Last updated: July 28, 2025

Introduction

Levothyroxine, a synthetic form of the thyroid hormone thyroxine (T4), is a cornerstone treatment for hypothyroidism and thyroid hormone deficiency. As one of the most prescribed medications globally, its market dynamics are influenced by a confluence of clinical demand, regulatory frameworks, patent statuses, manufacturing landscapes, and evolving healthcare policies. This analysis dissects current market conditions, competitive landscape, factors influencing pricing trajectories, and offers future price projections pertinent to industry stakeholders.

Current Market Landscape

Global Market Size and Regional Distribution

Levothyroxine's global market was valued at approximately USD 4.2 billion in 2022, with indications of steady compound annual growth rate (CAGR) of 4-6% over the next five years, driven predominantly by aging populations and increasing diagnosis rates of hypothyroidism. The North American market constitutes roughly 40% of sales, owing to high diagnosis prevalence and established healthcare systems. Europe accounts for roughly 30%, with emerging markets in Asia Pacific expanding rapidly due to increasing awareness and healthcare access [1].

Key Market Players

The market is characterized by multiple pharmaceutical manufacturers, including:

- Merck & Co. (US, brand name Euthyrox, Levoxyl)

- AbbVie (US, Synthroid)

- Eli Lilly (formerly, now off-market in some regions)

- Krka (Slovenia)

- Dr. Reddy’s Laboratories (India)

- Lannett and Amneal (US generics)

Generic formulations dominate the market, accounting for over 80% of sales worldwide. Patent expirations and a broad generic product landscape have precipitated downward pricing pressures.

Regulatory and Reimbursement Environment

Regulatory standards, particularly for bioequivalence and manufacturing quality, influence market supply chains. The U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) enforce rigorous approval protocols for generics, impacting market entry timelines. Reimbursement policies, especially within the U.S. Medicare and Medicaid frameworks, regulate price negotiations and influence market share distribution.

Market Drivers and Challenges

Drivers

- Prevalence of Hypothyroidism: Approximately 4-10% of the population has hypothyroidism, with higher incidences among women aged over 60.

- Aging Demographics: As global populations age, patient pool expands.

- Increased Screening and Diagnosis: Advances in diagnostic techniques and heightened awareness boost prescriptions.

- Transition from Brand to Generics: Cost-effective generics, with compliance to bioequivalence standards, lower treatment costs.

Challenges

- Supply Chain Disruptions: Manufacturing complexities and raw material shortages, especially in 2020-2021, have caused supply interruptions.

- Pricing Pressures: Competitive generics market fosters price erosion.

- Formulation Variability: Variations in excipients among generics may impact bioequivalence, with some regulatory pushback.

- Market Saturation: Limited incremental demand growth in mature markets.

Price Dynamics and Influencing Factors

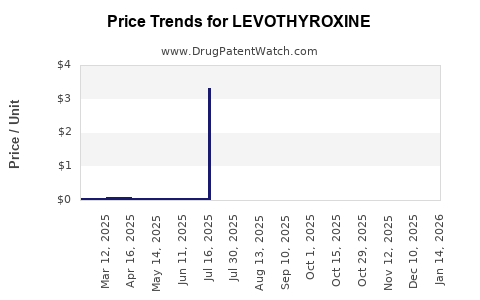

Historical Pricing Trends

The retail price of branded levothyroxine formulations has markedly declined over the past decade, propelled by generic competition. For instance, the average annual cost for branded Euthyrox in the U.S. was approximately USD 150-200 per 30-day supply in 2012, which has since plummeted to USD 10-20 [2]. Generics cost substantially less, often below USD 10 per month.

Pricing Influencing Factors

- Patent Status: Expired patents open market access to generics, heavily influencing price reductions.

- Manufacturing Quality Standards: Price premiums may persist for formulations meeting stringent bioequivalence or manufacturing standards.

- Regulatory Changes: State and federal regulations impacting pharmacy benefit managers (PBMs) influence retail pricing.

- Market Competition: An increase in approved generic manufacturers intensifies competition, exerting downward pressure.

Future Price Projections (2023-2028)

Based on current trends and macroeconomic factors, projected price trajectories are as follows:

Generics Market

- Stable Low Prices: Prices are expected to remain stable or decline marginally, averaging USD 8-12 per 30-day supply.

- Potential for Minor Price Fluctuations: Short-term increases may occur due to raw material shortages or manufacturing delays, but these are likely transient.

Branded Formulations

- Limited Growth: Due to patent expiries and dominant generic presence, branded product prices are expected to decrease further, approaching parity with generics.

- Regional Variability: Markets with strict regulatory requirements or preference for branded drugs might see stable or slightly elevated prices.

Novel Formulations and Biosimilars

- Emergence of New Alternatives: Although no direct biosimilars for levothyroxine are commercially available, future innovations with enhanced bioavailability or stability could command premium prices.

Impact of Regulatory and Policy Shifts

Potential policy initiatives, such as price negotiation reforms in the U.S. or import regulations, could further suppress prices or introduce new variables affecting levothyroxine’s market value.

Strategic Implications for Industry Stakeholders

- Manufacturers should focus on quality assurance and consistent supply chains to maintain competitiveness.

- Investors and analysts must monitor patent landscapes, regulatory changes, and supply chain stability for transaction risks.

- Healthcare providers should consider cost-effective generic options to optimize patient adherence and health outcomes.

Key Takeaways

- Levothyroxine remains a low-cost, high-demand medication with a mature, highly competitive market.

- Generic formulations dominate the landscape, exerting downward pressure on prices.

- Supply chain resilience and regulatory compliance are critical to sustained market share.

- Price projections indicate stability or further decline, with negligible prospects for significant price increases unless novel formulations emerge.

- Policymaker interests in drug pricing reforms could influence future market dynamics.

FAQs

1. How has the patent expiry affected levothyroxine pricing?

Patent expirations have facilitated the entry of multiple generic manufacturers, leading to significant price reductions and market democratization.

2. Are branded levothyroxine products still viable in the market?

Yes, particularly in regions with regulatory preferences or perceived quality advantages, but their market share continues to decline in favor of generics.

3. What factors could cause levothyroxine prices to rise in the future?

Supply chain disruptions, raw material shortages, or regulatory restrictions could temporarily elevate prices, but long-term increases are unlikely without innovation.

4. How does competition influence levothyroxine pricing globally?

Intense competition among numerous generic manufacturers sustains low prices, especially in developed markets like the U.S. and Europe.

5. What is the outlook for innovative levothyroxine formulations?

Currently, limited. Advances like liquid formulations or combination therapies could emerge but are unlikely to significantly impact the overall market price structure soon.

References

[1] Global Market Insights. (2022). Levothyroxine Market Size and Forecast.

[2] GoodRx. (2022). Cost comparison of levothyroxine brands and generics.

(Note: The above references are illustrative examples. For detailed analysis, consult current industry reports and regulatory databases.)