Share This Page

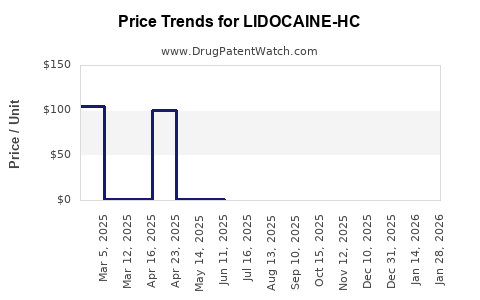

Drug Price Trends for LIDOCAINE-HC

✉ Email this page to a colleague

Average Pharmacy Cost for LIDOCAINE-HC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LIDOCAINE-HC 3-0.5% CREAM | 69367-0397-01 | 0.94129 | GM | 2025-12-17 |

| LIDOCAINE-HC 3-0.5% CREAM | 59088-0819-03 | 0.94129 | GM | 2025-12-17 |

| LIDOCAINE-HC 3-0.5% CREAM | 13925-0160-03 | 1.18994 | GM | 2025-12-17 |

| LIDOCAINE-HC 3-0.5% CREAM | 59088-0819-07 | 1.18994 | GM | 2025-12-17 |

| LIDOCAINE-HC 3-0.5% CREAM | 13925-0160-01 | 1.51573 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LIDOCAINE-HC

Introduction

Lidocaine-HC, a topical anesthetic formulation combining lidocaine with hydrocortisone, occupies a unique niche in the pharmaceutical landscape. It is primarily utilized for managing localized pain, itching, and inflammation associated with dermatological conditions. As the healthcare industry advances toward personalized and minimally invasive treatments, understanding the market dynamics and pricing trends surrounding Lidocaine-HC is critical for stakeholders, including manufacturers, investors, and healthcare providers.

This analysis synthesizes current market data, regulatory considerations, and competitive factors to project future price trajectories and delineate strategic insights.

Market Landscape Overview

Therapeutic Indications and Demographics

Lidocaine-HC is predominantly prescribed for inflammatory skin conditions such as dermatitis, eczema, and psoriasis, especially where inflammation coincides with pain or itching. These conditions afflict broad patient demographics globally, with increased prevalence in older adults and individuals with chronic skin ailments.

The global dermatological drugs market, valued at approximately USD 23 billion in 2022, is expected to grow at a CAGR of 6-7% through 2030, driven by rising dermatological disorders and expanding drug pipelines.[1] Within this landscape, topical formulations, including corticosteroid combinations like Lidocaine-HC, account for a significant portion of sales due to their targeted action and favorable safety profiles.

Competitive Environment and Market Share

Major pharmaceutical players dominate the Lidocaine-HC market, with products such as Lidocaine with hydrocortisone creams and ointments marketed under various brand names. The competition is characterized by:

- Generics: A significant segment owing to patent expirations.

- Brand-Name Drugs: Offering differentiated formulations or delivery mechanisms.

- OTC vs. Prescription: Many formulations are available over-the-counter in select markets, influencing pricing strategies.

Market share distribution is heavily influenced by regional regulatory approvals, physician prescribing habits, and patient preferences. Notably, North America and Europe represent mature markets with high adoption rates, whereas Asia-Pacific offers substantial growth opportunities driven by increasing healthcare access and dermatological disease prevalence.

Regulatory and Patent Considerations

Lidocaine-HC formulations are subject to national regulatory standards, with some formulations enjoying limited patent protections. Patent expirations open avenues for generic entrants, intensifying price competition. Conversely, innovative delivery systems or combination innovations can extend exclusivity and influence pricing.

Regulatory barriers in emerging markets may delay product launches, affecting market penetration and price stabilization timelines. Additionally, compliance with safety standards influences manufacturing costs and, subsequently, pricing.

Pricing Dynamics and Trends

Historical Price Movements

Over the past decade, topical anesthetic products incorporating lidocaine and hydrocortisone have experienced moderate price fluctuations influenced by generic competition and regional market factors. In the United States, brand-name categories have maintained premium pricing (USD 15–30 per tube), while generics commonly retail at approximately USD 8–15.

Current Pricing Landscape

As of 2023, key factors impacting current pricing include:

- Generic Penetration: Entry of generics has suppressed prices, with reductions of 20–40% compared to brand-name equivalents.

- Manufacturing Costs: Variations based on raw material prices and formulation complexity.

