Share This Page

Drug Price Trends for LEXAPRO

✉ Email this page to a colleague

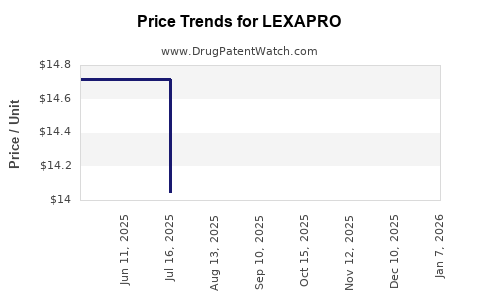

Average Pharmacy Cost for LEXAPRO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LEXAPRO 10 MG TABLET | 00456-2010-01 | 14.70443 | EACH | 2025-11-19 |

| LEXAPRO 20 MG TABLET | 00456-2020-01 | 15.32603 | EACH | 2025-11-19 |

| LEXAPRO 10 MG TABLET | 00456-2010-01 | 14.71203 | EACH | 2025-10-22 |

| LEXAPRO 20 MG TABLET | 00456-2020-01 | 15.32183 | EACH | 2025-10-22 |

| LEXAPRO 20 MG TABLET | 00456-2020-01 | 15.31136 | EACH | 2025-09-17 |

| LEXAPRO 5 MG TABLET | 00456-2005-01 | 14.02627 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lexapro (Escitalopram)

Introduction

Lexapro (generic name: escitalopram) is a widely prescribed selective serotonin reuptake inhibitor (SSRI) used primarily for major depressive disorder (MDD) and generalized anxiety disorder (GAD). Since its debut in 2002 by Forest Laboratories (acquired by Allergan in 2015, now part of AbbVie), Lexapro has maintained a strong market presence due to its efficacy, tolerability, and established safety profile. This article provides an in-depth market analysis and price projections for Lexapro, considering current industry trends, patent landscape, generic entry, regulatory developments, and potential factors influencing future pricing.

Market Landscape

Current Commercial Status

Lexapro remains a leading SSRI, with a significant global market share in depression and anxiety therapeutics. The drug's sales peaked in the early 2010s, but the patent expiration in August 2012 in the U.S. initiated the entry of generic versions, leading to substantial price erosion.

Patent and Patent Expiry Impact

Originally patented until 2012, Lexapro faced patent cliffs in various regions, especially in the United States. The 2012 patent expiry marked the beginning of a wave of generic competition, with multiple manufacturers launching approved equivalents. U.S. generic approvals consist of several companies with marketed formulations, such as Teva, Apotex, and Sun Pharma.

The patent landscape significantly influences market dynamics. While the primary patent expiration led to sharp price drops, secondary patents and exclusivities briefly sustained higher prices in certain markets. Currently, the availability of multiple generics maintains intense price competition.

Competitive Dynamics

The market is saturated with generics, exerting downward pressure on prices. Despite this, branded Lexapro retains some premium pricing in select markets reliant on physician preference, patient familiarity, and formulary preferences. Notably, in emerging markets, branded prescriptions often command higher prices due to delayed generic penetration.

Market Size and Demographic Trends

The global antidepressant market was valued at approximately USD 15 billion in 2021, with SSRIs, including Lexapro, representing a large segment. The growth is driven by increasing prevalence of depression and anxiety, expanded mental health awareness, and off-label uses.

In the U.S., depression affects over 17 million adults annually. The aging population and rising mental health concerns suggest sustained or increased demand. Similar trends are observable in Europe and Asia.

Price Trends and Projections

Historical Price Trends

Post-generic entry, Lexapro’s per-unit price decreased sharply. In 2012, the average retail price per tablet (~10 mg) in the U.S. was approximately USD 5.50–6.00, which declined to about USD 1.50 in subsequent years. This decline stabilized over the last five years, reflecting market saturation and stiff generic competition.

Current Pricing Environment

Today, the average wholesale price (AWP) for generic escitalopram in the U.S. hovers around USD 0.50–1.00 per tablet, with pharmacy benefit managers (PBMs) and insurance plans often reimbursing even lower through negotiated contracts. The branded Lexapro now commands a premium, often priced at approximately USD 4–6 per tablet, primarily for patients with specific insurance coverage or formulary restrictions.

Future Price Projections (2023–2030)

Factors influencing future prices:

- Generic Market Penetration: Expect continued price erosion for generic escitalopram, driven by new entrants and bidding practices in pharmacy marketplaces.

- Formulary Decisions and Insurance Coverage: Payers favor generics, further suppressing branded prices.

- Potential Patent Strategies & Formulary Exclusivity: Absent new patent filings or exclusivities, branded prices will likely diminish further.

