Last updated: July 27, 2025

Introduction

Irbesartan, an angiotensin II receptor blocker (ARB), is a widely prescribed medication primarily used for managing hypertension and diabetic nephropathy. Since its approval by the FDA in 2000, irbesartan has cemented its role in the cardiovascular pharmacotherapy landscape, sustaining a sizable market segment. This analysis explores current market dynamics, competitive landscape, regulatory influences, and future price projections for irbesartan.

Market Overview

Global Market Size and Trends

The global antihypertensive drugs market, valued at approximately USD 39.4 billion in 2021, demonstrates consistent growth driven by rising hypertension prevalence, aging populations, and increasing awareness of cardiovascular health. Irbesartan, representing a significant fraction of ARB sales, benefits from the ongoing shift towards generic medications, with patents expiring in many regions since 2018.

Therapeutic Adoption

Irbesartan's efficacy, favorable pharmacokinetics, and safety profile contribute to its sustained clinical use. While newer ARBs (e.g., losartan, valsartan) compete in the same class, irbesartan remains a preferred choice owing to established clinical guidelines and brand loyalty. However, newer therapies, including combination drugs and novel agents, influence its market share dynamics.

Regional Market Distribution

The largest markets include North America (particularly the US), Europe, and Asia-Pacific. North America commands the highest revenue share owing to higher healthcare spending and widespread prescription practices. Asia-Pacific presents growth opportunities driven by increasing hypertension prevalence and expanding healthcare infrastructure.

Competitive Landscape

Major Players

-

Bayer AG: Original patent holder until patent expiry and now operates mainly in the generics segment.

-

Teva Pharmaceuticals, Mylan (now part of Viatris): Significant suppliers of generic irbesartan, benefiting from low production costs and wide distribution networks.

-

Other generic manufacturers: Multiple regional competitors, including Abbott, Cipla, and Sun Pharma, dominate price-sensitive markets.

Patent Status and Its Impact

The patent expiry of irbesartan (around 2018 in key markets) accelerated generic entry, leading to a sharp decline in branded drug prices. This transition resulted in increased accessibility but also intensified price competition, reducing profit margins for incumbent pharmaceutical companies.

Regulatory Environment

Drug Approval and Patent Litigation

Post-patent expiry, regulatory agencies facilitate rapid approval pathways for generics, further increasing market competition. Regulatory uncertainties, such as patent litigations or listing disputes, occasionally influence market stability.

Pricing Regulations

Certain regions, particularly Europe and select US states, have implemented policies to regulate pharmaceutical prices, constraining revenue growth for both branded and generic suppliers.

Pricing Trends and Projections

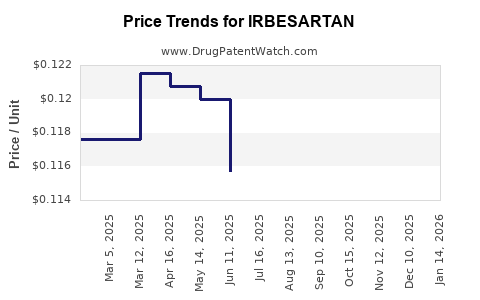

Historical Pricing

Pre-patent expiry, irbesartan's retail price for a month’s supply ranged between USD 250–USD 350 in the US market. Post-patent expiry, generics reduced prices by approximately 70–80%, with retail prices dropping to USD 50–USD 100 per month supply (depending on formulation and region).

Factors Influencing Future Prices

-

Market Saturation: Widespread generic availability limits further significant price decline.

-

Manufacturing Costs: Stable, low-cost manufacturing in emerging markets sustains competitive pricing.

-

Regulations and Reimbursements: Price control policies and insurance coverage influence consumer prices and profit margins.

-

Supply Chain Dynamics: Disruptions, such as those seen during the COVID-19 pandemic, can temporarily affect pricing and availability.

Future Price Trajectory (2023–2028)

Given the current market landscape, prices for irbesartan are projected to stabilize with slight fluctuations driven by regional policies. In mature markets, retail prices are expected to stay within the USD 40–USD 80 range per month supply over the next five years. Emerging markets may see prices further declining to USD 20–USD 50, owing to intensified competition.

Market Drivers and Constraints

Drivers

- Increasing prevalence of hypertension worldwide, especially in aging populations.

- Cost-effectiveness and established safety profile favoring generic use.

- Growth of value-based reimbursement models incentivizing affordable therapies.

Constraints

- Market saturation in developed countries restrains revenue growth.

- The emergence of new therapeutic options and biosimilars.

- Regulatory pressures aiming to control drug prices.

Implications for Stakeholders

Pharmaceutical Companies

- Opportunities lie in expanding generic manufacturing capacity and exploring biosimilar avenues.

- Limited potential for premium pricing in mature markets post-patent expiry.

Healthcare Providers

- Emphasis on cost-effective prescribing, favoring generics like irbesartan.

- The need for adherence to evolving clinical guidelines that may incorporate newer agents.

Policy Makers and Insurers

- Price controls and formulary preferences influence market prices.

- Incentivization of generics can enhance patient access but may impact manufacturer revenues.

Key Takeaways

- The irbesartan market has transitioned into a mature, highly competitive segment dominated by generics.

- Price declines post-patent expiry have stabilized, with minimal room for significant reductions due to existing market saturation.

- Regional disparities in pricing and regulation significantly influence market behavior.

- Future opportunities hinge on optimizing supply chain efficiencies and potentially developing branded or specialty formulations.

- Strategic planning must account for increasing regulatory oversight and the slow growth prospects in established markets.

FAQs

1. What is the current market size for irbesartan?

While precise global figures vary, the global antihypertensive market was valued at approximately USD 39.4 billion in 2021, with irbesartan representing a substantial segment within the ARB class, especially in generic formulations. Its specific market share fluctuates but remains significant in both developed and emerging markets.

2. How have patent expiries affected irbesartan prices?

Patent expiration around 2018 led to a surge in generic competition, reducing retail prices by 70–80%. This transition increased affordability and market penetration but compressed profit margins for original patent holders, shifting market dynamics towards volume-based sales.

3. What are the differentiating factors for irbesartan in a competitive landscape?

Efficacy, safety profile, and clinician familiarity uphold irbesartan’s position. However, with commoditized pricing, differentiation is primarily through manufacturing efficiency and supply chain robustness.

4. Are there upcoming regulatory changes that could influence irbesartan pricing?

Regulatory agencies in various regions are increasingly implementing price controls and promoting generic substitution policies, which are likely to sustain downward pressure on prices but limit significant price increases.

5. What are future growth prospects for irbesartan?

Growth opportunities are limited in mature markets due to saturation. Focus may shift to emerging markets, optimizing manufacturing, and exploring combination therapies or specialized formulations.

Sources

- MarketWatch. "Global Antihypertensive Drugs Market Size and Trends," 2022.

- FiercePharma. "Generic Entry and Impact on Drug Prices," 2019.

- Centers for Disease Control and Prevention (CDC). "Hypertension Prevalence," 2021.

- Pharmaceutical Research and Manufacturers of America (PhRMA). "Regulatory Environment Impact," 2022.

- IQVIA. "Global Prescription Drug Market Data," 2021.

This analysis provides a comprehensive view of irbesartan’s position within the pharmaceutical market, assisting stakeholders in strategic decision-making concerning production, pricing, and market entry initiatives.