Last updated: July 31, 2025

Introduction

Leuprolide, a synthetic gonadotropin-releasing hormone (GnRH) agonist, plays a crucial role in hormone therapy, particularly in prostate cancer, breast cancer, endometriosis, and central precocious puberty. Market dynamics for leuprolide are influenced by therapeutic demand, manufacturing complexities, regulatory landscapes, and competitive positioning within the GnRH agonist segment. This analysis explores current market factors and offers price projection insights to inform stakeholders across pharmaceutical manufacturing, distribution, and healthcare sectors.

Market Overview

Therapeutic Indications and Market Drivers

Leuprolide’s primary pharmaceutical indications include advanced prostate cancer, endometriosis, uterine fibroids, and central precocious puberty. The increasing prevalence of hormone-dependent cancers and reproductive disorders sustains consistent demand. According to WHO data, prostate cancer incidence is rising globally, notably in North America, Europe, and parts of Asia, expanding the market for hormone therapies.

Furthermore, rising awareness and earlier diagnosis of hormone-driven conditions expand indications for sustained hormone suppression therapy. As effective first-line treatments, leuprolide’s role in combination therapies also propels continuous demand, compounded by its branded and generic formulations.

Competitive Landscape

The global market features dominant players such as AbbVie (Lupron), Ferring Pharmaceuticals, and Takeda Pharmaceuticals, alongside several generic manufacturers. Patents held by branded formulations have historically restricted generic entry, but expiration periods are now leading to increased competition.

Emerging biosimilar entrants (notably in Europe and Asia) threaten price erosion of branded leuprolide therapies. Additionally, alternative hormonal agents and GnRH antagonists (e.g., degarelix) pose substitution risks, influencing pricing strategies.

Regulatory and Reimbursement Factors

Regulatory approvals for biosimilars and generics are critical price drivers. Favorable reimbursement policies, particularly in the U.S. (Medicare/Medicaid), European nations, and emerging markets, influence patient access and pricing. Pricing negotiations with national health authorities often lead to discounts in public healthcare markets, while private insurers might accept higher prices for branded formulations based on perceived efficacy and safety.

Price Analysis

Current Pricing Landscape

Pricing for leuprolide varies by formulation, dosage, brand, and geographic region. In the U.S., branded Lupron Depot (AbbVie) typically retails at approximately $3,500 to $5,000 per monthly dose, while generic equivalents, available since patent expirations in the early 2010s, are priced substantially lower, often ranging from $1,200 to $2,500 per dose.

In Europe, prices mirror U.S. trends but are often negotiated downward through national tenders. The Asian markets, particularly India and China, see even lower prices due to local manufacturing and competitive bidding.

Factors Affecting Price Trajectory

-

Patent Expiry and Generic Competition: The expiration of key patents (e.g., Lupron in 2021 in the U.S.) triggers direct price reductions and increased market penetration of generics, which can reduce current prices by up to 50-70% against branded prices within a few years [1].

-

Biosimilar Development: Biosimilar versions of leuprolide are developing, especially in Europe and Asia. Their entry is projected to induce further downward pressure on prices, potentially by an additional 30-50%.

-

Manufacturing and Supply Chain: Advances in biotechnological manufacturing reduce costs over time. Supply chain robustness affects pricing, especially in emerging markets where supply constraints can sustain higher prices temporarily.

-

Regulatory Policies: Governments implementing price caps or allowing negotiated discounts influence future baseline prices, accelerating downward trends.

Price Projections (2023–2030)

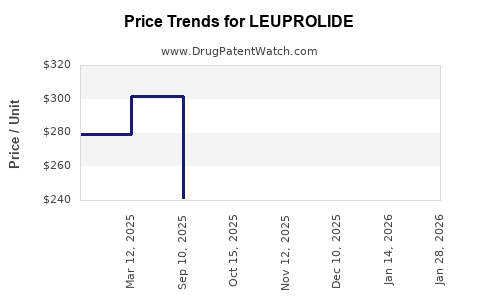

Short-Term (2023–2025)

With patent expirations now mature and biosimilar development accelerating, branded leuprolide prices are expected to decline sharply. Expected decreases of 15-25% in high-income markets are likely, driven by increased generic penetration. For instance, prices in the U.S. could fall to approximately $2,000–$3,500 per dose for branded, with generics capturing a larger market share at approximately $800–$1,500.

