Share This Page

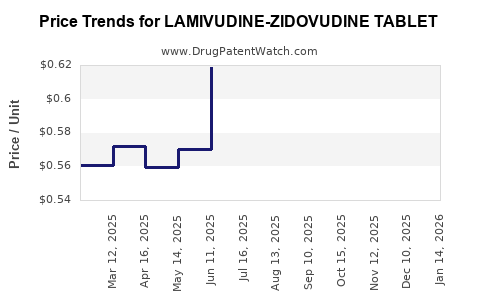

Drug Price Trends for LAMIVUDINE-ZIDOVUDINE TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for LAMIVUDINE-ZIDOVUDINE TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LAMIVUDINE-ZIDOVUDINE TABLET | 65862-0036-60 | 0.65007 | EACH | 2025-11-19 |

| LAMIVUDINE-ZIDOVUDINE TABLET | 31722-0506-60 | 0.65007 | EACH | 2025-11-19 |

| LAMIVUDINE-ZIDOVUDINE TABLET | 33342-0003-09 | 0.65007 | EACH | 2025-11-19 |

| LAMIVUDINE-ZIDOVUDINE TABLET | 64380-0707-03 | 0.65007 | EACH | 2025-11-19 |

| LAMIVUDINE-ZIDOVUDINE TABLET | 65862-0036-60 | 0.71478 | EACH | 2025-10-22 |

| LAMIVUDINE-ZIDOVUDINE TABLET | 31722-0506-60 | 0.71478 | EACH | 2025-10-22 |

| LAMIVUDINE-ZIDOVUDINE TABLET | 64380-0707-03 | 0.71478 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lamivudine-Zidovudine Tablet

Introduction

Lamivudine-Zidovudine tablet represents a combination antiretroviral therapy (ART) used primarily in the management of Human Immunodeficiency Virus (HIV) infection. This fixed-dose combination simplifies the treatment regimen, enhances patient adherence, and reduces pill burden. Understanding market dynamics and establishing price projections are critical for stakeholders, including pharmaceutical companies, healthcare providers, policymakers, and investors aiming to capitalize on or regulate this therapeutic segment.

Market Overview

Global HIV/AIDS Treatment Landscape

The global HIV/AIDS therapeutic market is characterized by steady growth, driven by increasing prevalence rates, expanding access to ART, advances in drug formulations, and international health initiatives such as UNAIDS’ 95-95-95 targets. According to the Joint United Nations Programme on HIV/AIDS (UNAIDS), approximately 38 million people worldwide were living with HIV in 2021[^1]. The proliferation of combination therapies, including lamivudine-zidovudine, has become the cornerstone of ART protocols recommended by WHO and national health agencies.

Therapeutic Position of Lamivudine-Zidovudine

Lamivudine (3TC) and Zidovudine (AZT) as a fixed-dose combination target treatment-naïve and experienced patients, especially in resource-limited settings due to proven efficacy, safety profile, and cost-effectiveness. Despite newer agents offering improved tolerability and resistance profiles, lamivudine-zidovudine retains relevance owing to its affordability and established clinical use.

Market Segments & Key Players

The primary market segments include:

- Generic manufacturers: Dominating supply, especially in Africa, Asia, and Latin America.

- Brand-name producers: Limited but significant in high-income countries.

- Public health programs: Sub-Saharan Africa and Southeast Asia show high dependency on generics.

Notable stakeholders include companies like Mylan, Cipla, and Accord Healthcare, which produce cost-effective generics, reinforcing the drug's accessibility.

Market Drivers & Challenges

Drivers

- Rising HIV prevalence: With over 1.7 million new infections annually[^2], demand remains robust.

- Global initiatives: International agencies promote affordable ART, heavily favoring generic formulations.

- Cost-effectiveness: The low production cost makes it attractive for large-scale procurement.

- Patent expirations: Expiry of patents in numerous jurisdictions has opened markets for generics.

Challenges

- Shift towards newer agents: Dolutegravir-based regimens are preferred due to better resistance profiles.

- Pricing pressures: Governments and NGOs demand further price reductions.

- Regulatory hurdles: Varying approval processes across countries complicate market access.

Market Size & Revenue Projections

Current Market Size

Based on 2021 data, the global generic HIV-antiretroviral drugs market was valued at approximately USD 4.7 billion[^3]. Lamivudine-Zidovudine, accounting for a significant share, especially in low- and middle-income countries (LMICs), likely represents over 20% of this segment, approximating USD 940 million.

Future Growth Projections

The market is projected to grow at a CAGR of approximately 4-6% over the next five years, driven by:

- Expanding ART access: WHO aims for universal access, targeting 95% of diagnosed individuals[^4].

- Declining patent barriers: Facilitating generic entry.

