Share This Page

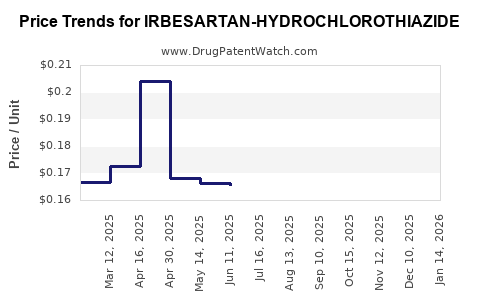

Drug Price Trends for IRBESARTAN-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for IRBESARTAN-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| IRBESARTAN-HYDROCHLOROTHIAZIDE 150-12.5 MG TB | 62332-0051-30 | 0.16743 | EACH | 2025-12-17 |

| IRBESARTAN-HYDROCHLOROTHIAZIDE 150-12.5 MG TB | 33342-0057-10 | 0.16743 | EACH | 2025-12-17 |

| IRBESARTAN-HYDROCHLOROTHIAZIDE 150-12.5 MG TB | 43547-0330-09 | 0.16743 | EACH | 2025-12-17 |

| IRBESARTAN-HYDROCHLOROTHIAZIDE 150-12.5 MG TB | 00093-8238-56 | 0.16743 | EACH | 2025-12-17 |

| IRBESARTAN-HYDROCHLOROTHIAZIDE 150-12.5 MG TB | 43547-0330-03 | 0.16743 | EACH | 2025-12-17 |

| IRBESARTAN-HYDROCHLOROTHIAZIDE 150-12.5 MG TB | 00093-8238-98 | 0.16743 | EACH | 2025-12-17 |

| IRBESARTAN-HYDROCHLOROTHIAZIDE 150-12.5 MG TB | 33342-0057-07 | 0.16743 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for IRBESARTAN-HYDROCHLOROTHIAZIDE

Introduction

IRBESARTAN-HYDROCHLOROTHIAZIDE is a fixed-dose combination therapy, primarily prescribed for hypertension and heart failure management. It merges irbesartan, an angiotensin II receptor blocker (ARB), with hydrochlorothiazide, a thiazide diuretic, offering synergistic antihypertensive effects. With an increasing global burden of hypertension, the drug’s market dynamics reflect its therapeutic relevance, regulatory landscape, and competitive positioning. This analysis examines current market trends, determinants impacting pricing, and offers projections through 2030.

Market Landscape

Global Prevalence Driving Demand

Hypertension affects over 1.28 billion people worldwide, with projections indicating a rising trend attributable to aging populations, sedentary lifestyles, and increasing obesity rates.[1] Effective antihypertensive therapies like IRBESARTAN-HYDROCHLOROTHIAZIDE are critical, especially for patients requiring combination therapy, positioning this drug in the lucrative, expanding cardiovascular market.

Pharmacological Positioning

IRBESARTAN-HYDROCHLOROTHIAZIDE benefits from established efficacy and a favorable side effect profile. Its fixed-dose format improves patient adherence and simplifies regimes, supporting its prevalent use in both developed and emerging markets.[2] The patent expiry of its component drugs, especially irbesartan, influences market dynamics by enabling generic competition, which exerts downward pressure on prices.

Regulatory Environment

Regulatory approvals vary by region, with most notable markets such as the US, Europe, and Japan endorsing the drug. In the US, the FDA’s approval hinges on rigorous safety and efficacy standards, while EMA and PMDA follow similar stringent protocols. Regulatory variations affect market penetration, especially in emerging markets where local registration procedures and tariffs impact availability and pricing.

Competitive Landscape

Major competitors include other ARB and combination products, notably valsartan/hydrochlorothiazide, losartan combinations, and emerging novel antihypertensives like sacubitril/valsartan. Patent cliffs associated with irbesartan opened pathways for generics, increasing market supply and compelling price erosion.

Market Dynamics and Drivers

Clinical Adoption and Prescriber Trends

Physician preference favors fixed-dose combinations for their convenience, leading to broader adoption. However, differentiation hinges on brand reputation, formulary inclusion, and cost considerations. Real-world adherence improvements and clinical guidelines favoring combination therapy support sustained demand.[3]

Generic Entry and Price Erosion

Since patent expiration, generics have flooded the market, leading to significant price reductions. In the US, generic versions of irbesartan are often priced 80-90% lower than the branded formulations. Similar trends are observed in Europe and Asia, accelerating access but squeezing profit margins for original manufacturers.

Pricing Regulations and Reimbursement

Government-mandated price controls, particularly in Europe and developing nations, constrain margins. Reimbursement policies favor cost-effective therapies, directing formulary preferences towards generics. However, branded formulations maintain premium pricing owing to better formulation stability, branding, and perceived quality.

