Share This Page

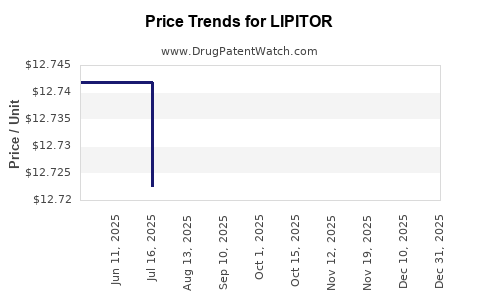

Drug Price Trends for LIPITOR

✉ Email this page to a colleague

Average Pharmacy Cost for LIPITOR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LIPITOR 80 MG TABLET | 58151-0158-77 | 18.14891 | EACH | 2025-12-17 |

| LIPITOR 10 MG TABLET | 58151-0155-77 | 12.76732 | EACH | 2025-12-17 |

| LIPITOR 40 MG TABLET | 00071-0157-23 | 18.28282 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lipitor (Atorvastatin)

Introduction

Lipitor (atorvastatin calcium), developed by Pfizer, remains one of the world's best-selling drugs for managing hypercholesterolemia and preventing cardiovascular disease. Despite global genericization post-patent expiry, Lipitor's brand valuation persists due to its longstanding clinical reputation, widespread usage, and the ongoing development of niche formulations. This analysis explores Lipitor's current market dynamics, competitive landscape, pricing strategies, and projective trends over the next five years to assist stakeholders in making informed strategic decisions.

Market Overview

Historical Market Performance

Lipitor launched in 1997, revolutionizing cholesterol management with its statin mechanism. At its peak, Lipitor generated over $10 billion annually, accounting for approximately 20% of Pfizer's global revenue in 2008 [1]. The patent expiry in most major markets around 2011 led to a sharp decline in brand sales due to generic entry, which diminished Lipitor's market share by over 90% in some regions.

Current Market Size and Composition

Despite the erosion of exclusivity, Lipitor remains a significant player, particularly in emerging markets where generic penetration lags behind. The global statins market was valued at approximately $17 billion in 2022, with atorvastatin constituting over 70% of that figure [2]. The persistent demand is driven by the drug's efficacy, extensive clinical backing, and its inclusion in treatment guidelines.

Market Segmentation

- Geographic Distribution: North America (primarily the U.S.) accounts for approximately 45% of global sales; Europe contributes around 25%, with Asia-Pacific and Latin America comprising the remainder.

- Patient Demographics: Primarily middle-aged to elderly populations with hyperlipidemia or increased cardiovascular risk.

Competitive Landscape

Patent and Generic Status

Pfizer's Lipitor patent expired in 2011 in the U.S. and EU, leading to a proliferation of generic atorvastatin products. However, Pfizer's Lipitor retained certain market segments through:

- Branded formulations with enhanced bioavailability.

- Combination therapies involving atorvastatin.

- Patent protections on specific formulations and delivery methods (e.g., Lipitor's pediatric doses or formulations with extended-release mechanisms).

Key Competitors

-

Generics: Multiple manufacturers like Teva, Mylan, and Sandoz produce bioequivalent atorvastatin generics, often priced 80-90% lower than the branded product.

-

Alternative Statins: Simvastatin, rosuvastatin, pravastatin, and pitavastatin serve as alternatives, often competing based on efficacy, tolerability, and patent status.

-

Innovative LDL-C Lowering Agents: PCSK9 inhibitors like evolocumab and alirocumab, which provide high-efficacy LDL reduction, particularly for high-risk patients resistant to statins.

Market Share Dynamics

Despite pharmacological competition, Lipitor maintains a niche for patients requiring high-dose statin therapy or benefiting from its established safety profile. Brand loyalty and physician familiarity further contribute to its sustained, though diminished, market share.

Price Trends and Strategy

Pre-Patents Expiry Pricing

Before patent expiry, Lipitor was priced at a premium point, reflecting its brand value. US wholesale prices averaged $3-4 per daily dose, with substantial margins for Pfizer.

Post-Generic Entry Pricing

Following patent expiration, generic atorvastatin prices plummeted, with per-dose costs falling below $0.10 — a reduction of over 95%. The price decline was swift, aiming to capture market share from the branded product.

Current Pricing Environment

In mature markets like the US and EU, branded Lipitor prices remain approximately 4-5 times higher than generics. Some factors impacting pricing include:

- Formulation Differentiation: Specialty formulations or combination drugs command higher prices.

