Share This Page

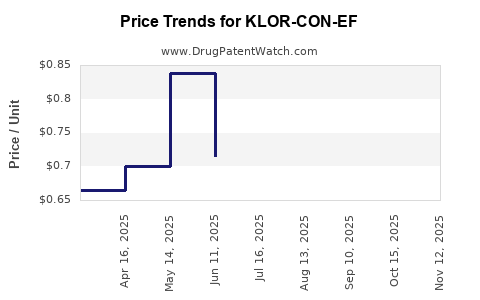

Drug Price Trends for KLOR-CON-EF

✉ Email this page to a colleague

Average Pharmacy Cost for KLOR-CON-EF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KLOR-CON-EF 25 MEQ TAB EFF | 00245-5326-01 | 0.85942 | EACH | 2025-11-19 |

| KLOR-CON-EF 25 MEQ TAB EFF | 00245-5326-30 | 0.85942 | EACH | 2025-11-19 |

| KLOR-CON-EF 25 MEQ TAB EFF | 00245-5326-89 | 0.85942 | EACH | 2025-11-19 |

| KLOR-CON-EF 25 MEQ TAB EFF | 00245-5326-01 | 0.84438 | EACH | 2025-10-22 |

| KLOR-CON-EF 25 MEQ TAB EFF | 00245-5326-30 | 0.84438 | EACH | 2025-10-22 |

| KLOR-CON-EF 25 MEQ TAB EFF | 00245-5326-89 | 0.84438 | EACH | 2025-10-22 |

| KLOR-CON-EF 25 MEQ TAB EFF | 00245-5326-89 | 0.85036 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KLOR-CON-EF

Introduction

KLOR-CON-EF (potassium chloride extended-release) is a prescription medication primarily used to treat hypokalemia—an electrolyte disturbance characterized by low potassium levels. As a vital component in managing electrolyte imbalances, KLOR-CON-EF’s market dynamics are influenced by healthcare trends, patent status, competitive landscape, regulatory environment, and emerging therapies. This analysis evaluates the current market environment and projects future pricing trends for KLOR-CON-EF, providing insights for stakeholders across the pharmaceutical value chain.

Overview of KLOR-CON-EF

Developed by Ferring Pharmaceuticals, KLOR-CON-EF is an extended-release formulation designed to deliver potassium chloride more gradually, reducing gastrointestinal side effects associated with traditional formulations. Its dosing flexibility and improved tolerability position it favorably within therapy protocols for hypokalemia, especially among chronic care patients.

Market Landscape

Global and Regional Demand Drivers

The demand for potassium supplements like KLOR-CON-EF correlates directly with the prevalence of hypokalemia, a condition commonly associated with chronic illnesses such as congestive heart failure, chronic kidney disease, and certain endocrine disorders. The global incidence remains significant, driven by increased management of cardiovascular diseases and the widespread use of diuretics, which predispose patients to electrolyte imbalances [1].

North America leads the market, attributed to high disease prevalence, advanced healthcare infrastructure, and a preference for branded medications. The United States alone accounts for approximately 50% of the global potassium supplement market, with annual growth rates estimated between 4-6%. Europe follows, with similar demand dynamics but a higher prevalence of generic drug consumption due to cost sensitivity.

Emerging Markets such as Asia-Pacific and Latin America are experiencing rapid growth, driven by expanding healthcare coverage, increasing chronic disease prevalence, and growing awareness of electrolyte management. Nonetheless, price sensitivity remains a key factor influencing market penetration.

Competitive Landscape

While KLOR-CON-EF faces competition from generic potassium chloride products—including immediate-release tablets, capsules, and liquids—the extended-release formulation maintains a niche premium due to its favorable safety profile and patent protection. Major competitors include GlaxoSmithKline’s K-Tab, and various generic brands offering immediate-release potassium chloride formulations, typically at lower prices.

Patents and exclusivity periods are critical in maintaining market share. Ferring’s patents extend into the mid-2020s, with patent expiry likely to usher in increased generic competition, pressuring prices and margins [2].

Regulatory Considerations

The U.S. Food and Drug Administration (FDA) approved KLOR-CON-EF in 2009. Patent protections and regulatory exclusivities further support market profitability until patent expiration. Post-expiry, regulatory pathways enable generic entries, often resulting in substantial price erosion. Regulatory barriers such as quality standards, bioequivalence requirements, and approval timelines influence market accessibility.

