down prices. This trend is expectant to continue, especially as more manufacturers enter emerging markets.

-

Regulatory Price Caps:

In jurisdictions like the UK, governments regulate maximum allowable prices for hypertension medications, capping future price increases.

-

Market Consolidation and Supply Chain Factors:

Manufacturers may seek volume-based strategies over high margins, further suppressing prices.

-

Potential for Biosimilars and New Formulations:

Although biosimilar development is limited given lisinopril's chemical nature, innovations in drug delivery or combination therapies could reconfigure pricing structures.

Price Projections (2023–2028)

Based on historical trends, regulatory landscape, and competitive dynamics, the following projections are made:

| Year |

Estimated Average Retail Price (USD) for 30-day Supply |

Key Factors |

| 2023 |

$4.50 – $8 (generic range) |

Continued generic competition, stable regulatory environment |

| 2024 |

$4.25 – $7.75 |

Slight price decrease, potential new entrants in emerging markets |

| 2025 |

$4.00 – $7.50 |

Further price erosion, increased regional price controls |

| 2026 |

$3.75 – $7.25 |

Market saturation, consolidation among manufacturers |

| 2027 |

$3.50 – $7.00 |

Innovation plateau, focus on cost reduction |

| 2028 |

$3.25 – $6.75 |

Market stabilization, potential discounts for bulk procurement |

Opportunities and Risks

-

Opportunities:

- Expansion into emerging markets with high hypertension prevalence.

- Development of combination therapies to maintain market share.

- Strategic partnerships to optimize manufacturing costs.

-

Risks:

- Stringent regulatory interventions affecting pricing.

- Pharmaceutical patent challenges or litigation delaying entry of generics.

- Changes in treatment guidelines favoring alternative drug classes.

Conclusion

Lisinopril’s market remains robust owing to its clinical efficacy and global acceptance. However, the landscape is increasingly defined by intense generic competition, regulatory controls, and cost pressures. Prices are projected to decline progressively over the next five years, with potential stabilization in mature markets. Stakeholders should focus on cost efficiency, geographic expansion, and innovation to sustain profitability.

Key Takeaways

- The global lisinopril market is driven by its role as a first-line antihypertensive therapy, with widespread generic availability fostering affordability and access.

- Price erosion, primarily from generic competition, is expected to persist, with average prices declining 20-25% over the next five years.

- Emerging markets offer growth opportunities due to high disease prevalence and lower regulatory barriers.

- Regulatory and policy risks could influence pricing strategies, necessitating ongoing market surveillance.

- Innovation, such as combination formulations, remains a potential avenue for value addition amid price pressures.

FAQs

1. How is the price of lisinopril expected to change globally over the next five years?

Prices are anticipated to decline due to increased generic competition and regulatory price controls, particularly in developed markets. In emerging markets, prices may stabilize or increase modestly owing to demand growth and localized pricing strategies.

2. What factors influence lisinopril pricing in different regions?

Regulatory policies, market competition, procurement policies, healthcare infrastructure, and economic conditions significantly impact regional pricing.

3. Will new formulations or combination therapies impact lisinopril prices?

Potentially. While innovation can command premium pricing, market acceptance and regulatory approvals determine overall impact. Currently, combination ACE inhibitor therapies are primarily in development phases.

4. How does patent expiration influence lisinopril's market?

Patent expiry has facilitated the proliferation of generic manufacturers, leading to substantial price reductions and increased accessibility.

5. What competitive strategies should manufacturers pursue in the lisinopril market?

Focusing on cost optimization, expanding into high-growth markets, diversifying product portfolios, and engaging in strategic partnership arrangements are essential to maintaining margins amid price competition.

References

[1] IQVIA. (2022). Pharmaceutical Market Data & Analysis.

[2] WHO. (2019). Hypertension. World Health Organization.

[3] American College of Cardiology. (2017). 2017 Guideline for the Prevention, Detection, Evaluation, and Management of High Blood Pressure.

[4] GoodRx. (2023). Lisinopril Prices and Coupons.