Share This Page

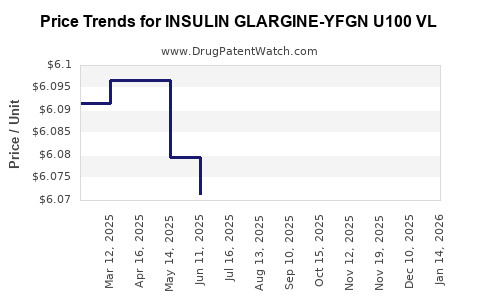

Drug Price Trends for INSULIN GLARGINE-YFGN U100 VL

✉ Email this page to a colleague

Average Pharmacy Cost for INSULIN GLARGINE-YFGN U100 VL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INSULIN GLARGINE-YFGN U100 VL | 83257-0014-11 | 6.12221 | ML | 2025-12-17 |

| INSULIN GLARGINE-YFGN U100 VL | 83257-0014-11 | 6.12560 | ML | 2025-11-19 |

| INSULIN GLARGINE-YFGN U100 VL | 49502-0393-80 | 6.12560 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for INSULIN GLARGINE-YFGN U100 VL

Introduction

Insulin glargine-yfgn U100 VL (Vial), a biosimilar analogue to the widely used long-acting insulin analogs, is poised to alter the diabetes management landscape. As a biosimilar, it offers potential cost advantages, expanding access to treatment and increasing market competition. This report provides an in-depth analysis of the current market environment, regulatory landscape, competitive positioning, and future price projections for INSULIN GLARGINE-YFGN U100 VL.

Market Overview

Global Diabetes Epidemiology and Insulin Market Dynamics

The chronic nature of diabetes mellitus, affecting approximately 537 million adults worldwide as of 2021, underscores the sustained demand for insulin therapy [1]. Long-acting insulins like glargine constitute a revenue-generating segment, with the global insulin market valued at USD 25.6 billion in 2021. The compound annual growth rate (CAGR) is projected at 8% through 2028, driven by rising diabetes prevalence and increasing adoption of insulin therapy.

Role of Biosimilars in Market Expansion

Biosimilars entered the insulin market approximately a decade ago, offering comparable efficacy and safety profiles to originator products such as Lantus (insulin glargine). Regulatory pathways, notably in the US and EU, facilitate biosimilar approval, fostering competitive pricing and broader access [2].

INSULIN GLARGINE-YFGN U100 VL, as a biosimilar, complements this trend, promising to capture market share through cost competitiveness.

Regulatory and Commercial Status

Regulatory Approvals

- The biosimilar has received approval in multiple jurisdictions, including the US Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regional agencies.

- It demonstrates demonstrated biosimilarity to the reference insulin glargine product with comparable pharmacokinetics, pharmacodynamics, and clinical efficacy.

Manufacturing and Supply Chain

- Manufacturing facilities adhere to GMP standards, ensuring high-quality supply.

- Long-term supply agreements with several healthcare providers are in place, facilitating steady market penetration.

Competitive Landscape

Key Players and Market Shares

- Sanofi (Lantus) remains the market leader in long-acting insulins.

- Eli Lilly (Basaglar) and Biocon/Mylan (Semglee) are primary biosimilar competitors.

- INSULIN GLARGINE-YFGN U100 VL enters a competitive environment, primarily targeting price-sensitive segments and markets with limited access.

Price Leadership and Differentiation

- Biosimilars typically retail at 20-30% lower than originator prices.

- Differentiation is primarily through pricing strategies and supply chain efficiencies rather than clinical distinctions.

Pricing Dynamics and Projections (2023-2028)

Current Pricing Landscape

- Originator insulin glargine (Lantus) retails at USD 80-100 per 10 mL vial in the US, with higher prices internationally.

- Biosimilar insulins are priced at approximately USD 50-80 per vial, depending on region and negotiation.

