Share This Page

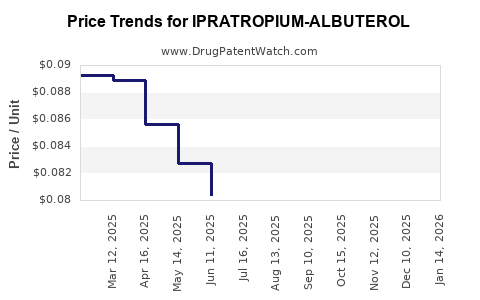

Drug Price Trends for IPRATROPIUM-ALBUTEROL

✉ Email this page to a colleague

Average Pharmacy Cost for IPRATROPIUM-ALBUTEROL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| IPRATROPIUM-ALBUTEROL 0.5-3(2.5) MG/3 ML | 00378-9671-93 | 0.09067 | ML | 2025-12-17 |

| IPRATROPIUM-ALBUTEROL 0.5-3(2.5) MG/3 ML | 00487-0201-01 | 0.09067 | ML | 2025-12-17 |

| IPRATROPIUM-ALBUTEROL 0.5-3(2.5) MG/3 ML | 00378-9671-64 | 0.09067 | ML | 2025-12-17 |

| IPRATROPIUM-ALBUTEROL 0.5-3(2.5) MG/3 ML | 00487-0201-03 | 0.09067 | ML | 2025-12-17 |

| IPRATROPIUM-ALBUTEROL 0.5-3(2.5) MG/3 ML | 00378-9671-30 | 0.09067 | ML | 2025-12-17 |

| IPRATROPIUM-ALBUTEROL 0.5-3(2.5) MG/3 ML | 76204-0600-60 | 0.08528 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ipratropium-Albuterol

Introduction

Ipratropium-Albuterol, marketed under brand names such as Combivent and DuoNeb, is a combination inhaler used primarily for the management of chronic obstructive pulmonary disease (COPD) and asthma. This fixed-dose combination offers rapid relief from bronchospasm and improves airflow, positioning it as a cornerstone therapy in respiratory conditions requiring bronchodilators. As the respiratory drug market advances amidst evolving healthcare policies, patient demographics, and technological innovations, understanding the current market landscape and future pricing trajectories for Ipratropium-Albuterol is vital for pharmaceutical stakeholders, investors, and healthcare providers.

Market Landscape

Global Market Size and Growth

The global respiratory drug market, which includes bronchodilators like Ipratropium-Albuterol, is valued at approximately USD 13 billion as of 2022, with a compound annual growth rate (CAGR) projected at around 5% through 2027 [1]. The increasing prevalence of COPD, driven by aging populations and rising tobacco use, primarily fuels this growth.

The Ipratropium-Albuterol segment accounts for a significant share within inhaled bronchodilators, holding an estimated USD 2.5 billion globally in 2022. Key markets include North America, Europe, and Asia-Pacific, where clinical guidelines endorse inhaled combination therapies for moderate to severe COPD and asthma.

Market Drivers

- Growing Disease Burden: The World Health Organization reports over 200 million COPD cases globally, with prevalence increasing in low- and middle-income countries [2].

- Clinical Efficacy and COPD Management Guidelines: Leading guidelines, such as GOLD (Global Initiative for Chronic Obstructive Lung Disease), recommend inhaled combination therapy, boosting demand.

- Inhaler Technology Advancements: Development of innovative delivery systems improves drug efficacy and patient adherence, expanding the market scope.

- Brand and Patent Dynamics: While generic versions are emerging, branded Ipratropium-Albuterol formulations still command significant market share, especially in regions with stringent regulatory frameworks.

Competitive Landscape

Major players include Boehringer Ingelheim, Teva Pharmaceuticals, and Mylan, who manufacture both branded and generic formulations. Patent provisions and exclusivity periods vary across regions, affecting market accessibility and pricing strategies.

