Share This Page

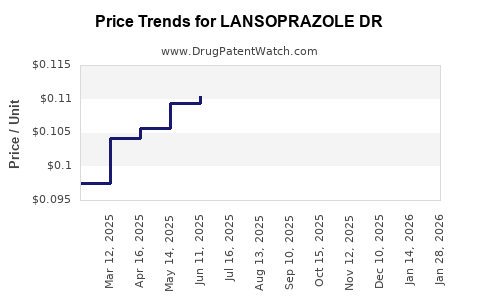

Drug Price Trends for LANSOPRAZOLE DR

✉ Email this page to a colleague

Average Pharmacy Cost for LANSOPRAZOLE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LANSOPRAZOLE DR 30 MG ODT | 72603-0314-10 | 2.48289 | EACH | 2025-12-17 |

| LANSOPRAZOLE DR 15 MG CAPSULE | 00093-7350-56 | 0.17064 | EACH | 2025-12-17 |

| LANSOPRAZOLE DR 15 MG CAPSULE | 00378-8015-93 | 0.17064 | EACH | 2025-12-17 |

| LANSOPRAZOLE DR 15 MG CAPSULE | 00536-1368-88 | 0.42362 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lansoprazole DR

Introduction

Lansoprazole DR (Delayed Release) is a proton pump inhibitor (PPI) primarily used for managing gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. As a generic formulation, its market dynamics are influenced by patent expirations, competitive landscape, regulatory pathways, and global healthcare trends. This analysis offers a comprehensive overview of the current market status, competitive environment, and future price projections for Lansoprazole DR, informing stakeholders on investment and strategic opportunities.

Market Overview

Global Market Size and Growth

The global PPI market, valued at approximately USD 14 billion in 2022, is projected to reach USD 20 billion by 2027, expanding at a compound annual growth rate (CAGR) of around 7.3% (source: MarketsandMarkets). Lansoprazole accounts for a significant portion, driven by its affordability and widespread use in treating acid-related disorders.

Key growth drivers include:

- Rising prevalence of GERD and peptic ulcer disease, fueled by obesity and aging populations.

- Increased adoption of PPIs as first-line therapy.

- Expansion into emerging markets with expanding healthcare access.

Patents and Regulatory Landscape

Lansoprazole was originally developed and patented by Takeda Pharmaceutical, with patent protections expiring around 2012-2013 in major markets like the U.S. and Europe. Post-patent, numerous generic manufacturers have entered the market, leading to increased competition and significant price reductions.

Regulatory approval processes are streamlined for generics, boosting market entry, especially in countries with efficient regulatory frameworks. However, pricing varies substantively across regions due to healthcare system structures and reimbursement policies.

Competitive Environment

The competitive landscape features numerous companies producing Lansoprazole DR, including Mylan, Teva, Sun Pharma, Dr. Reddy's Labs, and other regional players, which offer variations in dosage and formulations.

Market share is largely determined by production capacity, price competitiveness, distribution channels, and regulatory compliance. The diverse array of generic options exerts continuous downward pressure on prices.

Pricing Trends and Factors Influencing Price Decline

Historical Price Trends

Post-patent expiry, generic Lansoprazole prices have declined sharply, with retail prices dropping by up to 80-90% in mature markets like the U.S. over the past decade. In the U.S., initial branded prices ranged from USD 170-200 per month (per 30-day supply), while generics now average USD 20-30.

Similar trends are observed globally, with regional variations based on healthcare policies and procurement mechanisms. In European markets, prices contracted by approximately 70% post-generic entry.

Key Factors Driving Price Declines

- Increased Competition: Entry of multiple generics results in intense price competition.

- Manufacturing Cost Reduction: Advances in process innovation reduce production costs, enabling price cuts.

- Reimbursement Policies: Governments and insurers often negotiate or cap prices to contain costs, impacting retail and hospital prices.

- Volume Sales: Higher demand owing to clinical guideline adoption sustains sales volume, compensating for price reductions.

