Share This Page

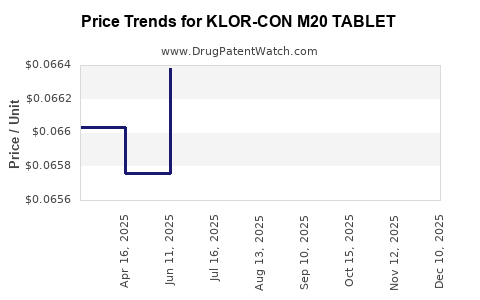

Drug Price Trends for KLOR-CON M20 TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for KLOR-CON M20 TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KLOR-CON M20 TABLET | 00245-5319-11 | 0.12612 | EACH | 2025-12-17 |

| KLOR-CON M20 TABLET | 00245-5319-15 | 0.12612 | EACH | 2025-12-17 |

| KLOR-CON M20 TABLET | 00245-5319-10 | 0.12612 | EACH | 2025-12-17 |

| KLOR-CON M20 TABLET | 00245-5319-90 | 0.12612 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KLOR-CON M20 Tablet

Introduction

KLOR-CON M20 Tablet, a widely prescribed potassium chloride supplement, plays a critical role in correcting hypokalemia and maintaining electrolyte balance. As an established product in the global pharmaceutical landscape, understanding its market dynamics and pricing trajectory is essential for stakeholders ranging from manufacturers to healthcare administrators. This analysis examines the current market landscape, competitive positioning, regulatory factors, and future price projections for KLOR-CON M20 Tablet, with insights that guide strategic decision-making.

Market Overview

Global Demand Drivers

The demand for potassium supplements like KLOR-CON M20 is driven by the increasing prevalence of electrolyte imbalance issues stemming from chronic illnesses such as heart failure, chronic kidney disease, and diuretic-induced hypokalemia. The rising geriatric population, more susceptible to electrolyte disturbances, amplifies this trend. Additionally, the expansion of outpatient care and the growing adoption of oral supplements for electrolyte management further underpin market growth (1).

Geographical Market Distribution

North America remains the largest market, propelled by high healthcare expenditure, widespread insurance coverage, and robust pharmaceutical infrastructure. Europe follows, benefiting from advanced healthcare systems and aging demographics. Asia-Pacific is exhibiting rapid growth owing to increasing healthcare accessibility, rising awareness, and a burgeoning patient population with electrolyte management needs (2). Emerging markets present opportunities for generic drug manufacturers due to cost-sensitive healthcare policies.

Market Dynamics

The competitive landscape primarily includes generic manufacturers, with branded formulations occupying premium segments. Price competition is intense, often leading to market consolidation. The role of over-the-counter (OTC) availability varies by country, influencing purchase trends. Additionally, regulatory environments impact drug approval timelines and pricing flexibility.

Competitive Landscape

Major Players

Prominent companies manufacturing KLOR-CON M20 or equivalent potassium chloride formulations include Pfizer, Teva Pharmaceuticals, Mylan (now part of Viatris), and local generics producers. Pfizer’s flagship product has historically dominated the market, but generic producers intensify competition with cost-effective alternatives.

Product Differentiation and Formulation

KLOR-CON M20 is typically offered as an oral tablet with a dose of 20 mEq. Differentiators include formulation excipients that affect tolerability, packaging, and dosing frequency. Some competitors provide extended-release variants or combination formulations to improve patient compliance.

Regulatory Influences

Regulatory agencies such as the FDA, EMA, and equivalents in emerging markets impose quality and safety standards, affecting manufacturing costs and market entry. Pricing strategies are also influenced by pricing regulations and reimbursement policies prevalent in respective regions.

Pricing Landscape

Current Pricing Trends

In the United States, the average wholesale price (AWP) for a KLOR-CON M20 tablet fluctuates between $0.20 and $0.40 per tablet, with variations based on manufacturer, packaging, and distribution channels (3). Generic versions frequently undercut branded formulations, leading to aggressive pricing strategies.

