Share This Page

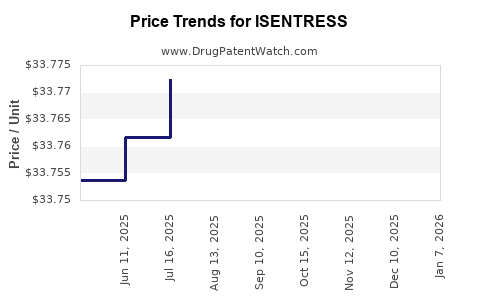

Drug Price Trends for ISENTRESS

✉ Email this page to a colleague

Average Pharmacy Cost for ISENTRESS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ISENTRESS 400 MG TABLET | 00006-0227-61 | 33.78393 | EACH | 2025-12-17 |

| ISENTRESS HD 600 MG TABLET | 00006-3080-01 | 33.80009 | EACH | 2025-12-17 |

| ISENTRESS 400 MG TABLET | 00006-0227-61 | 33.78757 | EACH | 2025-11-19 |

| ISENTRESS HD 600 MG TABLET | 00006-3080-01 | 33.82048 | EACH | 2025-11-19 |

| ISENTRESS HD 600 MG TABLET | 00006-3080-01 | 33.81905 | EACH | 2025-10-22 |

| ISENTRESS 400 MG TABLET | 00006-0227-61 | 33.77965 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ISENTRESS (Raltegravir)

Introduction

ISENTRESS (raltegravir), developed by Merck & Co., is an antiretroviral medication used primarily in the treatment of HIV-1 infection. Since its FDA approval in 2007, ISENTRESS has become a cornerstone in combination antiretroviral therapy (ART), especially in Regimen options targeting integrase strand transfer inhibitors (INSTIs). This analysis evaluates the current market landscape for ISENTRESS, examines competitive dynamics, pricing strategies, regulatory influences, and projects future pricing trends.

Market Overview

Global HIV/AIDS Treatment Market

The global HIV/AIDS therapeutics market was valued at approximately USD 32 billion in 2022 and is projected to grow at a CAGR of around 7% through 2030 [1]. The increasing prevalence of HIV, especially in Sub-Saharan Africa and emerging markets, fosters sustained demand for effective antiretroviral therapies (ART). North America and Europe dominate the market due to advanced healthcare infrastructure and higher market penetration.

ISENTRESS's Position

Within the INSTI class, ISENTRESS holds a significant market share, valued at approximately USD 1.2 billion in 2022 [2]. Its unique mechanism of action provides high efficacy and tolerability, making it preferred in multiple treatment regimens. It competes chiefly with other INSTIs like Genvoya (Gilead), Tivicay (GSK), and Biktarvy (Gilead).

Market Drivers

- Increasing HIV prevalence: Approximately 38 million people worldwide live with HIV [3].

- Advancements in ART regimens: A shift towards once-daily, integrase-based combinations drives demand.

- Long-term treatment adherence: Efficacy and tolerability encourage persistent use.

- Patent expirations and biosimilars: While ISENTRESS remains under patent, upcoming expirations could influence pricing.

Competitive Landscape

Key Competitors and Market Dynamics

- Gilead Sciences' Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide) commands a dominant role, with sales surpassing USD 8 billion in 2022 [2].

- Tivicay (dolutegravir), also by GSK, remains a significant first-line option.

- ViiV's Juluca and Triumeq combine multiple antiretrovirals, intensifying competition.

- Emerging generic options and biosimilars are anticipated post-patent expiry.

Pricing Strategies

Merck prices ISENTRESS as a branded medication, with the list price around USD 2,300 per 30-day supply in the US. Many insurers and government programs negotiate substantial discounts, with net prices reported to be significantly lower.

Patent and Regulatory Environment

- Patent protection extends to around 2026–2027 in key markets, delaying generic entry.

- Pending patent litigations or patent extensions may impact future pricing.

Price Trends and Projections

Historical Pricing Trends

- Initial list prices for ISENTRESS surged post-launch, aligning with market entry premiums.

- Intensified competition, especially from Gilead’s Biktarvy and Genvoya, has exerted downward pressure.

- Healthcare policy reforms and increased generic availability forecast further price reductions.

Forecasted Pricing Trajectory

Overall, the price of ISENTRESS is expected to decline gradually over the next five years, influenced by:

- Patent expiration: Expected between 2026–2028, potentially leading to biosimilar or generic competition.

- Market penetration: As penetration widens in emerging markets, price sensitivity increases.

- Negotiation pressures: Public and private payers' push for cost-effective therapies will lead Merck to adopt more aggressive pricing strategies.

- Discounting and rebates: Insurer negotiations and pharmacy benefit managers (PBMs) may lower net prices by 15–30% over the coming years.

Projected List Price in 2028: Approximately USD 1,800–USD 2,000 per 30-day supply, assuming no major patent extensions or regulatory delays.

Market Share Outlook

Post-patent expiry, biosimilar or generic products could capture upwards of 60–70% of the market share for raltegravir-based therapies, pressuring Merck to further reduce prices or innovate with improved formulations.

Regulatory and Policy Impacts

- Pricing regulations: Increased scrutiny on drug pricing in the US and European markets will likely catalyze volume-based discounts.

- Access programs: Merck’s patient assistance initiatives, such as PuP (Patient Assistance Programs), influence net pricing.

- Global health initiatives: Funding from organizations like WHO and PEPFAR incentivizes low-cost access, especially in low-income countries.

Implications for Stakeholders

- Healthcare providers: Must balance efficacy, tolerability, and cost in prescribing.

- Payers: Will push for competitive pricing and formulary inclusion.

- Merck: Needs to innovate or optimize pricing strategies to retain profitability and market position post-patent expiry.

- Competitors: Biosimilar entrants will drive downward price pressures.

Key Takeaways

- ISENTRESS remains a vital component of HIV treatment but faces increasing competition and imminent patent expiry.

- The market is trending toward substantial price reductions, especially in response to biosimilar availability.

- Strategic pricing, patient access programs, and ongoing innovation will determine future market share and profitability.

- Cost-conscious healthcare policies globally will accelerate downward pressure on prices.

- Stakeholders must monitor patent status, regulatory pathways, and market dynamics to optimize investment and formulary strategies.

FAQs

1. When is the patent for ISENTRESS expected to expire?

The primary patent protection for ISENTRESS is projected to expire around 2026–2027 in major markets like the US and Europe, opening the door for biosimilar competition.

2. How does ISENTRESS compare to other INSTIs in terms of price?

While list prices for ISENTRESS are comparable to other branded INSTIs, negotiated net prices are substantially lower, and competition from new entrants tends to drive prices downward.

3. What factors could influence future prices of ISENTRESS?

Patent expiration, biosimilar approval, market competition, healthcare policy reforms, and payer negotiation power are key determinants.

4. Will biosimilar versions of raltegravir impact the market significantly?

Yes, biosimilars are expected to significantly reduce prices once approved and come to market, intensifying price competition and expanding access.

5. Are there ongoing clinical developments related to ISENTRESS?

While Merck continues researching next-generation INSTIs and combination therapies, no new formulations of ISENTRESS are currently in late-stage development to replace existing products.

References

[1] MarketsandMarkets. "HIV/AIDS Therapeutics Market." 2022.

[2] EvaluatePharma. "Global HIV & AIDS Market Sales Data." 2022.

[3] UNAIDS. "Global HIV & AIDS Statistics." 2022.

More… ↓