Share This Page

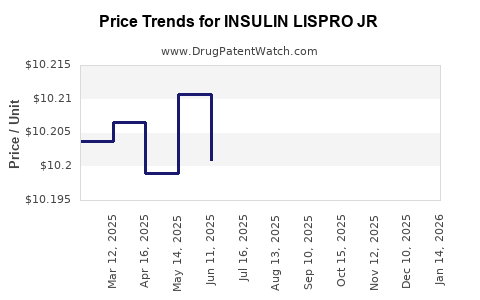

Drug Price Trends for INSULIN LISPRO JR

✉ Email this page to a colleague

Average Pharmacy Cost for INSULIN LISPRO JR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INSULIN LISPRO JR 100 UNIT/ML KWIKPEN | 00002-7752-05 | 10.20662 | ML | 2025-12-17 |

| INSULIN LISPRO JR 100 UNIT/ML KWIKPEN | 00002-7752-05 | 10.19875 | ML | 2025-11-19 |

| INSULIN LISPRO JR 100 UNIT/ML KWIKPEN | 00002-7752-05 | 10.20576 | ML | 2025-10-22 |

| INSULIN LISPRO JR 100 UNIT/ML KWIKPEN | 00002-7752-05 | 10.18453 | ML | 2025-09-17 |

| INSULIN LISPRO JR 100 UNIT/ML KWIKPEN | 00002-7752-05 | 10.17869 | ML | 2025-08-20 |

| INSULIN LISPRO JR 100 UNIT/ML KWIKPEN | 00002-7752-05 | 10.18979 | ML | 2025-07-23 |

| INSULIN LISPRO JR 100 UNIT/ML KWIKPEN | 00002-7752-05 | 10.20098 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for INSULIN LISPRO JR

Introduction

INSULIN LISPRO JR, a rapid-acting insulin analog designed primarily for pediatric patients with diabetes, is part of a broader market segment for insulin therapies. As a biosimilar or innovative first-in-class product, understanding its market dynamics and pricing trajectory is essential for stakeholders, including pharmaceutical companies, healthcare providers, payers, and investors.

This analysis explores current market size, competitive landscape, regulatory environment, pricing factors, and future price projections, providing a comprehensive outlook for INSULIN LISPRO JR’s commercial potential.

Market Overview

Global Diabetes Insulin Market

The global insulin market was valued at approximately USD 38.6 billion in 2022 and is projected to reach USD 63.4 billion by 2028, CAGR of around 8.4% [1]. Rapid growth stems from increasing diabetes prevalence, rising awareness, and a surge in insulin analog adoption for better glycemic control.

Pediatric Diabetes Segment

Pediatric diabetes management accounts for roughly 15–20% of insulin market revenues, driven by the increasing incidence of type 1 diabetes among children. The demand for specialized insulin formulations suitable for children, like INSULIN LISPRO JR, is expanding within this segment [2].

INSULIN LISPRO JR’s Niche

INSULIN LISPRO JR’s development as a rapid-acting insulin tailored for pediatric use offers a competitive advantage, especially in markets emphasizing tailored dosing and pediatric safety. It addresses gaps left by adult-oriented insulin formulations and biosimilars targeting mature age groups.

Market Drivers

-

Rising Incidence of Diabetes in Youth: The International Diabetes Federation reports that approximately 1.1 million children and adolescents globally suffer from type 1 diabetes, driving demand for pediatric-specific formulations [3].

-

Advancements in Insulin Therapies: The shift toward faster-acting insulins for improved post-prandial glucose control fuels growth.

-

Regulatory Support: Positive regulatory pathways for biosimilars and pediatric formulations enhance market entry, fostering competition and price stabilization.

-

Healthcare Infrastructure: Increasing healthcare access in emerging markets enables broader adoption of insulin therapies, particularly for chronic pediatric conditions.

Competitive Landscape

Key Players

-

Novo Nordisk: Dominates with insulin analogs like NovoRapid (insulin as rapid-acting insulin) and traditional formulations.

-

Eli Lilly: Offers Humalog (insulin lispro), competing directly in rapid-acting insulin.

-

Sanofi: Markets Apidra (insulin glulisine) for similar indications.

-

Emerging Biosimilars: Several biosimilar manufacturers are developing rapid-acting insulin analogs, including Admelog (biosimilar insulin lispro) by Mylan/Biocon and others that could target pediatric niches.

INSULIN LISPRO JR, by focusing on pediatric-specific dosing and formulation improvements, differentiates itself but must navigate price competition from biosimilars and off-label use of adult formulations.

Regulatory and Reimbursement Dynamics

The approval pathway for INSULIN LISPRO JR depends on region-specific regulatory agencies (FDA in the U.S., EMA in Europe). Pediatric indication approvals often require additional clinical trials, potentially delaying market entry or impacting pricing strategies.

