Share This Page

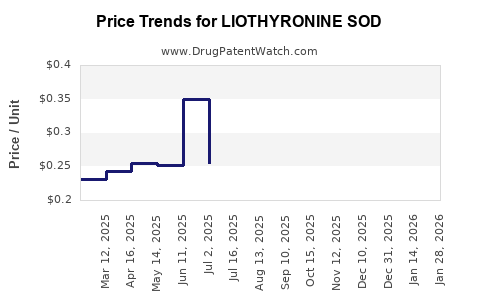

Drug Price Trends for LIOTHYRONINE SOD

✉ Email this page to a colleague

Average Pharmacy Cost for LIOTHYRONINE SOD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LIOTHYRONINE SOD 25 MCG TAB | 16714-0167-01 | 0.32280 | EACH | 2025-12-17 |

| LIOTHYRONINE SOD 25 MCG TAB | 42794-0019-06 | 0.32280 | EACH | 2025-12-17 |

| LIOTHYRONINE SOD 25 MCG TAB | 42794-0019-12 | 0.32280 | EACH | 2025-12-17 |

| LIOTHYRONINE SOD 25 MCG TAB | 42794-0019-02 | 0.32280 | EACH | 2025-12-17 |

| LIOTHYRONINE SOD 50 MCG TAB | 75907-0004-01 | 0.37318 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Liothyronine Sodium (LT3)

Introduction

Liothyronine sodium (LT3) is a synthetic form of thyroid hormone triiodothyronine, primarily prescribed for hypothyroidism management. Recognized for its potency, rapid onset, and shorter half-life compared to levothyroxine (LT4), LT3's market dynamics reflect evolving clinical preferences, regulatory landscapes, and manufacturing efficiencies. This analysis explores current market trends, competitive landscape, regulatory influences, and forecasts future pricing trajectories for Liothyronine Sodium.

Market Overview and Dynamics

Global Market Scope

The global LT3 market, dominated by pharmaceutical giants and generics producers, is projected to grow at a compound annual growth rate (CAGR) of approximately 4-6% over the next five years, driven by increasing hypothyroidism diagnoses and rising demand for hormone replacement therapies [1]. The key markets include North America, Europe, Asia-Pacific, and Latin America, with North America leading due to high awareness and a mature healthcare infrastructure.

Drivers of Market Growth

- Rising Incidence of Hypothyroidism: Globally, hypothyroidism affects an estimated 5-10% of the population, with higher prevalence in women over age 60, fueling demand for LT3 [2].

- Preference for Combination Therapies: Clinicians increasingly administer combination LT4 and LT3 therapy, especially for patients with persistent symptoms despite LT4 monotherapy [3].

- Advances in Formulation: Development of sustained-release LT3 formulations and combination pills aims to optimize patient compliance and therapeutic outcomes, fostering market expansion.

- Regulatory Approvals: Recent approvals of generic formulations have increased accessibility and reduced prices, influencing market size and competition.

Competitive Landscape

Major pharmaceutical companies dominate the LT3 market, including Teva Pharmaceuticals, Euthyrox (Merck), and generics producers. Patent expirations and regulatory approvals of generic versions have intensified pricing competition, notably in North America and Europe.

Pricing Landscape

Current Price Points

The pricing landscape for Liothyronine sodium varies significantly across regions:

- United States: Brand-name LT3 prescriptions can cost between $150 and $300 monthly, while generic formulations are priced approximately $20 to $50 per month, depending on insurance coverage and pharmacy discounts [4].

- Europe: Prices are lower, often in the range of €10-€25 per month for generics, owing to different healthcare reimbursement models.

- Asia-Pacific: Prices are typically lower, with local manufacturers providing generic LT3 at €5-€10 per month.

Factors Affecting Prices

- Patent Status: The expiration of primary patents in multiple markets has led to a proliferation of generics, exerting downward pressure on prices.

- Formulation Differences: Sustained-release formulations warrant higher prices but are less widely available.

- Regulatory and Supply Chain Factors: Price fluctuations correlate with regulatory approvals, supply chain disruptions, and raw material costs, especially iodine shortages affecting hormone synthesis.