- Increasing HIV prevalence: Particularly in sub-Saharan Africa, which accounts for over 60% of global HIV infections[^1].

By 2028, the market could approach USD 1.2 - 1.3 billion, assuming steady growth and continued reliance on generic formulations.

Price Trends & Forecasts

Historical Price Dynamics

Pricing of lamivudine-zidovudine tablets varies significantly:

- In high-income markets: Prices for branded versions range from USD 1.50 to USD 3.00 per tablet.

- In LMICs: Generics are priced between USD 0.05 and USD 0.20 per tablet, due to extensive market competition[^5].

Patents and regulatory exclusivities largely influence these disparities. For generics, economies of scale and procurement mechanisms, such as UNICEF and PEPFAR tenders, further suppress prices.

Projected Price Trends

- Short-term outlook (1-3 years): Prices are expected to remain stable or decline marginally (2-3%) driven by intensified competition, procurement negotiations, and quality assurance innovations.

- Medium to long-term (3-5 years): Prices could reduce by an additional 10-15%, contingent on patent expirations, market entry of biosimilars, and potential new formulations replacing older fixed-dose combinations.

In high-income markets, prices could stabilize or slightly rise owing to regulatory hurdles and brand premium retention. Conversely, in LMICs, prices are forecasted to potentially decline further with increased generic production and international procurement support.

Regulatory and Patent Outlook

Patent protections in major markets such as the US and EU have largely expired or are nearing expiry, facilitating generic manufacture. However, patent extensions or secondary patents in certain jurisdictions may delay entry or impact pricing strategies.

Biosimilar and combination patent developments paralleling newer formulations could influence future pricing and formulation options.

Impacts of COVID-19 and Global Health Policies

The COVID-19 pandemic has stressed supply chains but also heightened focus on affordable medications for vulnerable populations. Governments and NGOs remain committed to cost-effective HIV treatment, supporting stable or declining prices.

Competitive Landscape & Market Entry Strategies

The generic proliferation and partnerships with procurement agencies have sustained aggressive pricing strategies. Market entry hinges on regulatory approval, quality certifications (e.g., WHO prequalification), and distribution agreements.

Investors should monitor upcoming patent expirations, regional approval pathways, and international funding policies to capitalize on emerging opportunities.

Key Considerations for Stakeholders

- Supply security: Ensure diversified manufacturing bases.

- Regulatory compliance: Maintain adherence to evolving standards.

- Pricing strategies: Leverage economies of scale and competitive bidding.

- Market segmentation: Tailor offerings for specific regions’ needs.

Key Takeaways

- The global lamivudine-zidovudine tablet market is sizable and expected to grow modestly over the next five years.

- Cost-effectiveness and patent expirations underpin the accessible pricing landscape, especially in LMICs.

- Prices are projected to decline gradually, with variations based on regional regulations and competition.

- Stakeholders should focus on regulatory navigation, quality assurance, and strategic partnerships to maximize market penetration.

- Continuous market monitoring will be crucial to adapt to evolving drug formulations and international health policies.

FAQs

Q1: How does patent expiration impact the price of lamivudine-zidovudine tablets?

Patent expiration enables generic manufacturers to enter the market, increasing competition and driving prices down. According to industry reports, patent expiries in key jurisdictions have historically led to rapid price reductions, especially in LMICs.

Q2: What are the primary resale markets for lamivudine-zidovudine tablets?

Low- and middle-income countries, particularly in Africa, Asia, and Latin America, constitute the primary markets, supported by global health initiatives and procurement agencies.

Q3: Can newer combination therapies replace lamivudine-zidovudine?

Yes. While newer agents like dolutegravir-based regimens offer better resistance profiles and fewer side effects, lamivudine-zidovudine remains relevant due to its affordability and extensive clinical experience.

Q4: What regulatory considerations affect the pricing of these tablets?

Price variations are influenced by regulatory approvals, quality standards, and prequalification status by agencies like WHO. Markets with stricter regulations and limited generic competition tend to have higher prices.

Q5: How will COVID-19 influence the supply chain and pricing of lamivudine-zidovudine?

The pandemic disrupted supply chains, but increased focus on affordable medication provisioning and international aid has helped stabilize supply. Continued global health funding and procurement efforts are expected to sustain favorable pricing.

References

[^1]: UNAIDS. Global HIV & AIDS statistics — 2021 fact sheet.

[^2]: WHO. HIV/AIDS Key Facts. 2022.

[^3]: Research and Markets. Global Generic HIV Antiretroviral Market Analysis. 2022.

[^4]: WHO. Consolidated Guidelines on HIV Prevention, Testing, Treatment, Service Delivery. 2021.

[^5]: GlobalData. HIV drug pricing reports — 2022.

More… ↓