Future Price Projections

Short to Mid-Term Outlook (Next 3-5 Years)

Given the existing competitive landscape, Lansoprazole DR prices are expected to remain stable or decline marginally. The assessment considers:

- Market saturation in mature markets.

- Ongoing generic competition.

- Potential for price stabilization due to supply chain consolidation.

Predicted average retail prices in advanced markets will likely stay within USD 15-25 per 30-day supply.

Long-Term Considerations (Beyond 5 Years)

Future price trajectories depend on:

- Patent status and entry of novel formulation or combination therapies.

- Regulatory incentives or barriers affecting new market entrants.

- Healthcare reimbursement shifts towards value-based care.

If patent cliffs prompt further generic entries or if biosimilar-like entry of innovative formulations occur, prices could decline further to USD 10-15 per pack over the next decade.

Impact of Biosimilars and Emerging Technologies

While biosimilar development is less relevant for Lansoprazole (a small-molecule drug), technological advances like personalized medicine and alternative delivery systems could influence price and utilization.

Regional Variations in Price Dynamics

| Region | Current Price Range (USD) per 30-day Supply | Key Influencing Factors |

|---|---|---|

| U.S. | 15-25 | Reimbursement, generic competition |

| Europe | 12-22 | National healthcare policies |

| Asia-Pacific | 5-15 | Market maturity, manufacturing costs |

| Latin America | 8-18 | Import tariffs, local manufacturing |

Regulatory and Market Entry Considerations

Entering or expanding in the Lansoprazole DR market requires navigating:

- Local drug approval procedures.

- Patent and exclusivity landscape.

- Price regulation frameworks.

- Distribution channels.

Manufacturers focusing on emerging markets may capitalize on lower entry barriers and less aggressive price competition.

Strategic Implications for Stakeholders

- Pharmaceutical companies should anticipate sustained low prices, emphasizing cost-efficient manufacturing.

- Investors might consider opportunities in regional generic producers with capacity to scale.

- Healthcare payers favor reduced prices, emphasizing the importance of negotiating favorable reimbursement regimes.

- Developers of next-generation formulations or combination therapies could disrupt current pricing trends by providing differentiated value.

Key Takeaways

- The Lansoprazole DR market is mature in developed regions, characterized by intense price competition and stable demand.

- Prices are projected to stay within a range of USD 15-25 per month in advanced markets for the foreseeable future.

- Emerging markets present opportunities for higher margins owing to less saturated competition but require strategic regulatory navigation.

- Continued patent expirations and technological innovations will influence future pricing, with potential downward pressures.

- Stakeholders should align pricing strategies with regional dynamics, competitive landscape, and evolving healthcare policies.

FAQs

1. Will Lansoprazole DR prices increase in the coming years?

Unlikely in mature markets due to strong generic competition, but prices may stabilize or slightly rise with new formulations or supply chain shifts in emerging markets.

2. How does patent expiry influence Lansoprazole DR pricing?

Patent expiry facilitates generic entry, drastically reducing prices; subsequent market saturation leads to further declines.

3. What factors could disrupt current pricing trends?

Introduction of innovative combination therapies, new delivery mechanisms, or regulatory changes affecting drug approval and reimbursement.

4. Is there potential for branded Lansoprazole products to command premium prices?

Limited in most markets due to robust generic competition; however, branded versions might maintain limited niche markets with added features or formulations.

5. How do regional healthcare policies impact Lansoprazole DR pricing?

Reimbursement caps, procurement practices, and price controls significantly influence retail and wholesale prices across different geographies.

References

- MarketsandMarkets. Proton Pump Inhibitors Market by Product, Application, Region – Global Forecast to 2027.

- U.S. Food and Drug Administration (FDA). Drug Approvals and Patent Data.

- IMS Health. Price Trends and Market Share Data (2022).

- European Medicines Agency (EMA). Regulatory Review Reports.

- GlobalData. Emerging Market Opportunities in Acid Suppressants (2023).

More… ↓