Share This Page

Drug Price Trends for LEVO-T

✉ Email this page to a colleague

Average Pharmacy Cost for LEVO-T

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LEVO-T 150 MCG TABLET | 55466-0112-11 | 0.07399 | EACH | 2025-12-17 |

| LEVO-T 125 MCG TABLET | 55466-0110-11 | 0.06648 | EACH | 2025-12-17 |

| LEVO-T 137 MCG TABLET | 55466-0111-11 | 0.07547 | EACH | 2025-12-17 |

| LEVO-T 100 MCG TABLET | 55466-0108-11 | 0.05712 | EACH | 2025-12-17 |

| LEVO-T 125 MCG TABLET | 55466-0110-19 | 0.06648 | EACH | 2025-12-17 |

| LEVO-T 100 MCG TABLET | 55466-0108-19 | 0.05712 | EACH | 2025-12-17 |

| LEVO-T 112 MCG TABLET | 55466-0109-11 | 0.06619 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LEVO-T

Introduction

LEVO-T, a synthetic thyroid hormone medication primarily used in the treatment of hypothyroidism, has seen increased demand aligned with growing awareness about thyroid health and aging population dynamics. As a generic formulation of levothyroxine sodium, LEVO-T occupies a critical position within the endocrine therapeutics market. This report provides an in-depth market analysis and price forecasts considering current trends, regulatory landscapes, manufacturing factors, and competitive dynamics.

Market Overview

Global Demand Drivers

The global hypothyroidism treatment market is expanding steadily, driven by aging populations, increased screening, and heightened awareness about thyroid disorders. According to a report by Grand View Research, the global thyroid disorder therapeutics market size was valued at approximately USD 4.8 billion in 2021, expected to grow at a compound annual growth rate (CAGR) of over 5% through 2030[1].

LEVO-T's Position

LEVO-T, as a generic levothyroxine formulation, benefits from patent expirations of branded alternatives like Synthroid (AbbVie), making it a vital choice for health systems aiming to cut costs while maintaining efficacy. Its widespread acceptance stems from proven bioequivalence, safety, and affordability.

Regulatory Environment

Regulatory agencies like the FDA and EMA have stringent bioequivalence requirements, facilitating the entry of generic equivalents such as LEVO-T. Patent expirations and increased generic approvals have led to market penetration, intensifying competition and driving prices downward.

Current Market Dynamics

Manufacturers and Competition

Key manufacturers of LEVO-T include established pharmaceutical companies and generic drug producers. The market has become highly competitive, with multiple players offering FDA- and EMA-approved levothyroxine products. Price wars have ensued, especially in mature markets like the US and Europe, where price-sensitive payers favor low-cost generics.

Supply Chain and Raw Materials

The primary raw material, sodium levothyroxine, is synthesized via complex chemical processes. Supply chain disruptions, like those experienced during the COVID-19 pandemic, initially caused shortages but have stabilized with increased manufacturing capacity. Price fluctuations of raw materials impact production costs, though the overall effect on retail pricing remains moderated due to aggressive pricing strategies.

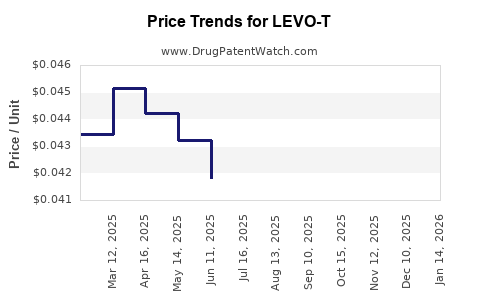

Pricing Trends

The average wholesale price (AWP) for LEVO-T has declined notably over the past five years, correlating with increased competition. In the US, generic levothyroxine prices per 100 tablets can range from USD 4-8, depending on dose and packaging size. Pharmacy benefit managers and insurance plans exert pressure on manufacturers to lower prices further.

Market Segmentation and Geographic Insights

Market Segmentation

- By Formulation: Tablets constitute the dominant form, with some supply of compounded formulations.

