Share This Page

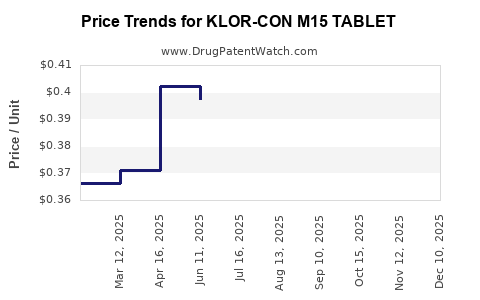

Drug Price Trends for KLOR-CON M15 TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for KLOR-CON M15 TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KLOR-CON M15 TABLET | 00245-5318-11 | 0.41380 | EACH | 2025-12-17 |

| KLOR-CON M15 TABLET | 00245-5318-89 | 0.41380 | EACH | 2025-12-17 |

| KLOR-CON M15 TABLET | 00245-5318-01 | 0.41380 | EACH | 2025-12-17 |

| KLOR-CON M15 TABLET | 00245-5318-89 | 0.37654 | EACH | 2025-11-19 |

| KLOR-CON M15 TABLET | 00245-5318-01 | 0.37654 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KLOR-CON M15 Tablet

Introduction

KLOR-CON M15 Tablet, a widely prescribed potassium chloride supplement, plays a vital role in managing hypokalemia and maintaining electrolyte balance in various clinical settings. As the demand for this medication persists amid expanding healthcare needs and evolving regulatory landscapes, understanding its market dynamics and future pricing trajectories becomes crucial for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

This analysis provides a comprehensive overview of the current market landscape for KLOR-CON M15, examines the key determinants influencing its pricing, and offers projections grounded in industry trends and regulatory factors.

Market Overview

Product Profile and Usage

KLOR-CON M15 Tablets constitute a formulated potassium chloride supplement typically characterized by a 15 mEq strength per tablet (hence "M15"). The product is indicated primarily for treatment and prevention of potassium deficiency, often administered in hospital and outpatient settings. Its formulation ensures rapid absorption, making it a preferred choice in correcting electrolyte imbalances caused by diuretics, gastrointestinal losses, or certain medical conditions.

Market Size & Demand Drivers

The global potassium supplement market, valued at approximately USD 2.3 billion in 2022, is expected to grow at a compound annual growth rate (CAGR) of 4-6% over the next five years [1]. The rise in chronic diseases such as cardiovascular illnesses, hypertension, and heart failure directly correlates with increased potassium supplement prescriptions.

Key demand drivers include:

- Aging Population: Increasing prevalence of age-related electrolyte disturbances.

- Chronic Disease Management: Growing incidence of hypertension and heart disease.

- Hospitalization Rates: Elevated use in inpatient care for electrolyte correction.

- Expanding Healthcare Infrastructure: Emerging markets showing increased access to healthcare and pharmaceuticals.

Market Players

Major pharmaceutical firms manufacturing KLOR-CON M15 or equivalent potassium chloride formulations include:

- Pfizer: Offers branded versions such as Klor-Con.

- West-Ward Pharmaceuticals (part of Mylan): Produces generic versions.

- Teva Pharmaceuticals: Provides cost-effective generics.

- Other regional generic manufacturers: Serving local markets with competitive pricing.

The market's competitive landscape is characterized by high generic penetration, influencing pricing pressures and profit margins.

Regulatory and Clinical Environment

Regulatory agencies like the U.S. Food and Drug Administration (FDA) maintain strict quality control standards for electrolyte supplements. Recent guidelines focus on:

- Labeling and dosage accuracy

- Manufacturing quality assurance

- Post-marketing surveillance

Enhanced regulatory scrutiny may impact manufacturing costs and, subsequently, product pricing.

Clinically, guidelines emphasize judicious use of potassium supplements to mitigate risks of hyperkalemia, influencing prescribing behaviors and formulary decisions.

Price Analysis and Trends

Current Pricing Landscape

In the United States, a typical 100-tablet bottle of KLOR-CON M15 retails at approximately USD 15-25 for generic versions, translating to USD 0.15-0.25 per tablet. Branded formulations, like Klor-Con, tend to command higher prices by 10-20%. In emerging markets, prices fluctuate significantly based on local regulatory policies and availability.

