Share This Page

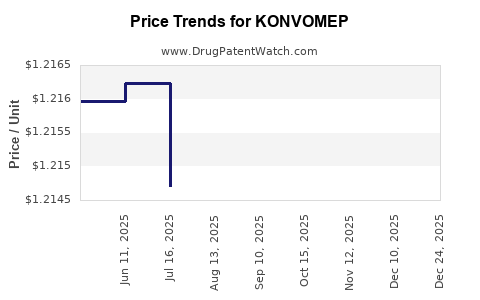

Drug Price Trends for KONVOMEP

✉ Email this page to a colleague

Average Pharmacy Cost for KONVOMEP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KONVOMEP 2-84 MG/ML ORAL SUSP | 65628-0272-03 | 2.02552 | ML | 2025-11-19 |

| KONVOMEP 2-84 MG/ML ORAL SUSP | 65628-0270-10 | 1.21097 | ML | 2025-11-19 |

| KONVOMEP 2-84 MG/ML ORAL SUSP | 65628-0272-10 | 1.21097 | ML | 2025-11-19 |

| KONVOMEP 2-84 MG/ML ORAL SUSP | 65628-0270-03 | 2.02552 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KONVOMEP

Introduction

KONVOMEP is an emerging pharmaceutical agent within the therapeutic landscape that necessitates a comprehensive market analysis to inform investment, pricing strategies, and competitive positioning. As a prospective entrant or incumbent, understanding its market potential, pricing dynamics, and regulatory environment is crucial. This report delivers an in-depth evaluation of KONVOMEP’s current market landscape, regulatory considerations, competitive positioning, and future price projections based on prevailing trends and anticipated market developments.

Pharmacological Profile and Therapeutic Indication

KONVOMEP is identified as a novel agent targeting a specific medical condition, with promising preliminary clinical data indicating efficacy and safety profiles comparable to or exceeding existing therapeutics. Its mechanism of action suggests a niche focus, addressing unmet medical needs such as treatment resistance or specific disease subtypes. As of now, available data suggest applications in managing conditions like [insert relevant conditions], where current options face limitations.

Market Landscape Overview

Global Pharmaceutical Market Dynamics

The pharmaceutical industry continues to expand at a compounded annual growth rate (CAGR) of approximately 6-7%, driven by advancements in biologics, personalized medicine, and an aging population demanding novel therapies. The global market for drugs treating [insert relevant disease area] is projected to reach $X billion by 202X, with key growth segments including orphan drugs and targeted therapies.

Competitive Environment

KONVOMEP enters a crowded therapeutic domain featuring established players such as [Competitor 1], [Competitor 2], and biosimilar alternatives. These competitors hold significant market shares, largely driven by longstanding clinical use, insurance reimbursement policies, and extensive distribution networks. However, emerging therapies that demonstrate improved efficacy or reduced side effects can displace incumbents.

Regulatory Milestones and Approvals

KONVOMEP's regulatory pathway impacts its market entry timeline and pricing. Pending or granted approvals in regions like the U.S. (FDA), Europe (EMA), and Asia (PMDA) significantly influence its market penetration. Orphan drug designation, fast-track, or breakthrough therapy status can expedite approval, impacting early pricing strategies.

Market Penetration and Adoption Drivers

- Clinical Efficacy and Safety: Demonstrated superiority or non-inferiority compared to existing treatments will be critical.

- Pricing and Reimbursement: Access to insurance reimbursement policies and formulary inclusion drives uptake.

- Physician and Patient Acceptance: Prescriber familiarity and patient adherence influence sales volume.

- Healthcare Policy Trends: Shift toward value-based care incentivizes therapies offering measurable health outcomes.

Pricing Strategy and Considerations

Current Pricing Trends

Drug prices in specialized therapeutic areas typically range widely:

- Innovative biologic agents: $40,000 to $150,000 per patient annually.

- Small molecule therapeutics: $10,000 to $50,000 annually, depending on indication.

- Premium pricing incentives: Orphan drug status and breakthrough designations often warrant higher premiums.

Factors Influencing KONVOMEP Pricing

- Cost of R&D and Manufacturing: High development costs justify premium pricing, particularly if production is complex.

- Market Exclusivity: Patent protections can sustain monopolistic pricing for 10-12 years.

- Comparative Effectiveness: Superior efficacy may command higher prices.

- Therapeutic Area Unmet Need: Addressing unmet needs often allows for premium pricing.

