Share This Page

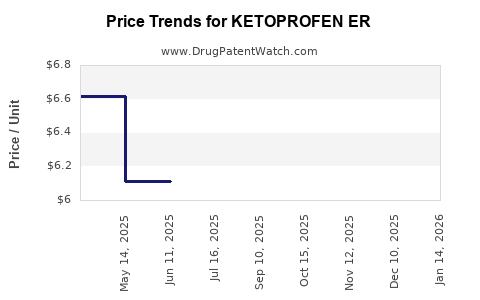

Drug Price Trends for KETOPROFEN ER

✉ Email this page to a colleague

Average Pharmacy Cost for KETOPROFEN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 5.65138 | EACH | 2025-11-19 |

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 5.65138 | EACH | 2025-10-22 |

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 5.65138 | EACH | 2025-09-17 |

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 6.10972 | EACH | 2025-07-23 |

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 6.10972 | EACH | 2025-06-18 |

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 6.10972 | EACH | 2025-05-21 |

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 6.61864 | EACH | 2025-02-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KETOPROFEN ER

Introduction

Ketoprofen ER (Extended Release) is a nonsteroidal anti-inflammatory drug (NSAID) widely prescribed for managing pain, inflammation, and arthritis conditions. As a therapeutic agent with both acute and chronic indications, its market dynamics, competitive landscape, and pricing trends are pivotal for stakeholders, including pharmaceutical companies, healthcare providers, and investors. This analysis evaluates current market conditions, competitive positioning, regulatory factors, and projects future pricing trends for Ketoprofen ER.

Market Overview

Current Market Size

The global NSAID market is substantial, driven by the prevalence of musculoskeletal disorders, osteoarthritis, rheumatoid arthritis, and postoperative pain. In 2022, the NSAID segment was valued at approximately USD 14 billion, with older, established drugs such as ibuprofen and Naproxen dominating. Ketoprofen ER, although a niche within this landscape, benefits from an increasing preference for extended-release formulations due to improved patient adherence and reduced dosing frequency.

Market Segmentation

- Indications: Osteoarthritis, rheumatoid arthritis, ankylosing spondylitis, acute pain.

- Geographies: North America accounts for the largest share (~40%), with Europe and Asia-Pacific following.

- Formulation Users: Hospitals, outpatient clinics, and retail pharmacy outlets.

Regulatory Status and Approvals

In key markets, Ketoprofen ER holds approvals from agencies such as the FDA (U.S.) and EMA (Europe), primarily under prescription-only status. The drug's patent landscape, including expiration timelines, critically influences market entry and pricing.

Competitive Landscape

Key Players

- Generic manufacturers: Currently dominate, offering cost-effective versions.

- Branded formulations: Limited, owing to broad generic availability.

- Emerging competitors: Development of new formulations (e.g., combination therapies, novel delivery systems).

Patent and Exclusivity

The original patent for Ketoprofen ER has expired in most regions, resulting in generics flooding the market. Competitive pricing pressures have consequently driven down prices but also opened opportunities for premium formulations targeting specific patient needs.

Pricing Dynamics

Current Pricing Trends

- Generic formulations: Retail price approximately USD 0.50–1.00 per tablet, depending on dosage and packaging.

- Brand-name equivalents: Usually priced 20-30% higher than generics.

- Extended-release formulations: Typically command a higher price point (~15-25%) owing to convenience and improved adherence.

Factors Affecting Price

- Manufacturing costs: Economies of scale lower generic prices.

- Regulatory factors: Stringent regulatory compliance increases costs, potentially raising prices.

- Market competition: A saturated generic market exerts downward pressure.

- Reimbursement policies: Insurance coverage affects consumer out-of-pocket expenses.

Market Trends and Future Outlook

Growing Demand for Extended-Release NSAIDs

Patient preference shifts toward extended-release formulations are expected to sustain demand. Real-world evidence supports improved compliance and reduced gastrointestinal side effects due to controlled drug release, further favoring Ketoprofen ER.

Impact of Biosimilars and Alternative Therapies

While biosimilars are less relevant due to Ketoprofen's small-molecule nature, competitors such as diclofenac ER and other NSAIDs influence pricing and market share. The emergence of personalized medicine and combination therapies could reshape the landscape.

Regulatory and Patent Cliff Effects

Upcoming patent expirations will encourage new entrants and further drive price reductions. Conversely, regulatory advances or new formulations could offer premium pricing opportunities.

Forecasted Pricing Trends (2023–2028)

- Price decline for generics: Estimated 10–15% decrease annually, due to increased competition.

- Premium formulations: Potential 5–10% premium growth, contingent on evidence of improved outcomes.

- Market consolidation: Larger pharmaceutical companies may leverage economies of scale to offer aggressive pricing.

Key Challenges and Opportunities

Challenges:

- Oversaturation of generic options limiting profit margins.

- Price erosion driven by global procurement agencies and insurance pressures.

- Regulatory hurdles in emerging markets.

Opportunities:

- Development of combination drugs with enhanced efficacy.

- Expansion into underpenetrated geographies like Asia and Latin America.

- Adoption of innovative delivery systems (e.g., transdermal patches).

Strategic Recommendations

- For Manufacturers: Invest in differentiated formulations or delivery methods to command premium pricing.

- For Investors: Monitor patent expiration timelines and emerging biosimilar or generic entrants.

- For Healthcare Providers: Consider cost-effective generics balanced with patient-specific needs.

Key Takeaways

- Ketoprofen ER occupies a niche within the broader NSAID market, benefiting from a growing preference for extended-release formulations.

- Price erosion is anticipated due to widespread generic competition, but opportunities exist for premium formulations catering to specific needs.

- Regulatory developments and patent expirations will significantly influence future pricing and market dynamics.

- Market expansion into emerging geographies offers growth potential amid competitive pricing pressures elsewhere.

- Strategic innovation and differentiation will be key to maintaining profitability in a highly commoditized environment.

FAQs

1. What factors most influence the price of Ketoprofen ER?

Market competition, patent status, manufacturing costs, regulatory requirements, and reimbursement policies significantly impact its pricing.

2. How does the generic drug market affect Ketoprofen ER pricing?

Generic availability introduces price competition, typically driving prices downward; however, extended-release formulations may retain a premium margin.

3. What is the forecast for Ketoprofen ER pricing over the next five years?

Expect a gradual decrease in generic prices (10–15% annually), with potential premium pricing for innovative or combination formulations.

4. Are there regulatory barriers that could impact the pricing of Ketoprofen ER?

Yes. Regulatory compliance costs and approval requirements can influence manufacturing costs and pricing strategies.

5. How can companies leverage market trends to secure profitability?

By developing differentiated formulations, targeting underserved markets, and optimizing supply chains, companies can navigate pricing pressures effectively.

Sources

- Grand View Research. NSAID Market Size, Share & Trends Analysis, 2022.

- U.S. Food and Drug Administration. Approved Drugs Database.

- European Medicines Agency. Pharmacovigilance and Drug Analysis Reports.

- IQVIA. Global Prescription Drug Price Data, 2022.

- MarketWatch. NSAID Market Opportunities and Competitive Landscape, 2023.

Note: This analysis synthesizes current market data and projected trends based on industry reports up to Q1 2023. Actual prices and market conditions may vary with regulatory changes and new product developments.

More… ↓