Share This Page

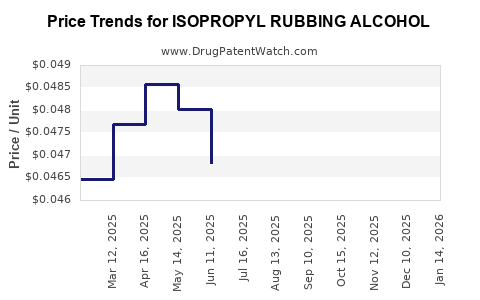

Drug Price Trends for ISOPROPYL RUBBING ALCOHOL

✉ Email this page to a colleague

Average Pharmacy Cost for ISOPROPYL RUBBING ALCOHOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ISOPROPYL RUBBING ALCOHOL 70% | 68599-2302-06 | 0.04534 | ML | 2025-12-17 |

| ISOPROPYL RUBBING ALCOHOL 70% | 68599-2302-06 | 0.04440 | ML | 2025-11-19 |

| ISOPROPYL RUBBING ALCOHOL 70% | 68599-2302-06 | 0.04495 | ML | 2025-10-22 |

| ISOPROPYL RUBBING ALCOHOL 70% | 68599-2302-06 | 0.04514 | ML | 2025-09-17 |

| ISOPROPYL RUBBING ALCOHOL 70% | 68599-2302-06 | 0.04603 | ML | 2025-08-20 |

| ISOPROPYL RUBBING ALCOHOL 70% | 68599-2302-06 | 0.04604 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Isopropyl Rubbing Alcohol (IPA)

Introduction

Isopropyl rubbing alcohol (IPA) is a widely utilized antiseptic, disinfectant, and cleaning agent in both household and industrial sectors. Its relevance surged during the COVID-19 pandemic, highlighting its importance in infection control. This report provides an in-depth market analysis and price projection for IPA, critical for stakeholders including manufacturers, investors, and healthcare providers.

Market Overview

Global Demand and Industry Drivers

The global demand for isopropyl rubbing alcohol has experienced consistent growth driven by increased emphasis on hygiene and sanitation, especially during health crises. The Asia-Pacific region leads consumption due to expanding healthcare infrastructure, manufacturing, and retail sectors. North America and Europe follow, driven by stringent hygiene standards and rising awareness about infection prevention.

Key Segments and Applications

- Healthcare Sector: Used extensively for skin disinfection, instrument sterilization, and surface cleaning.

- Consumer Goods: Incorporated in hand sanitizers, disinfectant wipes, and household cleaning products.

- Industrial Use: Employed in electronics cleaning, lubrication, and manufacturing processes requiring solvent properties.

Market Sectors and Growth Trends

- Healthcare and Pharmaceuticals: The largest segment, with a compound annual growth rate (CAGR) of approximately 3-5% over the next five years.

- Household and Commercial Cleaning: Projected to grow at a CAGR of 4-6%, bolstered by increased consumer awareness.

- Industrial Applications: Steady growth, though capitalizing on manufacturing expansions.

Supply Chain and Production Dynamics

Major production regions include China, India, the United States, and Southeast Asia. The supply chain faces disruptions from raw material shortages, regulatory hurdles, and geopolitical factors. Raw materials like propylene are subject to fluctuation, impacting production costs and prices.

Regulatory and Environmental Factors

Regulations around solvent emissions and product purity influence manufacturing costs. The push toward eco-friendly and low-VOC formulations may shape future product standards, potentially affecting pricing and market entry.

Market Size and Revenue Projections

In 2022, the global market for isopropyl rubbing alcohol was valued at approximately USD 2.5 billion. Projections estimate a CAGR of 4%, reaching roughly USD 3.2 billion by 2027. The rising adoption in emerging markets and sustained demand in developed nations underpin this growth trajectory.

Regional Market Breakdown (2022 Estimates):

- Asia-Pacific: ~40% of global consumption, USD 1 billion.

- North America: ~30%, USD 750 million.

- Europe: ~20%, USD 500 million.

- Rest of the World: Remaining 10%, USD 250 million.

Pricing Trends and Historical Data

Historically, the price of IPA has fluctuated between USD 1.50 to USD 3.00 per liter, influenced by raw material costs, demand-supply dynamics, and regulatory adjustments. The COVID-19 pandemic prompted a sharp surge, with prices reaching USD 3.50 per liter in 2020 due to supply shortages and demand spikes.

Current Price Range (2023): USD 2.00 – USD 2.75 per liter, depending on grade, purity, and purchase volume.

