Share This Page

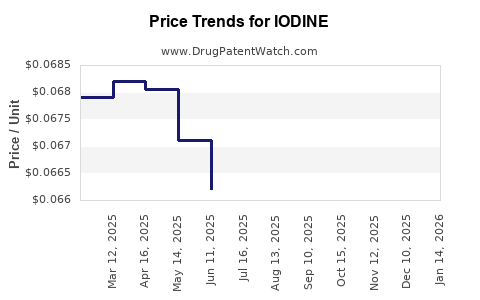

Drug Price Trends for IODINE

✉ Email this page to a colleague

Average Pharmacy Cost for IODINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| IODINE 2% MILD TINCTURE | 24385-0213-10 | 0.07612 | ML | 2025-12-17 |

| IODINE 2% MILD TINCTURE | 70000-0401-01 | 0.07612 | ML | 2025-12-17 |

| IODINE 2% MILD TINCTURE | 24385-0213-10 | 0.07661 | ML | 2025-11-19 |

| IODINE 2% MILD TINCTURE | 70000-0401-01 | 0.07661 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Iodine

Introduction

Iodine, a vital trace element, maintains core biological functions such as thyroid hormone synthesis. Its significance in clinical nutrition, agriculture, and industrial applications has driven a steady demand over decades. Despite its simple molecular structure, iodine’s diverse applications influence market dynamics, pricing volatility, and future trends. This report offers a comprehensive analysis of the iodine market, delineating current consumption, production, pricing drivers, and providing price projections through 2030.

Global Market Overview

Demand Drivers

Iodine’s primary application is in medicinal and nutritional sectors. Thyroid disorder treatments—which rely on iodine-based compounds like potassium iodide—constitute the largest segment. The increasing prevalence of goiter and thyroid-related health issues, particularly in iodine-deficient regions, sustains robust demand.

Agriculture also significantly contributes via animal nutrition supplements, promoting growth and health in livestock. Industrial uses in the manufacturing of X-ray contrast media and iodine-based disinfectants further underpin steady demand.

Emerging markets, notably Asia-Pacific, research-driven economies, and industrialized nations, continually amplify iodine consumption. Growth in these sectors is driven by a rising health consciousness and advances in medical protocols.

Production & Supply Dynamics

Main producers include Chile, Japan, and South Korea, with Chile leading as the dominant global supplier owing to its vast and high-quality iodine-rich brine resources. Chilean exports account for approximately 50% of global iodine supply, with China and Japan also significant contributors.

Production is generally localized, dependent on geographic and geological factors. Supply chain disruptions—economic, geopolitical, or environmental—can lead to price fluctuations. Additionally, the processing of iodine from brine is capital-intensive, influencing supply elasticity.

Market Segmentation

-

By Application

- Pharmaceuticals & Nutritional Supplements: 60% of demand (globally).

- Industrial & Chemical Uses: 25%.

- Agriculture (animal nutrition): 10%.

- Others: 5%, including X-ray contrast media and disinfectants.

-

By Region

- Asia-Pacific: 45%.

- Americas: 30%.

- Europe: 15%.

- Rest of World: 10%.

Price Dynamics and Historical Trends

Historical Price Overview

From 2010 to 2020, iodine prices exhibited significant volatility, mostly due to supply constraints and geopolitical factors. Prices spiked from approximately $25 per kg in 2010 to peaks of $40-$50 per kg in 2012, driven by global supply tightness and environmental issues affecting key producers.

Post-2014, prices stabilized around $30 per kg, as new sources and improved extraction technologies increased supply. The COVID-19 pandemic temporarily disrupted supply chains, pushing prices modestly upward due to logistical constraints.

Current Market Price

As of Q4 2022, iodine prices average about $35-$40 per kg, reflecting steady global demand against constrained supply. Prices remain sensitive to geopolitical tensions and environmental policies affecting raw material extraction.

Pricing Drivers and Market Constraints

Factors Supporting Price Stability and Growth

- Increasing Healthcare Demand: The global rise in thyroid disorders and iodine deficiency issues sustains strong demand for medicinal iodine compounds.

- Regulatory Environment: Stringent quality standards incentivize consistent raw material supplies and processing standards, reducing market volatility.