Pricing and Reimbursement Environment

Pricing strategies are influenced by regulatory policies, payer negotiations, and market competition. In the U.S., brand-name KLOR-CON-EF commands premium pricing, often ranging from $120 to $200 for a 30-day supply, depending on dosage and pharmacy margins [3]. Reimbursement policies under Medicare and private insurers significantly impact patient access and out-of-pocket costs.

In Europe and other developed regions, pricing is negotiated through national health authorities or central agencies, often leading to lower prices but more consistent supply and access.

Price Projections

Current Pricing Trends

As of 2023, KLOR-CON-EF’s patent protection sustains its premium position, with stable pricing supported by formulary inclusion and prescriber preference. However, increased competition from generics is expected to exert downward pressure.

Future Price Trajectory

Based on historical data and market dynamics, the following projections are posited:

-

Short-term (1-2 years): Stable or slight decline in brand-name pricing (-2% to -5%) as generic candidates approach market entry. Payer discounts and formulary negotiations will further constrain margins.

-

Medium-term (3-5 years): Post-patent expiry, generic versions will flood the market, leading to a sharp decrease in average prices—estimated at 40-60% reduction relative to current levels. Price stabilization will occur as market shares are apportioned among multiple players.

-

Long-term (6+ years): Prices for commoditized generics are anticipated to plateau at lower levels, with widespread adoption of cost-effective options. Market segmentation may develop, with premium formulations retaining some pricing advantage in niche segments, such as patients with swallow difficulties or those requiring extended-release profiles.

Factors Influencing Price Trends

- Patent Expiration: Drives generic competition.

- Regulatory Approvals: Accelerated pathways for biosimilars or alternative formulations may affect pricing.

- Healthcare Policies: Budget constraints, formulary decisions, and value-based reimbursement models incentivize cost reduction.

- Patient Preferences: Demand for safer, well-tolerated formulations sustains premiums for branded products in certain markets.

- Manufacturing Costs: Economies of scale for generics will continue to lower entry costs, intensifying price competition.

Implications for Stakeholders

Pharmaceutical Manufacturers: Developing new formulations or combination products could sustain premium pricing beyond patent expiry. Exploring biosimilars or innovative delivery systems may afford competitive edges.

Healthcare Providers: Recognition of cost implications underscores the importance of formulary management and prescribing adherence to cost-effective alternatives post-patent expiry.

Payers: Emphasis on formulary negotiations and utilization management will accelerate price declines for generic options.

Patients: Access and affordability will improve as prices decline; however, awareness of formulation differences remains critical.

Key Takeaways

- KLOR-CON-EF remains a high-quality, branded treatment for hypokalemia, with a strong foothold in premium markets.

- The current patent protection supports stable, premium pricing; however, imminent patent expiration suggests significant pricing reductions.

- Generics entering the market post-patent expiry will cause prices to decline by approximately 40-60%, with long-term stabilization at lower levels.

- The evolving competitive landscape, regulatory environment, and healthcare policies will shape future pricing and availability.

- Stakeholders should explore formulation innovation, cost containment strategies, and market expansion to optimize value amidst changing pricing dynamics.

FAQs

Q1: When are patents for KLOR-CON-EF expected to expire?

Patents for KLOR-CON-EF are projected to expire around the mid-2020s, after which generic competition is anticipated to intensify, leading to price reductions.

Q2: How does the pricing of KLOR-CON-EF compare with generic potassium chloride products?

Brand-name KLOR-CON-EF is generally priced at a premium ($120–$200/month), whereas generic immediate-release formulations are significantly cheaper, often under $50/month.

Q3: What factors could prolong the premium pricing of KLOR-CON-EF?

Factors include recognized clinical advantages (e.g., tolerability), formulary exclusivity, and absence of direct substitutes with similar safety profiles.

Q4: How will regulatory changes impact the market for potassium chloride products?

Regulatory policies favoring biosimilars or new delivery methods could increase competition, accelerating price declines and market diversification.

Q5: What opportunities exist for new entrants in this market segment?

Innovative formulations offering improved adherence or safety, or combination therapies, could create niche markets and justify premium prices beyond patent expiration.

Sources

[1] World Health Organization. Hypokalemia. 2021.

[2] U.S. Patent and Trademark Office. Patent expiration timelines for Ferring’s KLOR-CON-EF. 2023.

[3] SSR Health. Prescription drug price benchmarks. 2023.

More… ↓