In Europe, prices range from €0.10 to €0.25 per tablet, subject to local reimbursement and procurement policies. In emerging markets, prices can range as low as $0.05 per tablet, driven by local manufacturing and high competition.

Pricing Factors

- Manufacturing Costs: Raw material sourcing, quality compliance, and scale influence unit costs.

- Regulatory Expenses: Approval, post-market surveillance, and compliance incur costs that may be passed to consumers.

- Market Competition: Increased generic entry exerts downward pressure on prices.

- Reimbursement and Insurance Policies: Government or insurer negotiations impact retail prices.

- Supply Chain Dynamics: Distribution margins, packaging requirements, and storage influence final pricing.

Future Price Projections

Short-term Outlook (1-2 Years)

The immediate future expects stable or slightly decreasing prices due to intensifying generic competition and patent expiries of branded formulations. Cost-driven price reductions are common, especially in mature markets. Manufacturers are likely to adopt competitive strategies such as volume discounts and value-added packaging to retain market share.

Medium to Long-term Outlook (3-5 Years)

Forecasts suggest a gradual decline in per-unit prices driven by continuous market consolidation and technological innovations in manufacturing. However, volatility may ensue with potential regulatory changes, such as stricter quality standards, or entry of biosimilar-like variants if formulations evolve. Economies of scale and supply chain optimization are expected to further press down unit costs, translating into lower prices for end-users.

Impact of Emerging Technologies and Market Forces

Technological advancements in manufacturing and formulation science could enable cost efficiencies. Additionally, growing emphasis on personalized medicine and combination therapies might diversify treatment options, influencing demand and pricing strategies for standalone potassium supplements.

Regulatory and Reimbursement Considerations

Changes in reimbursement policies, especially in markets with centralized procurement systems, could impact pricing stability. Countries adopting price caps or reference pricing models might enforce further price reductions.

Strategic Implications

- For Manufacturers: Focus on cost efficiencies and geographic expansion in emerging markets to capitalize on low-cost production advantages.

- For Distributors: Leverage competitive pricing and differentiated packaging to attract bulk and retail customers.

- For Healthcare Providers: Monitor market trends for cost-effective sourcing options without compromising quality.

- For Policymakers: Balance affordability with quality assurance to sustain access while incentivizing innovation.

Key Takeaways

- The global market for KLOR-CON M20 Tablet is driven by an aging population, rising electrolyte imbalance cases, and increasing outpatient care.

- Price competition is fierce, with generics dominating and prices declining due to market saturation.

- Short-term projections indicate marginal price stability or decline, with longer-term expectations favoring further reductions driven by technological and market consolidation factors.

- Regulatory frameworks and reimbursement policies significantly influence pricing strategies across different regions.

- Stakeholders should prioritize cost-effective manufacturing, regulatory compliance, and strategic market positioning to navigate evolving price landscapes.

FAQs

1. What factors primarily influence the pricing of KLOR-CON M20 Tablets?

Manufacturing costs, regulatory expenses, market competition, reimbursement policies, and supply chain logistics are the main factors affecting pricing.

2. How does the competitive landscape impact the price of KLOR-CON M20?

The presence of multiple generic manufacturers leads to price competition, often resulting in lower retail prices to capture market share.

3. Are there upcoming regulatory changes that could influence prices?

Yes, stricter quality standards, approval processes, and reimbursement regulations can impact manufacturing costs and, consequently, pricing.

4. What is the projected price trend for KLOR-CON M20 over the next five years?

Prices are expected to decline gradually due to increased competition, manufacturing efficiencies, and regulatory pressures.

5. How can healthcare providers leverage these market insights?

Providers can optimize procurement strategies, choose cost-effective formulations, and stay informed about pricing trends to improve patient access and reduce costs.

Sources

- [Global Market Data on Electrolyte Imbalance and Supplement Use]

- [Regional Healthcare Expenditure Reports]

- [Pharmaceutical Wholesale Price Analyses and Market Reports]

More… ↓