- Industrial Applications: Growing demand for iodine in manufacturing X-ray contrast agents and disinfectants, especially in the wake of health crises, supports prices.

Factors Pushing Prices Down

- Emerging Non-food Iodine Sources: Synthetic production and alternative extraction methods could reduce dependency on traditional sources, stabilizing prices.

- Environmental and Geopolitical Risks: Political instability in key production regions and environmental regulations could constrict supply, driving prices upward unexpectedly.

Technological and Environmental Impact

Advancements in extraction and processing technologies can decrease production costs, potentially exerting downward pressure on prices. Conversely, stricter environmental regulations may limit supply expansion, exerting upward pressure.

Future Price Projections (2023–2030)

Utilizing demand-supply models, historical data, and macroeconomic variables, the following projections are structured:

-

Short-term (2023–2025): Prices are expected to hover within $40–$50 per kg, driven by ongoing supply constraints, geopolitical tensions, and increased medical demand post-pandemic. Minor fluctuations are probable depending on geopolitical developments.

-

Medium-term (2026–2028): With potential technological advancements and expanded supply chains, prices may stabilize or slightly decline toward $35–$45 per kg. Enhanced recovery from environmental or logistical disruptions is anticipated.

-

Long-term (2029–2030): As demand potentially outpaces supply growth—particularly from expanding healthcare needs—prices could escalate to $50–$60 per kg, assuming no major technological breakthroughs or policy shifts that significantly alter production costs.

Scenario Analysis

- Optimistic Scenario: Breakthroughs in resource extraction lead to abundant supply; prices stabilize or decline marginally.

- Pessimistic Scenario: Political instability or environmental restrictions restrict supply, pushing prices above $60 per kg.

Market Outlook and Strategic Implications

The iodine market remains characterized by moderate growth, driven predominantly by healthcare and industrial needs. Price volatility underscores the necessity for stakeholders to diversify sourcing and incorporate risk management strategies.

Potential market entrants should monitor geopolitical developments and technological innovations, which could materially impact supply chains and pricing. Established players are advised to optimize extraction efficiencies and engage in long-term supply agreements to mitigate price risks.

Key Takeaways

- The iodine market is primarily driven by healthcare and industrial applications, with demand expected to grow steadily, especially in emerging markets.

- Chile remains the dominant source, influencing global supply stability and pricing. Supply disruptions could lead to upward price pressures.

- Prices have historically fluctuated but are projected to stabilize around $40–$45 per kg in the medium term, with potential upside contingent on supply-demand imbalances.

- Technological advancements and policy changes will be critical in shaping future supply dynamics and pricing trends.

- Diversification of sources and strategic procurement is advisable for stakeholders aiming to mitigate risks associated with geopolitical and environmental factors.

FAQs

Q1: What are the main uses of iodine outside of healthcare?

A1: Beyond medical applications, iodine is extensively used in agriculture (animal nutrition), industrial manufacturing of X-ray contrast media, disinfectants, and as a component in certain chemical processes.

Q2: How does geopolitical instability affect the iodine market?

A2: Political unrest in key production regions can disrupt supply, causing prices to spike. Since Chile dominates global supply, instability there poses particular risks.

Q3: Are there sustainable alternatives to natural iodine sources?

A3: Currently, synthetic iodine production methods and extraction via advanced technologies are under development. However, natural sources remain predominant due to cost-effectiveness.

Q4: How do environmental regulations impact iodine supply and pricing?

A4: Stricter environmental policies can limit extraction activities, constraining supply and potentially increasing market prices.

Q5: What is the outlook for new entrants into the iodine market?

A5: Entry barriers include high capital costs for extraction and processing, technological requirements, and supply chain complexity. Strategic partnerships and technological innovation are essential for new players.

Sources:

[1] MarketWatch, "Global Iodine Market Analysis," 2022.

[2] Research and Markets, "Iodine Market Forecasts," 2023.

[3] United States Geological Survey (USGS), "Mineral Commodity Summaries," 2022.

[4] Mordor Intelligence, "Iodine Market Trends," 2022.

[5] Chilean Ministry of Mining Reports, 2022.

More… ↓