- Emerging Market Dynamics: In countries with slower generic penetration, branded products—both Lexapro and its generics—may maintain higher prices.

Projection Summary:

| Year | Estimated Generic Price (USD per tablet) | Estimated Branded Price (USD per tablet) |

|---|---|---|

| 2023 | USD 0.50–1.00 | USD 4.00–6.00 |

| 2025 | USD 0.30–0.80 | USD 3.00–4.50 |

| 2030 | USD 0.20–0.50 | USD 2.50–4.00 |

By 2030, generic prices could decrease by 60–70% from 2022 levels, with branded prices possibly declining further or stabilizing depending on market exclusivity and brand loyalty nuances.

Key Market Drivers & Risks

Drivers

- Growing Mental Health Awareness: Increasing prescriptions for depression and anxiety will sustain demand.

- Expansion in Emerging Markets: Growing healthcare infrastructure and mental health programs will open new revenue streams.

- Insurance & Payer Strategies: Preference for cost-effective generic prescribing further suppresses branded prices.

Risks

- Regulatory Changes: Patent litigation or reform policies could impact pricing protections.

- Market Saturation: Intense competition among generics limits pricing power.

- Patent Strategies: Secondary patents or exclusivities can temporarily slow price declines.

- Off-Label Use & New Therapeutics: Emergence of novel antidepressants with better efficacy or safety profiles could erode Lexapro’s market share.

Impact of Regulatory and Patent Strategies

The pharmaceutical industry increasingly leverages strategic patent filings to extend exclusivity. While primary patents for Lexapro expired in 2012, secondary patents aimed at formulations or delivery methods could temporarily sustain higher prices. However, courts worldwide often challenge such patents, leading to further generics entering the market and intensifying price competition.

In recent years, some markets saw short-term stabilization of branded prices due to patent litigation or regulatory delays, but these effects are typically transient. The trend indicates a long-term decline in Lexapro’s branded pricing power as generics dominate.

Implications for Stakeholders

Pharmaceutical Companies

Manufacturers must innovate beyond traditional SSRIs to sustain profitability, potentially exploring extended-release formulations, combination therapies, or new indications. Strategic patent filings and licensing remain key to delaying generic competition.

Payers and Healthcare Providers

Cost containment pressures will lead to increased preference for generics. Negotiating favorable pricing and formulary inclusion are critical.

Investors and Market Analysts

The declining trend in pricing and revenues underscores the importance of diversification and investment in innovative therapeutics within mental health.

Conclusion

Lexapro’s market has matured following patent expiration, characterized by significant price erosion among generics. Future price landscapes will be shaped by ongoing generics competition, regulatory policies, and global market penetration. While branded Lexapro will likely maintain a niche role, especially in certain geographies, its pricing power is expected to diminish further by 2030, aligning with broader dynamics in the antidepressant segment.

Key Takeaways

- The patent expiry of Lexapro led to a sharp decline in branded product prices, with generics dominating most markets.

- Current and projected prices for generics will continue to decline, influenced by market saturation and increased competition.

- Emerging markets present opportunities for higher-priced branded prescriptions, although global trends favor generics.

- Patent strategies and regulatory environments significantly impact future pricing trajectories.

- Stakeholders should focus on innovation and cost-efficiency while monitoring evolving patent and regulatory landscapes.

FAQs

1. When did Lexapro lose its patent protection in major markets?

Lexapro’s primary patent expired in August 2012 in the United States, opening the market to generic competition.

2. How have generic entry affected Lexapro’s pricing?

Generic entry caused prices to drop by approximately 70–80%, making the drug more accessible but reducing branded revenues.

3. What is the forecast for Lexapro’s price in 2025?

Generics are projected to retail at around USD 0.30–0.80 per tablet, with branded prices declining to approximately USD 3.00–4.50.

4. Are there any patent litigations that could prolong Lexapro’s exclusivity?

Secondary patents have historically been challenged; the likelihood of such patents surviving long-term is low, given judicial trends.

5. Will Lexapro maintain market relevance in the next decade?

While it remains a prominent therapy, increased competition and new antidepressants are likely to diminish its market share and pricing power.

Sources

[1] EvaluatePharma. (2022). "Global antidepressant market report."

[2] U.S. FDA. (2022). "Generic Drug Approvals and Patent Litigation."

[3] IQVIA. (2022). "Pharmaceutical Pricing and Market Trends."

[4] IMS Health. (2021). "Global Mental Health Market Report."

[5] MarketWatch. (2022). "Lexapro Market Share and Price Trajectory."

More… ↓