Share This Page

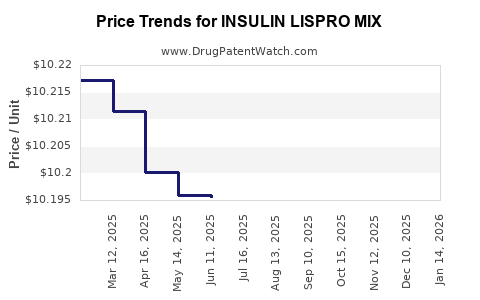

Drug Price Trends for INSULIN LISPRO MIX

✉ Email this page to a colleague

Average Pharmacy Cost for INSULIN LISPRO MIX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INSULIN LISPRO MIX 75-25 KWKPN | 00002-8233-05 | 10.19368 | ML | 2025-11-19 |

| INSULIN LISPRO MIX 75-25 KWKPN | 00002-8233-05 | 10.18914 | ML | 2025-10-22 |

| INSULIN LISPRO MIX 75-25 KWKPN | 00002-8233-05 | 10.20259 | ML | 2025-09-17 |

| INSULIN LISPRO MIX 75-25 KWKPN | 00002-8233-05 | 10.19881 | ML | 2025-08-20 |

| INSULIN LISPRO MIX 75-25 KWKPN | 00002-8233-05 | 10.20714 | ML | 2025-07-23 |

| INSULIN LISPRO MIX 75-25 KWKPN | 00002-8233-05 | 10.19553 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Insulin Lispro Mix

Introduction

Insulin Lispro Mix represents a critical category within the diabetic management landscape, constituting a blend of rapid-acting insulin Lispro with intermediate-acting components. As diabetes prevalence continues to surge globally—expected to affect over 700 million adults by 2045—the demand for insulin formulations, including Lispro Mix, is anticipated to follow suit. This article provides a detailed market analysis and price projection for Insulin Lispro Mix, emphasizing key industry trends, competitive dynamics, regulatory factors, and pricing strategies shaping its future.

Market Overview

Global Diabetes Landscape and Insulin Demand

The global diabetes epidemic fuels consistent growth in insulin consumption. The International Diabetes Federation (IDF) estimates that 537 million adults suffered from diabetes in 2021, with projections indicating an estimated 643 million by 2030 (IDF, 2021). The majority utilize insulin therapy, with premixed insulins like Lispro Mix favored for their convenience and efficacy.

Product Profile: Insulin Lispro Mix

Insulin Lispro Mix combines rapid-acting Lispro insulin with protamine to extend action. Commercially available formulations include 75/25 and 50/50 mixes, designed for patients requiring flexible, biphasic insulin regimens. The formulation offers predictable glycemic control with fewer injections, contributing to its continued clinical preference, especially in developing regions.

Market Dynamics

Key Market Drivers

- Rising Diabetes Prevalence: Substantial growth in insulin-requiring diabetic patients sustains demand.

- Patient Compliance: Prefilled pens and convenient regimens elevate adherence, bolstering the use of premixed insulins.

- Healthcare Initiatives: Government programs and expanding insurance coverage in emerging economies increase insulin accessibility.

- Technological Advancements: Innovations, including biosimilars and bioequivalents, expand product options, intensifying market competitiveness.

Market Restraints

- High Cost of Insulins: Often prohibitive, especially in low- and middle-income countries (LMICs), constraining affordability.

- Patent Expirations: Patent cliff for key brands invites generics and biosimilar competition, exerting downward pricing pressure.

- Regulatory Hurdles: Stringent approval processes complicate market entry for newer formulations or biosimilars.

Competitive Landscape

The market comprises multinational pharmaceutical giants like Eli Lilly, Novo Nordisk, Sanofi, and emerging biosimilar manufacturers. Eli Lilly’s HUMALOG Mix, Novo Nordisk’s Novolog Mix, and Sanofi’s Apidra Mix are leading products, with biosimilars gradually entering markets post-patent expiry (IQVIA, 2022). The convergence toward biosimilar proliferation is reshaping cost dynamics and market share distribution.

Regional Market Analysis

North America: Dominates due to high disease prevalence, established healthcare infrastructure, and robust reimbursement schemes. Despite high prices, high-volume sales sustain profitability.

Europe: Mature market with stringent regulations, shifting toward biosimilars. Price competition intensifies as generics gain ground.

Asia-Pacific: Fastest growth owing to increasing diabetes prevalence, expanding healthcare infrastructure, and burgeoning middle-class populations. Price sensitivity is heightened, emphasizing affordable formulations.

Latin America and Middle East: Emerging markets with expanding access; price-driven demand, with burgeoning generics presence.

