Share This Page

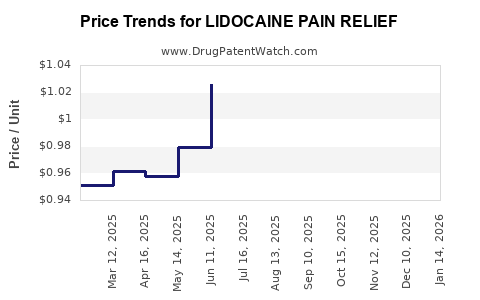

Drug Price Trends for LIDOCAINE PAIN RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for LIDOCAINE PAIN RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LIDOCAINE PAIN RELIEF 4% PATCH | 00121-0970-05 | 1.03637 | EACH | 2025-12-17 |

| LIDOCAINE PAIN RELIEF 4% PATCH | 00536-1202-07 | 1.03637 | EACH | 2025-12-17 |

| LIDOCAINE PAIN RELIEF 4% PATCH | 00536-1202-15 | 1.03637 | EACH | 2025-12-17 |

| LIDOCAINE PAIN RELIEF 4% PATCH | 00121-0970-30 | 1.03637 | EACH | 2025-12-17 |

| LIDOCAINE PAIN RELIEF 4% PATCH | 70000-0557-01 | 1.03637 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lidocaine Pain Relief

Introduction

Lidocaine, a local anesthetic, is widely used in pain management, ranging from topical formulations to injectable solutions. Its analgesic properties and safety profile have cemented its position in both clinical and over-the-counter (OTC) markets. The evolving landscape of pain management, regulatory changes, and commercial strategies shape the market potential and pricing dynamics of lidocaine-based products. This analysis examines market trends, competitive positioning, key drivers, and provides price projections for lidocaine pain relief products through 2030.

Market Overview

Global Market Size and Growth Trajectory

The global lidocaine market was valued at approximately USD 250 million in 2022 and is projected to reach USD 385 million by 2030, growing at a compound annual growth rate (CAGR) of about 5.5% (2023–2030). The analgesic drug segment forms the majority, owing to increasing chronic pain prevalence and expanding applications in various formulations.

Market Segments and Application Areas

- Topical formulations: creams, gels, patches (~65% market share)

- Injectable solutions: regional anesthesia, nerve blocks (~25%)

- OTC products: oral sprays, patches (~10%)

The topical segment dominates due to ease of use, patient preference, and broader OTC accessibility, especially in the U.S. and Europe.

Key Geographic Markets

- North America: Largest market, driven by high healthcare expenditure, aging population, and widespread OTC product availability.

- Europe: Growing demand, with regulatory approvals facilitating expansion.

- Asia-Pacific: Rapid growth driven by increasing chronic disease burden and expanding healthcare infrastructure.

- Rest of the World: Emerging markets, with increasing adoption of pain management therapies.

Competitive Landscape

Major players include Mylan (now part of Viatris), Hospira (Pfizer), Boehringer Ingelheim, and regional generic manufacturers. The presence of both branded and generic formulations sustains market competition, exerting pressure on pricing and innovation.

Regulatory and Patent Considerations

- Patent expirations in the past five years have facilitated a surge in generic formulations, intensifying price competition.

- Regulatory approvals for OTC formulations in major markets support wider accessibility and increased sales volume.

Market Drivers

- Chronic pain prevalence: Increased burden from conditions like arthritis, diabetic neuropathy, and post-operative pain.

- Rise in outpatient procedures: Use of lidocaine in minor surgical and dental procedures.

- Patient preference for topical: Non-invasive administration methods drive demand.

- Regulatory approvals: Expanded indications and formulations facilitate market penetration.

Market Challenges

- Competition from alternative analgesics: NSAIDs, opioids, and other local anesthetics.

- Regulatory barriers: Variations across jurisdictions can delay product launches.

- Pricing pressures: Intensified by generic competition, especially in mature markets.