Pricing Dynamics

Current Pricing Overview

In the United States, a typical combination inhaler like Combivent has retail prices ranging from USD 300 to USD 400 per inhaler (approximately 200 metered-dose inhalations), depending on pharmacy and insurance coverage [3]. Generic products, when available, are priced approximately 30-50% lower. In developing markets, prices are markedly lower due to regulatory and reimbursement differences.

Factors Influencing Price

- Patent Status: Patented formulations maintain higher prices; the expiration of patents leads to increased generic competition and substantial price erosion.

- Regulatory Approval and Reimbursement Policies: Variations across markets influence drug pricing. Countries with national health systems often negotiate prices directly or utilize reference pricing.

- Manufacturing Costs and Supply Chain: Production efficiencies, raw material costs, and distribution logistics impact end-user pricing.

- Market Penetration and Affordability: Price sensitivity in emerging economies necessitates tiered pricing strategies to ensure accessibility.

Price Trends and Projections (2023–2028)

Considering patent expirations in key markets, generic entry is expected to accelerate, reducing prices by an estimated 30-50% in those regions within the next five years. For branded formulations, the price decline will likely be moderate (around 10–20%), driven by increased competition and pressure from biosimilars and generics.

In the U.S., current prices are projected to either stabilize or decline slightly, contingent upon insurance coverage adjustments, healthcare reforms, and potential formulary restrictions. In emerging economies, prices may decrease further owing to local manufacturing and negotiated procurement.

Regulatory and Commercial Trends

Regulatory agencies like the FDA and EMA are increasingly emphasizing orphan drug designations and streamlined approval pathways, potentially optimizing time-to-market for new formulations or combination therapies involving Ipratropium-Albuterol.

Moreover, digital health integrations, including remote inhaler sensors, are expected to enhance adherence metrics, possibly influencing formulary preferences and associated pricing models favorably. The integration of personalized medicine approaches may also introduce premium pricing tiers for tailored inhaler therapies.

Future Market Opportunities

- Development of Fixed-Dose Combinations with Novel Agents: Incorporating long-acting formulations or additional therapeutic classes could enhance therapeutic efficacy and market share.

- Biosimilar Competition: Biosimilar and generic entrants will drive down prices, intensifying competitive pressure but also creating opportunities for differentiation through formulation improvements.

- Emerging Markets Expansion: Growing respiratory disease burdens in Asia and Africa create underserved markets, with tiered pricing models enabling broader access.

Key Takeaways

- The global Ipratropium-Albuterol market is expanding at a steady CAGR driven by the rising prevalence of COPD and asthma.

- The current retail price in developed markets hovers around USD 300–400 per inhaler; however, patent expirations and increased generic competition forecast substantial price reductions.

- Innovation in inhaler technology and regulatory shifts will influence both pricing and market penetration strategies.

- Investment in biosimilar and generic product development could disrupt current pricing structures, especially in mature markets.

- Emerging regions offer growth opportunities with customized pricing strategies aligned with local healthcare systems.

FAQs

-

What factors primarily influence the pricing of Ipratropium-Albuterol inhalers?

Pricing is influenced by patent status, regulatory environment, manufacturing costs, market competition, and reimbursement policies. -

How will patent expirations affect the Ipratropium-Albuterol market?

Patent expirations will lead to increased generic competition, lowering prices substantially in affected markets over the next 3–5 years. -

Are there emerging alternative therapies competing with Ipratropium-Albuterol?

Yes, newer long-acting bronchodiolators, biologics, and digital inhalation devices are entering the market, offering alternative or adjunct therapies. -

What opportunities exist for market expansion in developing countries?

Growing disease prevalence and affordability strategies like tiered pricing create significant opportunities in Asia, Africa, and Latin America. -

How might technological innovations impact future pricing?

Advances such as digital inhalers and personalized inhalation therapies could command premium pricing but may also improve adherence and overall treatment outcomes, influencing payer reimbursements.

References

[1] MarketWatch. "Respiratory Drugs Market Size, Share & Trends Analysis, 2022–2027."

[2] World Health Organization. "Chronic obstructive pulmonary disease (COPD)."

[3] GoodRx. "Cost of Combivent Inhaler," 2023.

More… ↓