- Insurance and Reimbursement Policies: Payers favor generics, though branded options may be available for specific indications.

- Market Penetration in Emerging Markets: Prices vary significantly, with branded Lipitor often priced 20-30% higher than generics due to import duties and limited competition.

Pricing Strategies

Pfizer employs several strategies to sustain income from Lipitor:

- Licensing and co-marketing agreements.

- Promotional efforts emphasizing Lipitor's proven efficacy.

- Development of fixed-dose combinations.

Future Price Projections and Market Trends

Factors Influencing Future Prices

- Patent and Regulatory Landscape: Continued patent protections on specific formulations or manufacturing processes may sustain premium pricing niches.

- Market Penetration of Generics: Expected to plateau at around 80% market share in established regions, limiting price rebound but sustaining low-price competition.

- Emerging Market Growth: Expanding healthcare infrastructure and increasing cardiovascular risk factor prevalence will bolster demand.

- Development of Adjunct Therapies: Incorporation into multi-drug regimens may affect pricing models.

Projected Market Trends (2023-2028)

- Pricing Stability in Mature Markets: Branded Lipitor prices are unlikely to rebound significantly due to aggressive generic competition; expect stable or slightly declining prices, with a nominal CAGR of approximately -2% to -3%.

- Premium Segment Growth: Specialized formulations or combination therapies involving Lipitor may see modest price increases, with a projected CAGR of +1% to +2%.

- Emerging markets: Prices may increase as Pfizer invests in branding and distribution, with a tentative CAGR of +2% to +4%, compensating for currency fluctuations and inflation.

Revenue Forecasts

Assuming market demand stabilizes at current levels (~$1 billion globally), with mix shifts favoring generics, Pfizer’s Lipitor revenues may decline by approximately 10-15% annually over the next five years. Nevertheless, niche formulations and specific patient segments could sustain residual revenues, especially in regions with limited generic penetration.

Regulatory and Market Factors Affecting Pricing

- Pricing Regulations: Governments in certain countries impose price caps and reimbursement controls, constraining potential price increases.

- Patent Litigation and Patent Term Extensions: Strategic patent protections may prolong exclusivity for certain formulations, enabling premium pricing.

- Healthcare Policy Trends: Emphasis on value-based pricing and biosimilar competition can exert downward pressure on prices.

Strategic Recommendations for Stakeholders

- Pharmaceutical Companies: Invest in niche formulation development, combination therapies, and biosimilar strategies to sustain revenues.

- Payors and Providers: Emphasize generic substitution policies while recognizing the premium value of specific Lipitor formulations.

- Investors: Anticipate declining revenues but explore niche and emerging market opportunities for growth.

Key Takeaways

- Market Dynamics: Lipitor’s global sales have substantially declined post-patent expiry but remain relevant in niche markets and emerging economies.

- Pricing Trends: Branded prices maintain a premium but are constrained by generic competition and regulatory policies; expected gradual decline in mature markets.

- Future Revenue Streams: Niche formulations and penetration in emerging markets could offset some revenue loss, though overall trend indicates continued decline.

- Competitive Landscape: Generics dominate volume share, while branded Lipitor sustains value through specialized formulations and strategic patent protections.

- Market Outlook: The global atorvastatin market will experience slow decline, punctuated by opportunities in niche segments, with prices stabilizing at lower levels.

FAQs

Q1: Will Lipitor’s brand price rebound after patent expiry?

A: Unlikely. The entry of numerous generic competitors has driven prices down considerably; only niche formulations or formulations with patent protections may command premium prices.

Q2: How are emerging markets influencing Lipitor’s pricing?

A: Limited generic penetration and rising cardiovascular disease prevalence in emerging markets could support modest price increases and higher sales volumes.

Q3: Is Lipitor still a viable option compared to newer therapies?

A: For many patients, especially those with standard hyperlipidemia, Lipitor remains cost-effective and well-established. However, high-risk patients may benefit from newer agents like PCSK9 inhibitors.

Q4: What role do combination therapies play in Lipitor’s future?

A4: Fixed-dose combinations can command higher prices and improve adherence, potentially sustaining revenue streams in select patient populations.

Q5: How do regulatory policies impact Lipitor’s future pricing?

A: Price caps, reimbursement restrictions, and patent litigation will continue to influence pricing strategies and profit margins, especially in regulated markets.

References

- Pfizer’s Financial Reports (2008): Annual revenue analysis of Lipitor.

- Market Research Future (2022): Global statins market valuation and segmentation data.

More… ↓