Price Projections for 2024-2028

Based on prevailing market conditions and growth forecasts, future price trends are as follows:

-

2024: Anticipated stabilization with prices around USD 2.20 – USD 2.80 per liter. Raw material costs may exert upward pressure, but increased production capacity is expected to offset shortages.

-

2025: Slight price declines are possible as supply chain disruptions ease. Prices projected to hover around USD 2.10 – USD 2.70 per liter; however, increases in environmental regulation costs could marginally offset reductions.

-

2026: Stable to modest growth, with prices in the USD 2.30 – USD 2.90 range, driven by emerging market expansion and rising demand for disinfectants.

-

2027: Prices could reach USD 2.50 – USD 3.00 per liter if raw material costs escalate or regulatory changes tighten.

Factors Influencing Price Dynamics

-

Raw Material Costs: Propylene and isopropanol feedstock prices primarily dictate unit costs. Fluctuations are expected based on crude oil trends and refining capacities.

-

Environmental Regulations: Stricter emission standards can increase manufacturing costs, potentially raising prices.

-

Demand Growth: Accelerated adoption in healthcare and industrial sectors sustains upward pricing pressure.

-

Supply Chain Stability: Disruptions from geopolitical tensions or pandemics impact availability and pricing.

Competitive Landscape

Major players include BASF SE, Dow Chemical Company, Shell Chemicals, LP, and local manufacturers in Asia. Consolidation and capacity expansions by these firms are likely to influence pricing dynamics, with increased automation potentially lowering production costs in the long term.

Market Entry and Innovation Opportunities

Emerging opportunities include the development of eco-friendly, high-purity formulations, and cost-effective production methods. Regulatory compliance and sustainable manufacturing practices will serve as differentiators in the market.

Regulatory and Quality Standards

Adherence to pharmacopeial standards such as USP, EP, and JP is mandatory for medicinal and pharmaceutical applications. For industrial use, compliance with OSHA and EPA regulations remains critical. Regulatory landscape shifts toward sustainability could influence product standards and certification requirements.

Key Takeaways

- The global IPA market is projected to grow approximately 4-5% annually through 2027, driven by increased demand across healthcare, consumer, and industrial sectors.

- Pricing is expected to stabilize around USD 2.20 – USD 3.00 per liter in the coming years, with potential upward adjustments linked to raw material costs and regulatory factors.

- Supply chain resilience, raw material availability, and regulatory adaptations are critical factors influencing pricing and market stability.

- Innovation in eco-friendly formulations offers growth opportunities amid tightening environmental regulations.

- Stakeholders should monitor geopolitical developments, raw material pricing trends, and regulatory modifications for effective strategic planning.

FAQs

1. What factors primarily influence the price of isopropyl rubbing alcohol?

Raw material costs, especially propylene and isopropanol, supply chain stability, regulatory compliance expenses, and demand levels significantly impact pricing.

2. How has the COVID-19 pandemic affected the IPA market?

It caused a spike in demand, leading to price surges and supply shortages, many of which are gradually stabilizing as production capacity expands and supply chains normalize.

3. Is there a significant regional variation in IPA prices?

Yes, prices vary based on regional supply-demand dynamics, raw material access, regulatory environments, and manufacturing costs, with Asia-Pacific generally offering lower prices due to higher production volumes.

4. What are the key growth opportunities in the IPA market?

Innovation in eco-friendly, high-purity formulations, expansion in emerging markets, and technological advancements in production processes present substantial growth avenues.

5. How might environmental regulations impact future IPA pricing?

Stricter emissions standards and environmental policies could increase manufacturing costs, leading to higher product prices unless offset by technological efficiencies.

Sources

- Market Research Future. "Global Isopropyl Alcohol Market Forecast to 2027." (2022).

- Transparency Market Research. "Isopropyl Alcohol Market: Industry Analysis & Outlook." (2023).

- IBISWorld. "Disinfectant & Sanitizer Industry." (2022).

- chemicalconsultant.com. "Raw Material Price Trends." (2023).

- U.S. Environmental Protection Agency (EPA). "Regulations on Solvent Emissions." (2023).

Conclusion

The outlook for isopropyl rubbing alcohol remains favorable, characterized by steady demand growth and price stability in the near to medium term. Stakeholders should focus on supply chain resilience, regulatory compliance, and product innovation to capitalize on emerging opportunities. Continuous monitoring of raw material costs and environmental policies will be essential for adapting pricing strategies and maintaining competitive advantage.

More… ↓