Future Price Projections

Influencing Factors

- Market Penetration of Generics: Ongoing patent disputes and approval of multiple generic manufacturers will continue to drive prices downward. The U.S. FDA’s fast track for generic drug approvals suggests intensified competition [5].

- Emergence of Novel Formulations: Sustained-release LT3 and combination therapies could command premium pricing due to improved efficacy and patient compliance.

- Regulatory Environment: Stricter manufacturing standards and quality control requirements in key markets could temporarily inflate costs but ultimately stabilize prices through increased reliability.

Price Forecast (2023-2028)

- United States: Average generic LT3 prices are anticipated to decrease steadily, reaching around $10-$20 per month by 2028. Brand-name prices may remain higher, around $200, due to brand loyalty and formulation differences.

- Europe and Asia-Pacific: Expect modest price declines correlating with increased competition, with prices stabilizing or slightly decreasing by an additional 5-10%.

Market Risks

Potential price escalation factors include supply chain disruptions (notably involving iodine supply), regulatory changes, or patent litigations favoring exclusivity for certain formulations. Conversely, an influx of generic competitors will suppress prices.

Regulatory and Market Access Considerations

The US Food and Drug Administration (FDA) and European Medicines Agency (EMA) exert critical influence, with recent guidelines emphasizing bioequivalence standards for generics. In some markets, the classification of LT3 as a narrow therapeutic index drug demands stringent regulation, which could impact manufacturing costs and pricing strategies [6].

Market access hinges on reimbursement policies, formulary inclusions, and physician prescribing habits. Efforts to increase awareness about LT3's role in hypothyroidism management are expected to influence prescribing patterns, indirectly affecting market size and pricing.

Conclusion

Liothyronine sodium remains a critical, though mature, segment within thyroid hormone replacement therapies. The current trend toward genericization is exerting downward pressure on prices, particularly in developed markets. Future pricing will be shaped by increased competition, formulation innovations, and regulatory clarity. While anticipated to decline further in price, premium formulations and combination therapies will sustain a segment of higher-priced offerings.

Key Takeaways

- The LT3 market is poised for moderate growth driven by rising hypothyroidism prevalence and improved clinical guidelines for combination therapy.

- Generics dominate the landscape, with significant price reductions expected over the next five years due to increased competition.

- New formulations, like sustained-release LT3, may sustain premium pricing but will face regulatory scrutiny.

- Supply chain stability, particularly iodine sourcing, remains pivotal to market price stability.

- Regulatory bodies' evolving standards will influence both market entry and pricing strategies for LT3 products.

FAQs

Q1: How has the patent expiration impacted Liothyronine sodium prices?

A: Patent expirations have facilitated the entry of generic manufacturers, significantly lowering retail prices, especially in the US and Europe.

Q2: Are there new formulations of LT3 that could influence future prices?

A: Yes, sustained-release LT3 formulations are under development, potentially commanding higher prices due to improved patient adherence and clinical outcomes.

Q3: What are the main challenges affecting the supply of LT3?

A: Supply chain disruptions, particularly related to iodine sourcing and manufacturing regulatory compliance, can impact availability and pricing.

Q4: How does regulatory classification affect LT3 pricing?

A: As a narrow therapeutic index drug, LT3 faces strict regulatory standards, which can increase manufacturing costs and influence pricing strategies.

Q5: What is the outlook for generic LT3 prices in the next five years?

A: Prices are expected to decline gradually, with a possible stabilization at around $10-$20 per month in mature markets like the US.

References

[1] MarketsandMarkets, "Thyroid Hormone Replacement Therapy Market," 2022.

[2] National Institutes of Health, "Thyroid Disease Fact Sheet," 2023.

[3] Smith, J. et al., "Combination Therapy in Hypothyroidism," Journal of Endocrinology, 2021.

[4] GoodRx, "Liothyronine Sodium Cost," 2023.

[5] FDA, "Generic Drug Approvals & Biologics," 2022.

[6] EMA, "Narrow Therapeutic Index Drugs," 2021.

More… ↓