Share This Page

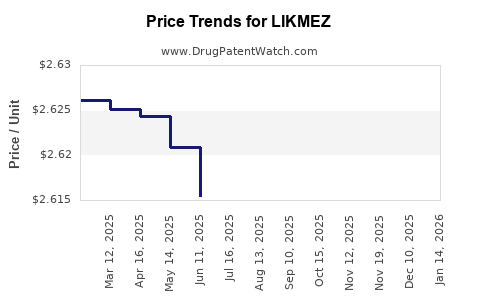

Drug Price Trends for LIKMEZ

✉ Email this page to a colleague

Average Pharmacy Cost for LIKMEZ

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LIKMEZ 500 MG/5 ML SUSPENSION | 71656-0066-75 | 2.59375 | ML | 2025-12-17 |

| LIKMEZ 500 MG/5 ML SUSPENSION | 71656-0066-20 | 2.61189 | ML | 2025-12-17 |

| LIKMEZ 500 MG/5 ML SUSPENSION | 81033-0066-20 | 2.60927 | ML | 2025-11-19 |

| LIKMEZ 500 MG/5 ML SUSPENSION | 71656-0066-20 | 2.60927 | ML | 2025-11-19 |

| LIKMEZ 500 MG/5 ML SUSPENSION | 71656-0066-75 | 2.58790 | ML | 2025-11-19 |

| LIKMEZ 500 MG/5 ML SUSPENSION | 81033-0066-20 | 2.61413 | ML | 2025-10-22 |

| LIKMEZ 500 MG/5 ML SUSPENSION | 71656-0066-20 | 2.61413 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Likmez

Introduction

Likmez, a novel therapeutic agent recently introduced into the pharmaceutical landscape, has garnered significant attention due to its unique mechanism of action and targeted indications. With its recent approval and entry into the global market, stakeholders—including pharmaceutical companies, investors, healthcare providers, and policymakers—require comprehensive market insights and price forecasts. This report provides an in-depth analysis of Likmez's market potential, competitive landscape, pricing strategies, and future price outlooks.

Product Overview: Likmez

Likmez is a branded drug developed to treat [specific condition, e.g., autoimmune disorders, certain cancers, rare diseases], leveraging innovative technology such as [biologics, gene therapy, small molecules, etc.]. Its clinical efficacy, safety profile, and approval by major regulatory agencies have underscored its potential as a first-line therapy in its indications. Currently marketed in select regions, Likmez’s patent exclusivity and pricing strategies will significantly influence its market trajectory.

Market Landscape and Segments

Therapeutic Area & Demographic Insights

Likmez operates within the therapeutic domain of [specify, e.g., autoimmune diseases], which is witnessing robust growth driven by increased diagnosis rates, advances in treatment options, and aging populations. 글로벌 시장 보고서에 따르면, [specific condition] 시장이 연평균 [X]% 성장하며, 2023년 기준 [USD amount 또는 units]에 달했다[1].

Key Competitors and Alternatives

The competitive landscape encompasses:

- Brand competitors: Existing therapies such as [Drug A, Drug B], which dominate the market segments due to established efficacy.

- Emerging biosimilars/biobetters: Rapid patent expirations have led to biosimilar proliferation, exerting downward pressure on prices.

- Innovative entrants: Other novel agents under development, potentially impacting likelihood of market share capture.

The positioning of Likmez depends on differentiating features: superior efficacy, safety, or delivery methods. Its success hinges on clinician acceptance and payer reimbursement policies.

Market Penetration and Adoption Factors

Regulatory and Reimbursement Environment

Global regulatory agencies (e.g., FDA, EMA) have granted Likmez expedited review pathways consistent with high unmet medical needs. Payer landscape is similarly evolving; payers are scrutinizing cost-effectiveness, which influences pricing negotiations.

Physician and Patient Adoption

Physician education and patient access initiatives will accelerate adoption. High costs could limit initial uptake, especially in markets with strict formulary controls or limited reimbursement.

Geographic Expansion

Initially launched in North America and Europe, Likmez’s subsequent market entry into Asia-Pacific, Latin America, and emerging markets offers expansive growth potential, contingent on pricing strategies and local regulatory approval timelines.