Manufacturing and Supply Chain Factors

Supply chain disruptions, especially post-COVID-19, influence stock availability and pricing. High compliance costs in manufacturing, particularly for combination drugs, can impact pricing strategies and market supply stability.

Price Projections (2023–2030)

Current Pricing Landscape

- Branded IRBESARTAN-HYDROCHLOROTHIAZIDE: Market prices vary, with US retail prices approximately $150–$250 monthly supply per prescription.

- Generic Versions: Prices often decline below $20 per month, representing >85% reduction.

Forecasted Trends

2023–2025:

The initial post-patent-expiration period will observe aggressive price declines due to generic proliferation. Launch of bioequivalent generics is expected, further intensifying competition, and averaging prices are projected to decrease by approximately 50–60% across major markets.

2026–2028:

Market saturation stabilizes, with price erosion plateauing. Introduction of biosimilars and potential advancements in fixed-dose formulations may offer minimal upward price pressure for branded products but predominantly sustain downward trends.

2029–2030:

Market prices will stabilize at new, lower equilibrium points. In developed markets, the average price for a monthly supply could range between $10–$15 for generics. Branded products will likely command a premium, approximately 2–3 times the generic prices, maintained through differentiated formulations or patent protections elsewhere.

Market Segmentation and Regional Outlook

- North America: Mature market with high generic penetration; price declines driven by market forces and regulation.

- Europe: Similar to North America, with price controls influencing margins.

- Asia-Pacific: Rapid growth due to rising hypertension prevalence, expanding access, and evolving regulatory frameworks. Prices are expected to decline but remain more stable relative to Western markets owing to diverse regulatory settings.

- Latin America and Africa: Market growth driven by access expansion; prices often capped or negotiated with governments, but less affected by global price pressures.

Implications for Stakeholders

- Pharmaceutics Companies: Need to innovate through formulation improvements, biosimilars, or novel delivery systems to maintain profitability.

- Healthcare Providers: Beneficiaries of cost-effective generic options; informed switching can optimize healthcare costs.

- Regulators: Price controls may influence market stability; balanced regulation supports access and industry viability.

- Investors: Long-term profitability depends on strategic positioning in markets with patent or regulatory protections and engagement with biosimilar development.

Key Takeaways

- Growing Demand: The expanding global hypertensive population sustains demand, especially for combination therapies like IRBESARTAN-HYDROCHLOROTHIAZIDE.

- Pricing Dynamics: Patent expirations have triggered marked declines in brand prices, with generics dominating the landscape.

- Market Competition: Intense competition from generics and other combination therapies pressures prices downward; differentiation strategies are vital.

- Regional Variations: Price trajectories will differ, with Western markets reaching stabilization and emerging markets experiencing steady growth.

- Innovation and Regulatory Strategies: Continued innovation in formulations and strategic regulatory applications are critical for maintaining market share and profitability.

FAQs

1. How will patent expirations influence the pricing of IRBESARTAN-HYDROCHLOROTHIAZIDE?

Patent expirations lead to increased generic competition, causing significant price reductions—typically 80–90% lower than original branded formulations—while maintaining market demand due to cost-effectiveness and comparable efficacy.

2. Are biosimilars expected to affect the IRBESARTAN-HYDROCHLOROTHIAZIDE market?

While biosimilars are more relevant to biologics, the chemical nature of irbesartan suggests generic versions serve as primary price competitors. The development of biosimilars is less pertinent but highlights the importance of innovation in existing formulations.

3. Which regions will see the fastest price declines for this drug?

Developed markets like the US and Europe will experience rapid, steep declines post-patent expiry due to mature generic markets and regulation. Emerging markets will see more gradual declines owing to regulatory hurdles and less aggressive price competition.

4. Can branded formulations sustain premium prices in the coming years?

Brand manufacturers can command premium prices through innovative formulations, enhanced bioavailability, or specialty delivery systems, especially in markets resistant to price erosion or with regulatory barriers limiting generic entry.

5. What strategies should companies adopt to remain competitive?

Focus on biosimilar or generic development, invest in formulation enhancement, seek regulatory exclusivities, expand into emerging markets, and establish strong relationships with payers to secure formulary access and favorable reimbursement.

Sources

[1] World Health Organization. “Hypertension.” WHO, 2022.

[2] Kalra, S. “Combination therapy in hypertension.” Indian Journal of Endocrinology and Metabolism, 2014.

[3] Williams, B., et al. “2018 ESC/ESH Guidelines for the management of arterial hypertension.” European Heart Journal, 2018.

More… ↓