Mid-Term (2026–2028)

Market saturation of biosimilars and generics should stabilize prices at lower levels. The presence of multiple biosimilars and entrenched competition may drive prices down by an additional 20-40%, with average prices hovering between $700–$1,200 in developed markets.

In emerging markets, prices may decline less substantially due to import tariffs, regulatory hurdles, and limited biosimilar infrastructure, maintaining prices around $600–$900.

Long-Term (2029–2030)

Enhanced manufacturing efficiencies and new delivery formulations (e.g., depot injections with extended dosing intervals) could further influence pricing. Prices may plateau or slightly decrease (~10-15%), especially in mature markets with comprehensive biosimilar penetration, potentially reaching as low as $600–$900 per dose for off-patent formulations.

Key Influencing Factors

- The pace of biosimilar regulatory approvals.

- Regional reimbursement policies and price control measures.

- Advancements in formulation technology, impacting manufacturing costs.

- Evolution of competing therapies and treatment guidelines.

Strategic Implications for Stakeholders

Manufacturers should strategize around patent expirations, investing early in biosimilar development to capture market share post-patent expiry. Payers and healthcare providers must monitor upcoming biosimilars to negotiate optimal pricing and ensure affordability. Investors should consider market maturation timelines and regulatory environments when evaluating leuprolide-based portfolio investments.

Key Takeaways

- The global leuprolide market is poised for significant price reduction driven by patent expirations and biosimilar development.

- Pricing in mature markets may decline by up to 50% over the next five years, with generic formulations leading the decline.

- Regional variation persists; emerging markets may see slower price declines due to regulatory and infrastructural factors.

- Technological advances and formulation innovations could stabilize or reduce prices further, enhancing patient access.

- Market entrants should prioritize biosimilar development and strategic licensing to capitalize on upcoming cost reductions.

Frequently Asked Questions (FAQs)

-

How will patent expirations impact leuprolide prices worldwide?

Patent expirations have historically led to increased generic and biosimilar competition, resulting in substantial price reductions—up to 70% in some markets. The extent of decline depends on regional patent laws, regulatory hurdles, and industry response.

-

Are biosimilars effective and safe alternatives to branded leuprolide?

Biosimilars undergo rigorous regulatory approval processes to demonstrate bioequivalence, safety, and efficacy comparable to original brands. Their adoption is increasing, offering comparable therapeutic outcomes at lower prices.

-

What factors are most influential in shaping future leuprolide prices?

Patent status, regulatory approval of biosimilars, manufacturing costs, regional reimbursement policies, and competitive dynamics are critical determinants of future pricing trajectories.

-

When can healthcare providers expect significant reductions in leuprolide costs?

Major price drops are anticipated within 2–3 years post-patent expiry, especially as biosimilars enter the market and gain acceptance among prescribers and payers.

-

How do formulation innovations affect leuprolide pricing?

Extended-release formulations and depot injections optimize treatment convenience and compliance but may carry higher manufacturing costs, which could temporarily sustain higher prices until technological economies of scale are realized.

References

[1] IMS Health. (2022). Global Generic Drug Market Trends and Outlook.

[2] European Medicines Agency. (2022). Biosimilar Medicines: Regulatory Procedures and Effects on Market Prices.

[3] World Health Organization. (2021). Global Cancer Statistics.

[4] EvaluatePharma. (2023). 10-Year Forecast for Oncology Drugs.

[5] U.S. Food and Drug Administration. (2022). Biosimilar Development and Approval Processes.