Share This Page

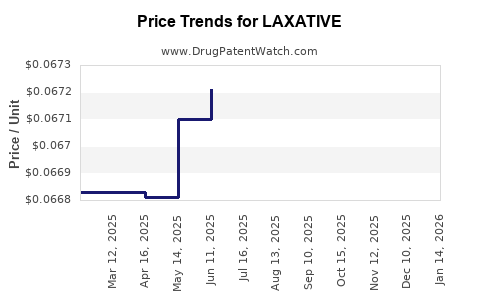

Drug Price Trends for LAXATIVE

✉ Email this page to a colleague

Average Pharmacy Cost for LAXATIVE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LAXATIVE 15 MG TABLET | 70000-0443-01 | 0.06782 | EACH | 2025-12-17 |

| LAXATIVE 25 MG TABLET | 70000-0077-01 | 0.11625 | EACH | 2025-12-17 |

| LAXATIVE EC 5 MG TABLET | 49483-0003-10 | 0.03854 | EACH | 2025-12-17 |

| LAXATIVE EC 5 MG TABLET | 49483-0003-01 | 0.03854 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Laxative Drugs

Introduction

Laxatives, a class of drugs used to alleviate constipation and promote bowel movements, represent a substantial segment within the global gastrointestinal (GI) therapeutics market. This analysis explores the current market landscape, key drivers, competitive environment, regulatory factors, and future price projections for laxative medications.

Market Overview

The global laxative market was valued at approximately USD 3.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 4.2% through 2030, reaching an estimated USD 5.1 billion. The growth is driven by rising prevalence of gastrointestinal disorders, an aging population, and increased demand for OTC products.

Key segments include:

- Bulk-forming laxatives: e.g., methylcellulose, psyllium

- Stimulant laxatives: e.g., bisacodyl, senna

- Osmotic laxatives: e.g., polyethylene glycol (PEG), lactulose

- Emollient laxatives: e.g., docusate sodium

- Prescribed versus OTC: OTC products dominate the market, accounting for roughly 70% of sales.

Market Drivers

-

Growing Incidence of Constipation:

Chronic constipation affects up to 20% of adults worldwide and is associated with lifestyle factors such as poor diet, sedentary behavior, and aging demographics, fueling demand for laxatives. -

Aging Population:

Elderly individuals are more prone to bowel movement irregularities, boosting the need for effective laxatives, especially in developed markets like North America and Europe. -

Rise in Gastrointestinal Disorders:

Conditions like irritable bowel syndrome (IBS) increase the reliance on laxatives. Additionally, the use of opioids, which often cause constipation, elevates demand in certain patient groups. -

OTC Sales Growth:

The over-the-counter nature of most laxatives lends to easy accessibility, with self-medication trends further propelling sales.

Competitive Landscape

Key global players include:

- Bayer AG (e.g., Dulcolax)

- Boehringer Ingelheim (e.g., Laxoberon)

- Salix Pharmaceuticals (e.g., Miralax)

- AbbVie (e.g., Linzess, although it also targets IBS)

- Procter & Gamble (e.g., Metamucil)

Market competition focuses on product innovation, formulation improvements, and marketing strategies. The rising trend of plant-based and natural laxatives appeals to health-conscious consumers, influencing product portfolios.

Regulatory Factors

The regulatory landscape significantly impacts market development and pricing. OTC laxatives typically require regulatory approval for marketing claims but face fewer hurdles compared to prescription drugs. In targeted markets, regulatory agencies such as the FDA (U.S.), EMA (Europe), and China's NMPA oversee manufacturing and safety standards.

Emerging regulations emphasizing natural and plant-based ingredients are incentivizing research and development in alternative laxative formulations.

Pricing Dynamics

Laxative prices are influenced by drug type (OTC vs. prescription), formulation complexity, brand dominance, and regional economic conditions.

-

OTC Products:

Prices range from USD 3 to USD 15 per package. For example, bulk-forming agents like psyllium fiber powders typically retail for USD 5–10, with generics dominating the low-cost segment. -

Prescription Products:

Prices escalate for prescription formulations, such as Linzess (linaclotide), which can cost USD 300–USD 500 per month without insurance, primarily in North America. -

Natural and Herbal Laxatives:

Prices tend to be more variable, often positioned at a premium due to perceived health benefits, with organic or herbal brands charging USD 10–USD 25 for similar quantities.