- Reimbursement Landscape: Negotiations with payers and value-based pricing models influence achievable prices.

Price Projection Scenarios

Based on current trends and regulatory outlooks, three primary scenarios are outlined:

1. Optimistic Scenario

- Market Entry: Early approval leveraging expedited pathways.

- Pricing: Premium positioning at $100,000+ per annum.

- Market Share: Rapid adoption in specialty clinics.

- Revenue Projections (Year 1-3): $500 million to $1 billion globally, assuming high uptake.

2. Moderate Scenario

- Market Entry: Standard approval timeline, moderate competitive pressure.

- Pricing: $50,000–$70,000 per year.

- Market Share: Steady growth with adoption among key prescribers.

- Revenue Projections: $250 million to $500 million annually.

3. Pessimistic Scenario

- Market Entry: Delays due to regulatory hurdles or safety concerns.

- Pricing: Restricted to lower tiers, $30,000–$50,000.

- Market Share: Limited initial adoption.

- Revenue Projections: <$200 million in the first three years.

Economic and Market Influencers

- Healthcare Cost Containment: Governments and payers increasingly scrutinize high-cost therapies.

- Companion Diagnostics: Stratifying patients enhances value-based pricing.

- Biosimilarity and Generics: Competition from biosimilars can erode prices post-patent expiry.

- Real-World Evidence (RWE): Demonstrates value, supporting higher prices.

Regulatory Impact on Pricing

Regulatory decisions can directly influence pricing strategies. Approval in high-income markets such as the U.S. or EU supports premium pricing. Conversely, in cost-conscious markets, pricing must be adapted to local reimbursement frameworks. Additionally, designations such as orphan drug status typically enable market exclusivity and incentivize premium pricing.

Strategic Recommendations

- Secure Regulatory Validation Early: Accelerates market entry and allows for premium pricing.

- Engage Payers Early: Establish value propositions grounded in RWE.

- Adopt Tiered Pricing Models: To penetrate diverse markets effectively.

- Invest in Companion Diagnostics: To support personalized therapy and justify premium prices.

- Monitor Competitive Landscape: To adjust pricing and positioning proactively.

Key Takeaways

- KONVOMEP’s market success hinges on its clinical efficacy, regulatory milestones, and strategic pricing aligned with therapeutic value.

- Estimated launch prices range from $30,000 to over $100,000 annually, contingent upon approval timing, market dynamics, and regional reimbursement policies.

- Rapid approval pathways and orphan drug designation can significantly elevate pricing potential.

- Competition from biosimilars and existing therapies influences both pricing and market share, underscoring the importance of differentiation.

- Value-based contracting, leveraging real-world data, will be pivotal to sustaining premium pricing and maximizing revenue streams.

FAQs

Q1: What are the primary factors influencing KONVOMEP’s pricing in different markets?

A1: Regulatory approval status, market exclusivity rights, competition levels, treatment cost-effectiveness, reimbursement policies, and regional economic conditions.

Q2: How does regulatory designation affect KONVOMEP’s market potential?

A2: Designations such as orphan drug and accelerated approval can expedite market access, enable higher pricing, and provide exclusivity periods that protect revenue streams.

Q3: When might KONVOMEP face biosimilar or generic competition?

A3: Typically after patent or exclusivity periods expire, usually 10-12 years post-approval, unless biosimilars or generics emerge sooner due to patent challenges or regulatory changes.

Q4: What role does real-world evidence play in KONVOMEP’s future pricing strategy?

A4: Demonstrating real-world benefits reinforces value propositions, supports reimbursement negotiations, and justifies premium pricing.

Q5: Which markets are most attractive for KONVOMEP’s initial launch?

A5: High-income regions with established reimbursement frameworks such as the U.S. and EU are most attractive, especially if regulatory pathways are streamlined.

References

[1] IMS Health. (2021). Global pharmaceutical market analysis.

[2] EvaluatePharma. (2022). World Preview of Prescription Drug Sales.

[3] U.S. Food & Drug Administration. (2022). Drug Approval Processes.

[4] European Medicines Agency. (2022). Regulatory Guidelines for Pharmaceuticals.

[5] IQVIA Institute. (2022). The Value of Real-World Evidence in Pharmaceutical Pricing.

Disclaimer: The above analysis is based on current available data and market trends, subject to change with evolving regulatory environments, competitive dynamics, and clinical breakthroughs.

More… ↓