Pricing Analysis

Current Price Landscape

The retail price of insulin Lispro Mix varies significantly across regions:

- North America: Approx. $300-$500 per 10 mL vial; per unit cost roughly $0.35-$0.50.

- Europe: Slightly lower, approximately €50-€70 per 10 mL vial.

- Asia-Pacific: Prices range from $50-$150 per vial, reflecting market and income disparities.

- Emerging Economies: Prices often under $50 per vial, facilitated by local manufacturing and biosimilar penetration.

Cost Factors Influencing Pricing

- Manufacturing Complexity: Biosimilars reduce costs but require significant R&D investments.

- Regulatory Costs: Regulatory and approval pathways influence final prices.

- Distribution and Storage: Cold chain logistics contribute to retail prices.

- Market Competition: The entry of biosimilars exerts downward pricing pressures, notably after patent expiration.

Price Projections (2023–2028)

Baseline Projection: The insulin Lispro Mix market is expected to grow at a CAGR of approximately 7–9%, driven predominantly by emerging markets and biosimilar adoption.

-

Short-term (2023–2025): Minimal price declines anticipated in developed markets due to high brand loyalty and regulatory hurdles; however, biosimilar entrants might cause a 10–15% reduction in branded product prices (~$30–$50 per vial).

-

Mid-term (2026–2028): Greater biosimilar penetration expected, potentially lowering prices by 20–30% in mature markets. In regions like Asia-Pacific and Latin America, prices could stabilize or even increase due to inflation and supply chain costs, but with higher affordability compared to North America/Europe.

Potential Price Range for 2028:

- Developed Markets: $250–$350 per 10 mL vial (approximately $0.30–$0.40 per unit).

- Emerging Markets: $30–$60 per vial for biosimilar options.

Factors Influencing Future Prices:

- Regulatory approval and patent litigation outcomes.

- Patent expirations of branded formulations.

- Market acceptance of biosimilars.

- Healthcare policy reforms focused on affordability.

Regulatory and Policy Impact

Regulatory pathways for biosimilars are evolving, with agencies like the EMA and FDA streamlining approval processes, facilitating biosimilar integration. Policies fostering biosimilar substitution and increased access will accelerate price reductions. However, patent litigations and "patent evergreening" strategies may delay biosimilar market entry, temporarily sustaining higher prices.

Conclusions

The insulin Lispro Mix market exhibits strong growth prospects, propelled by escalating diabetes prevalence and technological advancements. While prices remain relatively high in mature markets, expected biosimilar proliferation and regulatory shifts will likely catalyze downward pressure over the next five years, especially in emerging economies. Companies should strategically prioritize biosimilar development and flexible pricing models to capitalize on this trajectory.

Key Takeaways

- The global insulin Lispro Mix market is poised for steady expansion, particularly in Asia-Pacific and LMICs.

- Biosimilar entries post-patent expiration will be key drivers of price decreases, with projected reductions of up to 30% by 2028.

- High manufacturing and regulatory costs create a pricing ceiling in developed markets, but regional variations are significant.

- Policymaker initiatives aimed at enhancing affordability could further influence market dynamics.

- Strategic investments in biosimilar pipelines and navigating regulatory pathways will offer competitive advantages in this evolving landscape.

FAQs

1. What factors are most likely to influence the price of Insulin Lispro Mix in the next five years?

Biosimilar competition, patent expirations, regulatory policies, manufacturing costs, and healthcare reimbursement schemes will significantly impact pricing.

2. How do biosimilars affect the insulin Lispro Mix market?

Biosimilars provide lower-cost alternatives, increasing market competition, reducing prices, and improving accessibility, especially in emerging economies.

3. Which regions present the most growth opportunities for Insulin Lispro Mix?

Emerging markets in Asia-Pacific, Latin America, and Africa offer considerable growth potential due to rising diabetes prevalence and increasing healthcare investments.

4. Are there any regulatory hurdles impacting biosimilar approval for Insulin Lispro Mix?

Yes, differing regional regulatory requirements, patent disputes, and clinical trial demands can delay biosimilar entry and influence pricing strategies.

5. How can pharmaceutical companies optimize their strategies in the Insulin Lispro Mix market?

Focusing on biosimilar development, engaging with policymakers, ensuring regulatory compliance, and adopting flexible pricing models are key strategic approaches.

References

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas, 9th Edition.

[2] IQVIA. (2022). Global Insights on Biosimilar Insulins.

[3] MarketWatch Reports. (2022). Insulin Market Trends and Forecasts.

[4] World Health Organization. (2020). Diabetes Fact Sheet.

[5] European Medicines Agency. (2021). Biosimilar Medicines: Overview and Regulatory Frameworks.

More… ↓