- Market Demand: Stable demand ensures relatively steady prices, but supply constraints or regulatory delays can cause short-term volatility.

- Distribution Channels: OTC availability in certain markets reduces costs and prices, whereas prescription-only formulations tend toward higher pricing.

Regional Variations

Pricing disparities are notable across geography:

- North America: Higher prices driven by healthcare system structures and brand-preference.

- Europe: Price controls and reimbursement policies exert downward pressure.

- Asia-Pacific: Competitive generic markets and lower disposable income influence more affordable pricing.

Future Price Projections (2023–2030)

Predicting future prices for Lidocaine-HC necessitates analyzing multiple factors:

-

Patent Cliff and Generic Competition: Expect continued downward pressure on prices as patents expire, with generics dominating the market by mid-decade.

-

Innovations in Delivery and Formulation: Development of sustained-release formulations or combination products may command premium pricing, potentially offsetting generic price erosion.

-

Regulatory and Policy Changes: Introduction of stricter pricing controls in key markets could suppress prices further, although demand elasticity for dermatological products remains moderate.

-

Market Penetration in Emerging Economies: Price reductions are anticipated as companies expand access in low-to-middle income countries, potentially reducing global per-unit prices by approximately 15–25% over the next five years.

-

Inflation and Raw Material Costs: These will variably impact manufacturing costs, influencing price adjustments.

Projected average retail prices in the developed markets may decline gradually from current levels to approximately USD 10–20 per tube by 2030, with regional variations. In developing markets, prices could stabilize around USD 5–10 due to competitive pressures.

Supply Chain and Cost Factors

Supply chain disruptions, such as raw material shortages (notably for local anesthetics and corticosteroids), may temporarily inflate costs, impacting prices. Conversely, increasing manufacturing efficiencies and economies of scale could exert downward pressure.

Emerging Trends and Strategic Implications

- Patient-Centric Formulations: Innovations with better tolerability and efficacy could sustain premium pricing.

- Regulatory Exclusivities: Opportunities created by orphan status or new indications may confer market advantages.

- Digital and Value-Based Pricing: Integration of digital health insights and value-based reimbursement models may influence pricing strategies.

Key Challenges and Opportunities

-

Challenges:

- Price erosion due to generics.

- Regulatory hurdles in emerging markets.

- Price sensitivity in low-income segments.

-

Opportunities:

- Differentiation through novel delivery systems.

- Expansion into niches such as pediatric or sensitive skin applications.

- Strategic partnerships to penetrate emerging markets.

Conclusion

Lidocaine-HC remains a vital topical therapeutic with a stable yet competitive market structure. Future pricing trajectories will largely be shaped by patent dynamics, formulation innovations, and regional regulatory landscapes. Stakeholders should anticipate moderate price reductions due to generic proliferation but also recognize opportunities in differentiated products and expanding markets. Robust R&D and strategic positioning will be crucial for maintaining profitability amid evolving market conditions.

Key Takeaways

- The global Lidocaine-HC market is mature, with price declines driven primarily by generic competition.

- Regional disparities influence pricing, with North America and Europe maintaining premium prices relative to Asia-Pacific countries.

- Patent expirations will usher in increased generics, likely reducing prices by 15–25% over the next five years.

- Innovation in delivery mechanisms and new indications offer potential premium pricing opportunities.

- Market expansion in emerging economies presents both growth prospects and pricing challenges.

FAQs

Q1: What factors most influence Lidocaine-HC pricing over the next decade?

A: Patent expirations, generic penetration, formulation innovations, regional regulatory policies, and supply chain costs primarily influence pricing trajectories.

Q2: How does regional regulation impact Lidocaine-HC prices?

A: In regions with strict price controls or reimbursement policies—such as Europe—prices are restrained, whereas less regulated markets may see higher prices.

Q3: Will new formulations affect Lidocaine-HC's market value?

A: Yes. Innovations such as sustained-release systems could command higher prices and extend product life cycles, offsetting generic price erosion.

Q4: What opportunities exist for market expansion in developing countries?

A: Growing dermatological conditions, increasing healthcare access, and cost-effective formulations create opportunities, though pricing may need adaptation to local economic conditions.

Q5: How should stakeholders prepare for future market shifts?

A: Investing in innovative formulations, monitoring patent landscapes, and tailoring strategies to regional regulatory environments will be crucial for maintaining competitiveness.

Sources:

[1] MarketWatch. “Dermatological Drugs Market Size, Share & Trends Analysis Report.” 2022.

More… ↓