Reimbursement policies will significantly influence price projections. Countries with nationalized healthcare systems or strict price controls may limit maximum achievable prices, whereas free-market environments may permit premium pricing for specialized pediatric formulations.

Pricing Factors for INSULIN LISPRO JR

1. Manufacturing Costs:

Ensuring high bioequivalence in biosimilar or innovative formulations influences cost. Pediatric-specific formulations with unique delivery devices may increase manufacturing complexity.

2. Competitive Pricing Environment:

Biosimilars generally trigger price reductions of 20–40%, with established brands often discounting to retain market share.

3. Value-Based Pricing:

Clear evidence of improved pediatric outcomes, reduced hypoglycemia, and better quality of life can justify premium pricing.

4. Reimbursement and Access:

Coverage policies directly affect the price at which the product is sold in different markets.

5. Patent and Exclusivity Status:

Patent expirations or exclusivity periods influence initial pricing and market penetration strategies.

Price Projections for INSULIN LISPRO JR

Short-term Estimates (1–3 years post-launch)

- Price Range: USD 100–150 per vial or pen (50 units)

- Rationale: Premium pricing justified by pediatric-specific advantages, clinical trial data, and limited direct competition in this niche. Similar pediatric insulin formulations, such as insulin pumps or inhaled insulins, retail within this range.

Mid-term Projections (4–7 years post-launch)

- Price Range: USD 70–120 per vial/pen

- Market Dynamics: As biosimilar competition increases, prices are likely to decline. Enhanced supply chain efficiencies and increased market penetration will drive prices downward.

Long-term Outlook (>7 years)

- Price Range: USD 50–80 per vial/pen

- Factors: Widespread biosimilar entry, price negotiations, and the push for biosimilar adoption in pediatric markets will sustain lower pricing levels while maintaining margins.

Future Challenges Impacting Pricing

-

Biosimilar Competition: The proliferation of biosimilar insulin lispro products will exert downward pressure.

-

Pricing Regulations: Governments' efforts to cap prices for essential medicines, especially in lower-income markets, will influence pricing strategies.

-

Innovation and Clinical Evidence: Demonstrated superior safety or efficacy profiles could sustain premium prices longer.

-

Market Penetration Strategies: Effective contract negotiations and patient assistance programs will shape the ultimate affordability.

Conclusions

INSULIN LISPRO JR stands to carve out a niche in pediatric diabetes management with its tailored formulation and rapid-onset profile. While initial prices are anticipated to be premium, competitive dynamics—especially biosimilar entry—will gradually erode margins, leading to stabilized, lower prices over the long term.

Manufacturers should prioritize robust clinical data demonstrating pediatric advantages, strategic regulatory engagement, and flexible pricing strategies aligned with regional healthcare policies to optimize market uptake and profitability.

Key Takeaways

-

Market Growth: The pediatric insulin segment will continue expanding, driven by increasing diabetes prevalence and demand for tailored formulations.

-

Pricing Strategy: Early premium pricing justified by pediatric-specific features, with downward trends expected due to biosimilar competition and regulatory pressures.

-

Competitive Landscape: Entry of biosimilars will intensify price competition; differentiation through clinical benefits and delivery innovations remains vital.

-

Regulatory & Reimbursement Impact: Approvals and reimbursement policies will heavily influence achievable prices in different markets.

-

Long-Term Outlook: Sustainable profitability will depend on balancing pricing, clinical differentiation, and strategic market positioning amid evolving policy and competitive scenarios.

FAQs

Q1: How does INSULIN LISPRO JR’s pricing compare to adult formulations?

A1: Pediatric-specific formulations typically command a higher price premium due to tailored dosing, safety requirements, and formulation complexities. However, as biosimilar options increase, price convergence with adult formulations is expected over time.

Q2: What factors most influence INSULIN LISPRO JR’s market penetration?

A2: Key factors include regulatory approvals for pediatric indications, clinical evidence demonstrating safety and efficacy in children, reimbursement policies, and physician prescribing habits.

Q3: Will biosimilar insulin lispro significantly reduce prices?

A3: Yes. Biosimilars introduce price competition, often reducing insulin analog costs by 20–40%, which will impact INSULIN LISPRO JR’s pricing and margins.

Q4: Which markets will see the fastest adoption of INSULIN LISPRO JR?

A4: North America and Europe are expected to lead due to established regulatory pathways, higher healthcare expenditure, and focus on pediatric diabetes management. Emerging markets will adopt more slowly but with significant growth potential.

Q5: How can manufacturers maintain profitability amid price pressures?

A5: By emphasizing clinical differentiation, optimizing manufacturing efficiencies, developing strong payer relationships, and broadening indications, such as pediatric use, to justify premium pricing.

Sources

- Mordor Intelligence, "Global Insulin Market – Growth, Trends, and Forecast (2022–2028)."

- International Diabetes Federation, "Diabetes Atlas," 10th Edition, 2021.

- U.S. CDC, "National Diabetes Statistics Report," 2022.

More… ↓