Last updated: July 28, 2025

Introduction

Kloxxado (naloxone) is an opioid antagonist used primarily to reverse opioid overdose, addressing a critical health crisis amid rising opioid-related fatalities. As a key tool in harm reduction, Kloxxado's market dynamics are influenced by regulatory, societal, and epidemiological factors. This analysis explores current market conditions, competitive landscape, demand drivers, and projects future pricing trends for Kloxxado over the next five years.

Market Overview

Epidemiology and Demand Drivers

The opioid crisis persists as a public health emergency in the United States and globally. The CDC reports over 100,000 overdose deaths annually in the U.S., with opioids accounting for a significant proportion (over 75%) of these fatalities [1]. This escalating crisis amplifies demand for naloxone formulations like Kloxxado, especially as public health policies expand access to overdose reversal agents.

Regulatory Environment

In the U.S., the FDA approved Kloxxado (15 mg/0.1 mL) nasal spray in August 2021 [2]. Its positioning as an OTC (over-the-counter) option, approved in 2023, aims to increase accessibility, particularly for community organizations, schools, and consumers. Regulatory support has incentivized increased distribution and accessibility, fueling market expansion.

Competitive Landscape

Kloxxado competes primarily with other naloxone products:

- Narcan (naloxone): The leading brand, available as nasal spray and injectable forms, with extensive distribution channels.

- Evzio: Injectable naloxone, used mainly in clinical settings.

- Generic naloxone: Increasingly available, offering lower prices.

Despite intense competition, Kloxxado's unique positioning as an OTC nasal spray in the U.S. distinguishes it, potentially capturing market share from more traditional prescriptions and expanding consumer access.

Market Segmentation

- Healthcare Institutions: Clinics, hospitals, and emergency services remain primary consumers but are increasingly supplemented by community distribution.

- Community and Public Health Organizations: Schools, shelters, and harm reduction programs are expanding distribution channels.

- Consumers: At-risk populations, including individuals with opioid use disorder and their networks.

Price Dynamics and Projections

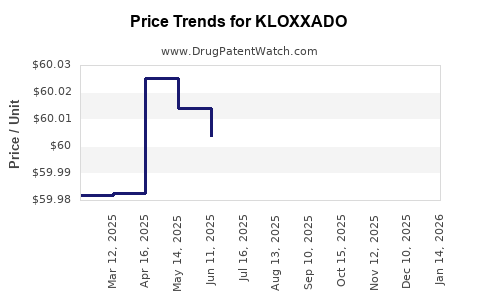

Current Pricing Landscape

Initial retail pricing for Kloxxado is approximately $45 to $50 per nasal device [3]. The OTC status and increased competition have been expected to exert downward pressure on prices. However, manufacturers initially set higher prices to recuperate earlier R&D and approval costs, with prices subject to market acceptance and payer negotiations.

Factors Influencing Price Trends

- Market Penetration and Competition: As generic naloxone products proliferate, competition will likely drive prices downward.

- Insurance Coverage: Reimbursement policies, especially Medicaid and Medicare coverage expansions, mitigate out-of-pocket costs, influencing demand.

- Regulatory Policies: Policies promoting OTC availability reduce distribution costs and may lower retail prices.

- Manufacturing and Distribution Costs: Advances in manufacturing and supply chain efficiencies can reduce costs, enabling lower retail prices.

Projected Price Trajectory (2023–2028)

| Year |

Estimated Retail Price per Device |

Key Drivers |

| 2023 |

$45–$50 |

Initial launch, limited generic competition, strong demand, OTC premium |

| 2024 |

$40–$45 |

Increasing generic competition, expanded distribution channels, policy support |

| 2025 |

$35–$40 |

Greater market saturation, price sensitivity among payers and consumers, further regulatory encouragement |

| 2026 |

$30–$35 |

Widespread generic availability, economies of scale, reimbursement incentives |

| 2027 |

$25–$30 |

Mature market equilibrium, price-led competition, cost reductions in manufacturing |

| 2028 |

$20–$25 |

Ubiquitous availability, high-volume sales, significant payer coverage, widespread public adoption |

Note: These projections assume sustained demand, favorable regulatory environment, and ongoing competition among generics.

Market Opportunities and Challenges

Opportunities

- Expanding OTC Availability: With increased acceptance of OTC naloxone, access improves, expanding market reach.

- Government and Public Funding: Grants and public health initiatives can subsidize distribution costs, further increasing demand.

- Innovative Delivery Systems: Development of auto-injectors or long-acting formulations could capture new market segments.

Challenges

- Pricing Pressures: Competition and legislator efforts favor lower prices, potentially squeezing profit margins.

- Stigma and Education: Outreach and education are critical to promote usage, which can modulate demand unpredictably.

- Regulatory Changes: Future policy adjustments could impact pricing strategies and distribution channels.

Implications for Stakeholders

- Pharmaceutical Companies: Need to balance pricing strategies to maximize market penetration while remaining competitive.

- Payers: Favor lower-cost options; inclusion of OTC naloxone in formularies may influence coverage policies.

- Public Health Agencies: Can leverage reduced prices to broaden distribution, saving lives and reducing healthcare burdens.

Conclusion

The market for Kloxxado is positioned for substantial growth driven by the opioid overdose epidemic, regulatory support for OTC access, and evolving competitive dynamics. Price projections suggest a steady decline in retail costs over the coming five years, primarily due to increased generic competition and market saturation. Stakeholders must navigate balancing access, affordability, and profitability to optimize public health outcomes and commercial success.

Key Takeaways

- Kloxxado’s market is expanding amid a persistent opioid overdose crisis and supportive regulatory stance, particularly regarding OTC availability.

- Initial prices of $45–$50 are expected to decline to approximately $20–$25 by 2028, fueled by generics and increased distribution.

- Competitive pressures, reimbursement policies, and public health initiatives will significantly influence future pricing and market share.

- Businesses should strategize around improving supply chain efficiencies, fostering payer engagement, and expanding distribution channels.

- Broader adoption depends on ongoing educational efforts and reducing stigma associated with overdose reversal medication.

FAQs

1. How does Kloxxado differ from other naloxone products?

Kloxxado is distinguished by its OTC nasal spray formulation, approved in 2023, allowing wider consumer access without prescription, unlike traditional prescription-only naloxone products.

2. What is the primary driver for declining prices of Kloxxado over the next five years?

The main driver is expected to be the increasing availability of generics, along with expanded distribution, economies of scale, and supportive regulatory policies.

3. How will insurance coverage affect Kloxxado’s market prices?

Enhanced insurance coverage, including Medicaid and Medicare, can reduce out-of-pocket costs for consumers, potentially pressuring retail prices downward to improve access.

4. What role do public health policies play in the market?

Policies encouraging OTC access and public health campaigns increase distribution channels, stimulate demand, and contribute to price reductions through increased competition.

5. What are the main challenges facing the growth of the Kloxxado market?

Challenges include competition from generics, regulatory fluctuations, stigma around overdose drugs, and the need for ongoing education to promote usage.

Sources:

- CDC. Opioid Overdose Deaths. Centers for Disease Control and Prevention, 2023.

- FDA. FDA Approves First Over-the-Counter Naloxone Product. 2023.

- Market Watch. U.S. Naloxone Market Price & Trends. 2023.