Future Price Projections (2023–2030)

Projected price trends are influenced by patent expiries, generic entry, regulatory policies, and consumer preferences.

However, certain trends are anticipated:

-

Increased Generic Competition:

Patent expiries for branded products like Bisacodyl (Dulcolax) and Peglyte will lead to more generics, reducing prices by approximately 15–30% in developed markets over the next five years. -

Shift Towards Natural and Organic Laxatives:

Premium pricing is expected for botanical and organic products, with prices increasing by 10–20% as consumer preferences shift. -

Innovation and Novel Formulations:

Introduction of targeted laxatives with improved efficacy and fewer side effects might command higher prices initially—potentially USD 10–USD 20 higher per unit—but will face price erosion once generics emerge. -

Regional Variations:

Emerging markets, such as India and Latin America, will experience lower prices due to competitive pricing and less regulatory restriction, with average prices for OTC products around USD 2–USD 5 per package. -

Impact of Reimbursement Policies:

Countries with robust insurance schemes (e.g., U.S., Europe) tend to sustain higher prices for prescription laxatives, while in markets with limited reimbursement, prices are historically lower but more sensitive to generic entry.

Summary of Price Projections:

| Timeframe | OTC Laxatives | Prescription Laxatives | Natural/Herbal Supplements |

|---|---|---|---|

| 2023 | USD 3–15 per pack | USD 300–USD 500 per month | USD 10–25 per unit |

| 2025 | Slight decline (~10%) due to generics | Stabilization, potential slight decline (~5%) | Mild price increase (~10%) |

| 2030 | Continued generic penetration, prices stabilize or decline moderately | Market stabilization or further reduction (~10%) | Potential premium for niche herbal products |

Market Challenges and Opportunities

Challenges:

- Regulatory scrutiny over OTC laxatives' safety and misuse.

- Market saturation with low-cost generics, impacting margins.

- Consumer shift toward natural remedies may limit growth of traditional synthetic laxatives.

Opportunities:

- Development of new, targeted formulations that reduce side effects.

- Expansion into emerging markets with growing healthcare infrastructure.

- Integration of natural ingredients aligned with wellness trends.

Key Takeaways

- The laxative market is robust, with steady growth driven by demographic and lifestyle factors.

- Price competition primarily hinges on generics, with significant downward pressure expected over the next decade.

- Natural and organic laxatives are poised for premium pricing due to consumer preferences.

- Innovation in formulation and delivery methods can generate higher initial prices but face eventual commoditization.

- Regional disparities significantly influence pricing strategies and market penetration.

FAQs

1. What are the primary factors influencing laxative prices globally?

Drug type (OTC vs. prescription), brand strength, patent status, regional economic conditions, regulatory environment, and consumer trends toward natural products critically affect pricing.

2. How will patent expiries impact laxative prices?

Patent expiries typically lead to an influx of generic products, reducing prices by approximately 15–30% as market competition intensifies.

3. Are natural laxatives more expensive than synthetic ones?

Generally, natural or herbal laxatives command higher prices due to consumer perceptions of safety, organic certification, and limited manufacturing scale, often retailing at USD 10–USD 25 per unit.

4. Which regions have the highest laxative prices, and why?

North America and Europe exhibit higher prices due to advanced healthcare infrastructure, higher consumer purchasing power, and stricter regulations, with prescription products reaching USD 300–USD 500 monthly.

5. What future innovations could influence laxative pricing?

Development of targeted, fast-acting formulations with fewer side effects, as well as personalized medicine approaches, could initially command higher prices, affecting market dynamics.

References

[1] MarketWatch. "Constipation Drugs Market Size & Trends." 2022.

[2] Grand View Research. "Laxatives Market Analysis." 2022.

[3] U.S. Food & Drug Administration (FDA). "OTC Drug Review." 2021.

[4] WHO. "Gastrointestinal Disorders and Aging." 2022.

[5] British Journal of Clinical Pharmacology. "Emerging Trends in GI Therapeutics." 2022.

In conclusion, the laxative market continues to demonstrate stability with moderate growth prospects, driven by demographic shifts and evolving consumer preferences. Price pressures from generics, coupled with innovation and natural product trends, will shape the competitive landscape over the coming years, offering both challenges and opportunities for stakeholders.

More… ↓