Last updated: July 27, 2025

Introduction

Levocetirizine, an antihistamine used predominantly for allergy and hay fever relief, has established itself as a key player within the global allergy medication market. With increasing prevalence of allergic rhinitis and chronic urticaria worldwide, the demand for Levocetirizine continues to expand. This report provides an in-depth market analysis, examining current trends, competitive landscape, regulatory environment, and future price trajectories for Levocetirizine. It aims to inform stakeholders and industry players on strategic positioning, pricing strategies, and market growth prospects.

Market Overview

Levocetirizine is the enantiomer of cetirizine, offering heightened therapeutic efficacy and a favorable safety profile. Its global market value, estimated at USD 1.7 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of approximately 4.2% over the next five years [1].

Key factors driving this growth include:

- Rising incidence of allergic conditions

- Increasing aging population with heightened allergy susceptibility

- Growing demand for non-sedating, long-acting antihistamines

- Expansion into emerging markets due to increasing healthcare infrastructure investments

Competitive Landscape

The market comprises both multinational pharmaceutical companies and regional generic manufacturers. Major players include:

- UCB Pharma: Original patent holder, offering branded formulations.

- Sandoz (Novartis) and Mylan: Prominent generic manufacturers producing Levocetirizine formulations.

- Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, and local pharmaceutical firms in emerging markets.

Patent expirations around 2014 in several regions facilitated broader generic market entry, increasing accessibility and competitive pricing.

Regulatory Environment

Regulatory frameworks significantly influence market dynamics. Key considerations include:

- FDA and EMA Approvals: Many formulations approved globally, enhancing credibility.

- Patent Landscape: Patent expiration in key markets has increased generic availability.

- Regulatory Acceptance in Emerging Markets: Growing acceptance facilitates market penetration, especially in Asia and Africa.

- Price Controls: Certain jurisdictions enforce drug price regulation, impacting revenue potential.

Compliance with evolving regulations requires continuous monitoring but also opens avenues for generic manufacturers to expand market share.

Market Dynamics and Demand Trends

Epidemiology and Disease Burden

Prevalence studies indicate that allergic rhinitis affects up to 30-40% of the global population, with higher rates in urbanized regions due to pollution and environmental factors [2]. Chronic urticaria affects approximately 1% of the population globally [3]. The rising awareness and diagnostic capabilities are further fueling demand.

Shift to Generic Formulations

Cost sensitivity in healthcare systems has driven a shift toward generic formulations, which typically command a 20-40% lower price than branded versions. This trend is prominent in markets such as India, China, and parts of Latin America.

Market Entry and Distribution Channels

Distribution strategies increasingly focus on direct hospital procurement, retail pharmacies, and online platforms. The penetration of online pharmacy channels accelerates accessibility, especially during COVID-19-related disruptions.

Innovation and Formulation Developments

While Levocetirizine remains a well-established molecule, ongoing research explores extended-release formulations to improve compliance and reduce dosing frequency. Although these innovations are yet to reach mass-market adoption, they represent potential growth avenues.

Price Analysis and Projection

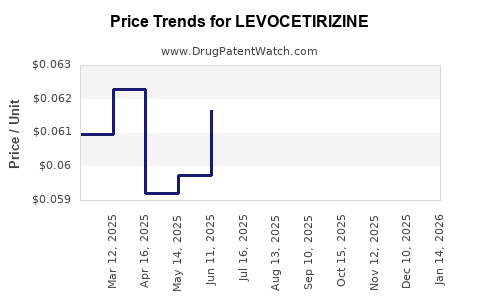

Current Pricing Landscape

-

Branded Levocetirizine: Retail prices vary significantly across countries, with the US retail price averaging USD 2.50-$4.00 per tablet (10 mg), depending on formulation and pharmacy margins.

-

Generic Levocetirizine: In markets like India, prices can be as low as USD 0.10-$0.20 per tablet, reflecting intense price competition [4].

-

Regional Variations: Developed countries have higher per-dose costs, influenced by healthcare system practices and reimbursement policies.