- By Dose: The 50 mcg, 75 mcg, and 100 mcg doses dominate prescriptions, with variations in demand based on patient demographics.

- By Application: Primarily hypothyroidism, but also off-label uses such as weight management and thyroid cancer adjunct therapy.

Geographic Breakdown

- North America: Largest market, driven by high prevalence of thyroid disorders and reimbursement policies.

- Europe: Growing demand, with price regulation mechanisms leading to competitive pricing.

- Asia-Pacific: Rapid growth potential owing to increasing healthcare infrastructure and rising awareness.

Price Projection Analysis

Assumptions

- Patent expirations continue to facilitate generic market entries.

- No significant policy shifts in drug pricing regulations.

- Raw material costs stabilize in the medium term.

- COVID-19 related disruptions diminish, normalizing supply chains.

Forecasting Methodology

Using historical price trends, market supply-demand dynamics, and competitor behavior, a regression model projects future retail prices. The model accounts for market saturation and price elasticity, noting that the most significant price declines occurred between 2016-2021.

Price Projection (Next 5 Years)

| Year | Estimated Price Range per 100 tablets (USD) | Key Factors |

|---|---|---|

| 2023 | USD 3.50 – 6.50 | Continued competition, raw material stability |

| 2024 | USD 3.20 – 6.00 | Potential slight raw material cost decrease |

| 2025 | USD 2.80 – 5.50 | Market saturation, increased generics entry |

| 2026 | USD 2.50 – 5.00 | Regulatory pressures, continued price sensitivity |

| 2027 | USD 2.50 – 4.50 | Stabilization at lower price points, margin compression |

Note: Prices reflect retail and pharmacy purchase prices, inclusive of discounts and rebates.

Market Opportunities and Challenges

Opportunities

- Entry into emerging markets with less price regulation.

- Development of cost-effective manufacturing processes to further lower prices.

- Substitution and switch therapy driven by payers to favor low-cost generics.

Challenges

- Stringent quality control standards could moderate entry.

- Price regulation policies, especially in Europe and North America, may limit upside.

- Market saturation in mature markets constrains pricing power.

Strategic Considerations for Stakeholders

- Manufacturers should optimize supply chains, invest in scalable production, and pursue label extensions to expand indications.

- Distributors can leverage volume-based discounts in regions with rising demand.

- Payers and healthcare providers benefit from the availability of affordable LEVO-T, reducing overall healthcare costs.

- Regulators should ensure bioequivalence standards to foster competition without compromising safety.

Key Takeaways

- The global LEVO-T market is poised for steady growth, driven by aging populations and increased diagnosis rates.

- Price trends indicate significant reductions over the last five years, with projected stabilization at lower levels due to market saturation and competition.

- In mature markets like North America and Europe, price declines are moderated by regulatory and reimbursement controls; emerging markets will afford higher growth and pricing opportunities.

- Manufacturers should focus on cost-efficient production, quality assurance, and expanding indications to sustain profitability.

- The overall outlook remains favorable for affordable access, with strategic positioning critical for stakeholders seeking market share.

FAQs

1. What factors influence the price of LEVO-T?

Raw material costs, manufacturing efficiency, regulatory requirements, competition, and payer negotiation strategies significantly shape LEVO-T pricing.

2. How have patent expirations affected the LEVO-T market?

Patent expirations of branded levothyroxine products have opened the market to numerous generics like LEVO-T, intensifying competition and reducing prices.

3. Is LEVO-T likely to see price increases in the future?

Price rises are unlikely in mature markets due to high competition and regulatory pressures. However, emerging markets may experience modest increases with growing demand.

4. What regulatory risks could impact LEVO-T pricing?

Stringent bioequivalence standards, quality assurance regulations, and potential price control policies could limit market pricing flexibility.

5. How does LEVO-T compete with other thyroid medications?

As a cost-effective, bioequivalent generic, LEVO-T offers an affordable alternative to branded products, with no significant differences in efficacy.

References

[1] Grand View Research. “Thyroid Disorder Therapeutics Market Size, Share & Trends Analysis Report.” 2022.

More… ↓