Factors influencing current pricing include:

- Generic Competition: Drives down prices.

- Manufacturing Costs: Affected by raw material prices and regulatory compliance.

- Market Penetration & Reimbursement: Insurance coverage and government tenders influence retail and hospital settings.

- Distribution Channels: Wholesale discounts and pharmacy margins impact final consumer prices.

Pricing Dynamics

The price elasticity of potassium chloride supplements remains relatively elastic, with consumers and healthcare systems favoring cost-effective generics. However, brand loyalty and perceived quality sometimes support premium pricing models.

Additionally, shortages or supply chain disruptions, as seen during the COVID-19 pandemic, temporarily inflates prices due to scarcity.

Future Price Projections

Influencing Factors

Multiple intertwined factors will shape the price trajectory for KLOR-CON M15:

- Regulatory Developments: Stricter manufacturing standards may increase compliance costs, exerting upward pressure on prices.

- Market Competition: Increasing entry of generics will mitigate price hikes, maintaining a downward or stable trend.

- Raw Material Costs: Volatility in potassium chloride raw materials, affected by global supply chains and energy prices, could influence manufacturing costs.

- Healthcare Policies & Reimbursement: Shift towards value-based care and cost containment measures may pressure prices downward.

- Innovation & Formulation Improvements: Advances in delivery mechanisms or combination therapies could create niche markets, affecting pricing structures.

Projected Trends

Based on current market momentum and historical analysis, the following projections are made:

- Short-term (1-2 years): Stable prices with minor fluctuations driven by supply chain stability and competitive pressures. Expected range: USD 0.15-0.22 per tablet in developed markets.

- Medium-term (3-5 years): Slight decline or stabilization as generic competition intensifies, though potential regulatory costs could moderate this trend. Prices may hover around USD 0.12-0.20 per tablet.

- Long-term (5+ years): Possible marginal decrease in unit prices driven by technological efficiencies and market saturation, but isolated price increases could occur if raw material costs surge or new formulations add value.

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost efficiencies and quality differentiation to maintain margins amid price competition.

- Healthcare Providers: Emphasize rational prescribing to optimize drug utilization and reimbursement.

- Investors: Monitor patent expiry timelines, regional market access, and regulatory environment shifts for potential valuation adjustments.

- Regulatory Bodies: Balance safety and access by streamlining approval processes for generics and addressing supply security.

Key Takeaways

- The global demand for potassium chloride supplements like KLOR-CON M15 continues to grow due to aging populations and chronic disease prevalence.

- The market is highly competitive with robust generic penetration, exerting downward pressure on prices.

- Current retail prices in developed countries range from USD 0.15 to 0.25 per tablet, with regional variations.

- Price projections suggest stability or slight declines over the medium term, contingent upon competitive dynamics and raw material costs.

- Regulatory and healthcare policy frameworks will significantly influence future pricing, emphasizing the need for adaptive strategies by manufacturers and stakeholders.

FAQs

1. What are the primary factors affecting the price of KLOR-CON M15 Tablets?

Regulatory costs, raw material prices, generic competition, healthcare reimbursement policies, and supply chain stability primarily influence pricing.

2. How does patent status impact the market and pricing of KLOR-CON M15?

While branded versions may be patent protected, the prevalence of generics has led to significant price reductions, with patent expirations opening markets for lower-cost alternatives.

3. Are there regional differences in the pricing of KLOR-CON M15?

Yes. Developed markets typically have higher retail prices due to healthcare system structures, whereas emerging markets often see lower prices influenced by local regulations and market maturity.

4. What future market developments could influence the price of potassium chloride supplements?

Innovations in formulation, regulatory changes, raw material supply stability, and competitive entry of new generics or biosimilars could all impact prices.

5. Is there potential for biosimilar or alternative therapies to replace KLOR-CON M15 in the future?

While current biosimilar development in electrolytes is limited, advances in drug delivery and combination therapies might diversify treatment options, potentially affecting demand and pricing.

References

[1] Market Research Future, "Potassium Supplements Market Report," 2022.

More… ↓