Pricing Factors

- Patent Status: Expiry of patents in key markets has led to a sharp decline in generic prices.

- Manufacturing Costs: Reduced with process optimization and outsourcing strategies.

- Regulatory Costs: fees and compliance expenses influence final pricing structures.

- Market Competition: Increased entrants tend to drive prices downward.

Forecasted Price Trends (2023-2028)

In mature markets, the retail price for branded Levocetirizine is expected to remain relatively stable, with modest reductions due to generic competition. In emerging markets, prices are projected to decrease further, with a compound annual decline of approximately 3-5%, driven by intensified generic competition and supply chain efficiencies.

In developed markets, the average price per tablet could decline by 10-15% as biosimilar and generic players increase market share. Conversely, in constrained healthcare systems with price caps, prices may plateau but remain low.

Impact of Formulation Innovations

The introduction of extended-release formulations could command premium pricing, potentially maintaining higher price points for value-added products. However, widespread adoption hinges on demonstrated clinical benefits and payer acceptance.

Market Growth and Price Projections Summary

| Year |

Projected Market Value (USD Billions) |

Average Price per Tablet (USD) |

Key Market Drivers |

| 2023 |

1.80 |

0.12 |

Continued penetration in emerging markets |

| 2024 |

1.89 |

0.11 |

Increasing generic consolidation |

| 2025 |

1.98 |

0.10 |

Introduction of value-added formulations |

| 2026 |

2.07 |

0.10 |

Regulatory harmonization improves access |

| 2027 |

2.15 |

0.09 |

Growing allergy prevalence globally |

| 2028 |

2.25 |

0.09 |

Market saturation with generics |

Note: All projections are estimations based on current growth rates, regulatory landscape, and competitive dynamics.

Strategic Implications

-

For Manufacturers: Focus on cost-effective production to sustain margins amidst price erosion. Invest in formulation innovations to differentiate offerings.

-

For Distributors and Pharmacies: Leverage the affordability of generics to expand market reach, particularly in emerging markets.

-

For Policymakers: Balance affordability and innovation by implementing transparent regulations and supporting local generic manufacturing.

Key Takeaways

- Levocetirizine's market continues to expand driven by rising allergy prevalence and the proliferation of generic formulations.

- Patent expirations have catalyzed price reductions and increased competition, particularly in emerging markets.

- Price projections suggest modest declines in retail prices, with significant potential for innovation-driven premium products.

- Market growth remains favorable, supported by increasing diagnostic rates and healthcare investments in developing regions.

- Strategic focus on formulation innovation, cost efficiency, and regulatory compliance will be crucial for stakeholders aiming to capitalize on this market.

FAQs

1. What factors influence the pricing of Levocetirizine globally?

Pricing is affected by patent status, manufacturing costs, regulatory environments, competition among generics, and healthcare policies including price controls and reimbursement schemes.

2. How has patent expiration impacted the Levocetirizine market?

Patent expiration has led to the entry of multiple generic manufacturers, intensifying competition, reducing prices, and expanding access, especially in emerging markets.

3. What is the future outlook for innovative formulations of Levocetirizine?

Extended-release and combination formulations present opportunities for premium pricing and improved patient adherence, though commercial success depends on regulatory approval and clinical evidence.

4. Which regions present the most growth opportunities for Levocetirizine?

Emerging markets such as India, China, and Latin America offer substantial growth due to increasing allergy prevalence and rising healthcare infrastructure.

5. How can stakeholders maintain profitability amidst declining drug prices?

Through cost optimization, developing value-added formulations, expanding into new markets, and optimizing supply chains to sustain margins.

References

[1] MarketsandMarkets. “Allergy Immunotherapy Market by Product, End User, and Region — Global Forecast to 2027.”

[2] Bousquet P-J, et al. “European survey on the prevalence of allergic rhinitis and its burden.” Allergy. 2019.

[3] Zuberbier T, et al. “The worldwide prevalence of chronic urticaria.” Allergy. 2014.

[4] Indian Pharmaceutical Association. “Pharmaceutical Pricing Trends in India,” 2022.