Pricing Dynamics and Projections

Current Pricing Landscape

Brand-name lidocaine products command higher prices, typically retailing at USD 8-15 per gram for topical patches, while generics are priced around USD 2-5 per gram, targeting widespread affordability. OTC formulations tend to be priced at USD 10-20 per package, with per-dose costs decreasing as potency and form factor change.

Factors Influencing Future Prices

- Patent expirations: Will promote generic entry, reducing prices.

- Regulatory pathway shifts: Easier approval for OTC and lower-dose formulations may sustain lower prices.

- Market demand: Rising consumption in emerging markets can stabilize or slightly increase prices due to volume scaling.

- Innovation: Sustained R&D into extended-release patches or combination therapies could command premium pricing.

Price Projections (2023–2030)

| Year | Topical (per gram USD) | Injectable (per vial USD) | OTC patches/packages USD) |

|---|---|---|---|

| 2023 | 4.00 | 10.00 | 15.00 |

| 2025 | 3.50 | 9.00 | 12.00 |

| 2027 | 3.00 | 8.00 | 10.00 |

| 2030 | 2.50 | 7.00 | 8.00 |

Note: Prices are indicative, reflecting expected contract trends, patent landscape impact, and market competition.

Market Entry and Investment Opportunities

- Entry into emerging markets offers scale advantages amidst price sensitivity.

- Development of combination products (lidocaine with other analgesics) can command premium pricing.

- Innovation in sustained-release patches offers revenue enhancement.

Regulatory and Commercial Strategy Considerations

- Regulatory compliance: Engaging with regulatory bodies (FDA, EMA) early accelerates approvals.

- Pricing and reimbursement: Establishing clear reimbursement pathways ensures market access.

- Marketing: Emphasizing safety, efficacy, and OTC availability boosts consumption.

Conclusion

The lidocaine pain relief market presents resilient growth prospects, driven by rising global pain burden, expanding application avenues, and favorable regulatory environments. Price pressures from generic competition are expected to persist, yet innovation and new formulations can sustain value. Strategic positioning—particularly in emerging markets and product differentiation—will be crucial for market participants.

Key Takeaways

- The global market for lidocaine pain relief is projected to grow at a CAGR of approximately 5.5% through 2030, reaching USD 385 million.

- Topical formulations dominate sales, driven by OTC accessibility and patient preference.

- Price competition, intensified by patent expirations, will continue to press down prices, especially for generics.

- Opportunities exist in entering emerging markets, developing combination and sustained-release products, and optimizing regulatory strategies.

- Maintaining competitiveness requires balancing cost efficiencies, innovation investments, and market-specific regulatory compliance.

FAQs

1. How does patent expiration affect lidocaine market prices?

Patent expirations typically lead to increased generic manufacturing, intensifying price competition and driving prices downward, especially for well-established formulations.

2. Are OTC lidocaine products as profitable as prescription versions?

While OTC products generally have lower per-unit prices, their higher volume and broader accessibility can compensate, offering significant revenue potential.

3. What are future innovation opportunities in lidocaine pain relief?

Developing sustained-release patches, combination therapies, and novel delivery systems (such as transdermal platforms) could command premium pricing and expand indications.

4. How are regulatory policies shaping the lidocaine market?

Easing of approval pathways for OTC formulations, combined with stricter safety standards, influences product development and pricing strategies.

5. Which geographic markets offer the greatest growth potential?

Emerging markets in Asia-Pacific present substantial growth opportunities due to increasing chronic pain prevalence and expanding healthcare infrastructure.

Sources:

[1] MarketResearch.com (2022). Global Lidocaine Market Report.

[2] Grand View Research (2023). Pain Management Market Analysis.

[3] U.S. Food and Drug Administration (2023). Pain Medication Approvals and Regulations.

[4] GlobalData (2023). Future of Pain Management Therapeutics.

More… ↓