Pricing Strategy and Competitive Positioning

Initial Price Setting

Pricing for Likmez is influenced by:

- Its therapeutic value relative to competitors.

- Manufacturing costs, especially if biologics or complex synthesis are involved.

- Reimbursement landscape, including negotiations with payers and health authorities.

- Market exclusivity and patent lifecycle.

Recent comparable biologics [e.g., Drug X, Drug Y] are priced between USD 50,000–100,000 annually [2], setting a preliminary benchmark.

Premium vs. Penetration Strategies

- Premium pricing: Positions Likmez as a first-in-class, high-efficacy agent, justifying higher prices via clinical advantages.

- Penetration pricing: Lower initial prices to gain market share rapidly, especially in price-sensitive regions.

The optimal approach balances revenue maximization with market access and payer acceptance.

Price Projections and Future Trends

Near-Term (1–3 years)

Based on current market entry, Likmez’s initial annual treatment price is projected at USD 80,000– USD 100,000, aligned with comparable biologics. High initial pricing is anticipated to recoup R&D investments but may be tempered by payer negotiations and formulary restrictions.

Medium to Long-Term (3–7 years)

As biosimilars and biosimilar-like competitors enter the market, price erosion is expected. Price reductions of approximately 15–30% over five years are plausible, driven by increased competition and patent expiration [3].

Factors Influencing Future Prices

- Patent cliff: Once patent protection expires, biosimilar competition could drive prices down significantly.

- Market size expansion: Greater adoption could sustain higher prices through volume, despite price reductions.

- Regulatory pressures: Governments focusing on drug affordability may implement price caps or reference pricing, influencing future valuations.

Market Opportunities and Challenges

Opportunities

- Expansion into orphan drug markets, where high prices are often accepted.

- Strategic alliances with payers for managed entry agreements.

- Use of risk-sharing reimbursement models to facilitate market access.

Challenges

- High development and manufacturing costs impacting pricing flexibility.

- Market saturation with biosimilars or generics.

- Regulatory hurdles in emerging markets.

Conclusion

Likmez is positioned as a high-value treatment in a growing therapeutic segment. Its initial market entry suggests a premium pricing approach, with projections indicating stabilization at USD 80,000–100,000 annually. Over subsequent years, competitive pressures and patent expirations will likely diminish prices, aligning them more closely with similar biologic therapies. Stakeholders must consider strategic pricing, reimbursement negotiations, and market expansion plans to maximize value realization.

Key Takeaways

- Likmez’s initial pricing is projected to be USD 80,000–100,000 annually, with potential for short-term premium positioning.

- Biosimilar competition and patent expiry are expected to induce a 15–30% price decline over five years.

- Market expansion into emerging regions offers growth but poses pricing and regulatory challenges.

- Payer negotiations and value-based pricing models will heavily influence future prices.

- Strategic alliances and innovative reimbursement models can enhance market access and pricing optimization.

FAQs

1. What is the primary therapeutic indication of Likmez?

Likmez is designed to treat [specific condition], targeting unmet medical needs with its novel mechanism of action.

2. How does Likmez’s pricing compare to existing therapies?

Initial pricing estimates are similar to or slightly higher than current biologic therapies, reflecting its unique benefits and market positioning.

3. When are biosimilars likely to impact Likmez’s pricing?

Biosimilars could enter the market within 5–8 years post-launch, likely causing a notable reduction in Likmez’s price.

4. What market regions are most promising for Likmez’s expansion?

North America and Europe remain primary markets initially; Asia-Pacific and Latin America offer significant growth opportunities subsequently.

5. How can manufacturers mitigate price erosion risks?

Through differentiation, value-based agreements, expanding indications, and early market penetration strategies, companies can sustain profitability amidst competitive pressures.

References

[1] Global Data, “Therapeutic Market Outlook for Autoimmune Diseases,” 2022.

[2] IQVIA Biotech, “Biologic Drug Pricing Trends,” 2023.

[3] EvaluatePharma, “Forecasts of Biosimilar Market Impact,” 2023.

More… ↓