Last updated: July 27, 2025

Introduction

Levalbuterol, a selective β2-adrenergic receptor agonist, is primarily prescribed as a bronchodilator for managing acute bronchospasm in conditions like asthma and chronic obstructive pulmonary disease (COPD). It is marketed mainly under brand names such as Xopenex. Given its clinical utility, market dynamics, and recent pharmaceutical innovations, assessing the current market landscape and projecting future prices for levalbuterol is essential for stakeholders including pharmaceutical companies, healthcare providers, and investors.

This analysis synthesizes recent market trends, regulatory developments, competitive positioning, and economic factors to provide comprehensive insights into the levalbuterol market trajectory and pricing outlook.

Current Market Landscape

Global Market Overview

The global respiratory therapeutics market was valued at approximately USD 20 billion in 2022, with inhaled bronchodilators constituting a significant segment. Levalbuterol, as a preferred outpatient bronchodilator, commands a robust niche within this segment. North America dominates the market owing to high prevalence of asthma/COPD, advanced healthcare infrastructure, and widespread insurance coverage. The U.S. accounts for approximately 70% of the global levalbuterol market share, driven by broader adoption and reimbursement mechanisms.

The market shares are divided among branded products (such as Xopenex) and generics. The latter have gained traction due to patent expirations and regulatory approvals reducing prices, intensifying competition.

Market Drivers

- Prevalence of Respiratory Conditions: Increasing incidence of asthma (~260 million globally) and COPD (~200 million globally) fuels demand for bronchodilators [[1]].

- Clinical Preference for Selective Bronchodilators: Levalbuterol’s selectivity offers fewer cardiac side effects compared to racemic albuterol, making it preferable in sensitive populations.

- Regulatory Favorability: Approvals of generic versions expand access and affordability.

- Advances in Inhalation Delivery: Development of metered-dose inhalers (MDIs), nebulizers, and dry powder inhalers improve delivery efficiency, expanding market reach.

Competitive Landscape

The market features a mix of branded drugs, generic formulations, and innovative inhaler devices. Major players include:

- Boehringer Ingelheim: Manufacturer of Xopenex.

- Teva Pharmaceuticals: Key generic levalbuterol products.

- Other generics supplied by Mylan, Sandoz, and Hikma.

The advent of generic competition has halved prices over the past decade, with a significant impact on market share dynamics.

Regulatory and Patent Outlook

Patent protections for innovator brands like Xopenex expired around 2018 in the U.S., leading to increased generic penetration. The FDA has approved multiple generic equivalents, intensifying price competition.

In some jurisdictions, patent challenges and regulatory pathways favor quicker generic approvals, leading to downward pricing pressure. Ongoing patent litigations and exclusivity periods influence pricing stability but generally accelerate price declines post-expiration.

Pricing Trends and Projections

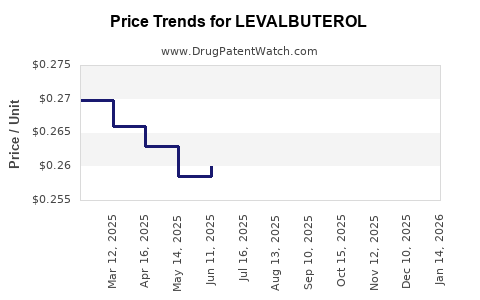

Historical Pricing

- Brand Name (Xopenex): Pricing per inhaler ranged from $50 to $80 in the U.S. market pre-generic entry.

- Generics: Post-2018, prices roughly halved, typically ranging between $20 and $40 per inhaler. Volume-based discounts and pharmacy benefits further influence actual paid prices.

Current Price Range

As of early 2023, the average wholesale acquisition cost (WAC) for generic levalbuterol inhalers stands at approximately $15-$25 per inhaler, depending on supplier and formulation.

Price Projection (2023-2028)

- Short-Term (1–2 years): Prices are expected to stabilize or slightly decline due to sustained generic competition, with some premium for new inhaler devices or combination formulations.

- Mid to Long-Term (3–5 years): Prices may decline further by 10–20%, influenced by:

- Patent cliff effects

- Entry of biosimilar or alternative treatments

- Healthcare policy initiatives promoting cost-effective care

- Manufacturer price strategies and supply chain costs

However, prices could stabilize or even increase marginally if innovations improve drug delivery or if supply chain constraints lead to shortages.

Market Barriers and Opportunities

Barriers

- Market Saturation: High generic penetration limits pricing power.

- Reimbursement Policies: Payer restrictions and formulary placements can suppress prices.

- Regulation: Stringent regulatory standards and approval processes may delay new formulations or biosimilars.

Opportunities

- Development of Long-acting Formulations: Enhances treatment adherence, commanding higher prices.

- Combination Therapies: Pharmacological innovations combining levalbuterol with corticosteroids or anticholinergics offer cross-sale opportunities.

- Emerging Markets: Growing respiratory disease burden in Asia-Pacific and Latin America could expand market access, potentially at higher unit prices driven by less mature healthcare systems.

Implications for Stakeholders

Pharmaceutical companies should prioritize pipeline expansion and formulation improvements to sustain revenue streams amid pricing pressures. Healthcare providers and payers must consider cost-effectiveness when approving bronchodilators, emphasizing generic substitution to optimize budgets. Regulatory agility and market differentiation will be key factors influencing future pricing and market share.

Key Takeaways

- The levalbuterol market is mature predominantly due to generic competition, leading to historically lower prices but stable demand.

- North America and Europe continue to dominate sales, with emerging markets offering growth opportunities.

- Price declines of approximately 20-30% are projected over the next five years, contingent on patent expiries and market entry of innovative formulations.

- Manufacturers should explore combination formulations and delivery innovations to maintain profitability.

- Regulatory environment and reimbursement policies will significantly influence future price trajectories.

FAQs

1. What factors have led to the decline in levalbuterol prices over the past decade?

Patent expirations and the subsequent approval of generic versions drove increased competition, significantly reducing prices. Additionally, healthcare payers’ cost-containment policies favor generic substitution, further driving prices downward.

2. How will emerging markets influence the future demand for levalbuterol?

Growing prevalence of respiratory diseases and expanding healthcare infrastructure in Asia-Pacific and Latin America increase demand. Price sensitivity in these regions may limit revenue growth but expand access.

3. Are there upcoming innovations that could impact levalbuterol pricing?

Yes, the development of long-acting inhalers, combination therapies, and novel delivery systems could command premium prices, especially if they demonstrate superior efficacy or adherence benefits.

4. How do regulatory policies impact levalbuterol’s market and pricing?

Regulatory approvals of generics and biosimilars accelerate price reductions. Conversely, regulatory delays or patent litigations can sustain higher prices temporarily.

5. What strategic moves should pharmaceutical companies consider?

Investing in formulation enhancements, exploring combination therapies, and entering emerging markets are crucial. Also, engaging with regulatory bodies for faster approvals and maintaining patent protections where possible will influence future market positioning.

References

[1] Global Initiative for Asthma (GINA). Global strategy for asthma management and prevention, 2022.

[2] IQVIA. Pharmaceutical Market Reports, 2022.

[3] FDA. Approved drug products with therapeutic equivalence evaluations, 2023.

[4] MarketWatch. Respiratory therapeutics market analysis, 2023.