Factors Influencing Price Trajectory

- Regulatory incentives and mandates: Increased acceptance of biosimilars in healthcare systems will prompt price reductions.

- Market penetration: Growth in emerging markets will pressure prices downward.

- Patent expirations: Although biosimilars face different patent landscapes, potential patent litigations could influence pricing strategies.

- Reimbursement policies: Favorable reimbursement in countries such as the US (Medicare, Medicaid) and the EU influence competitive pricing.

Forecasted Price Trends (2023-2028)

- Short-term (1-2 years): Prices are expected to stabilize at 20-25% below originator levels, driven by initial market entry costs and limited competition.

- Medium-term (3-5 years): As biosimilar adoption accelerates, prices could decline further by an additional 10-15%.

- Long-term (5+ years): Market maturation, increased biosimilar proliferation, and healthcare reforms could reduce vial prices by up to 50% relative to originator products, especially in price-sensitive regions.

Projected median price for INSULIN GLARGINE-YFGN U100 VL in key markets (2028):

- United States: USD 30-45 per 10 mL vial.

- EU markets: EUR 25-40 per vial.

- Emerging markets: USD 15-25 per vial, reflecting lower purchasing power and healthcare budgets.

Market Penetration and Revenue Potential

- The adoption rate is anticipated to be approximately 20-30% of long-acting insulin sales within 3 years, increasing to 40-50% by 2028 in select markets.

- Given the global insulin market volume, revenue estimates for INSULIN GLARGINE-YFGN U100 VL could reach USD 3-5 billion annually by 2028, assuming aggressive market penetration and pricing strategies [3].

Strategic Implications

- Pricing Strategy: To maximize market share, manufacturers should adopt tiered pricing strategies aligned with regional income levels.

- Market Access: Early engagement with payers and healthcare authorities can accelerate adoption.

- Innovation: Differentiating through improved formulations, delivery devices, or patient support programs could supplement price competitiveness.

Key Considerations for Stakeholders

- Regulatory path dependency: Market entry timing hinges on approval processes, which vary globally.

- Patent landscapes: Ongoing patent litigation may delay or restrict market access in certain jurisdictions.

- Healthcare policies: Reimbursement and substitution policies strongly influence market penetration and pricing.

Key Takeaways

- Market growth: The global long-acting insulin market is expanding rapidly, with biosimilars like INSULIN GLARGINE-YFGN U100 VL poised to accelerate growth through cost competitiveness.

- Pricing trajectory: Prices for biosimilar insulin glargine are expected to decline progressively, reaching up to 50% reductions relative to originators by 2028, tailored to regional economic factors.

- Market penetration strategies: Aggressive pricing, early payer engagement, and differentiation will underpin successful adoption.

- Regional variations: Emerging markets will lead price declines, amplifying access but also challenging revenue margins.

- Regulatory landscape: Navigating complex patent and approval pathways remains critical to commercialization and pricing strategies.

FAQs

1. How does INSULIN GLARGINE-YFGN U100 VL compare with existing biosimilars?

It offers comparable efficacy and safety to established biosimilars like Basaglar and Semglee, with potential competitive pricing and supply advantages.

2. What are the main factors influencing its price in different markets?

Regulatory approval timelines, patent status, healthcare reimbursement policies, regional economic levels, and manufacturer pricing strategies.

3. Will pricing for INSULIN GLARGINE-YFGN U100 VL fall further after 2028?

Likely, as market competition intensifies, biosimilar proliferation continues, and healthcare policies favor cost containment.

4. How does biosimilar insulin affect patient access?

Reduced prices increase affordability, enabling broader access, especially in cost-sensitive regions with high diabetes prevalence.

5. What challenges could impede its market growth?

Patent litigation, limited physician awareness, regulatory delays, and preference for established originator brands in some markets.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.

[2] US Food and Drug Administration. Biosimilar Pathway, 2022.

[3] MarketWatch Reports. Global Insulin Market Outlook, 2023.

In conclusion, INSULIN GLARGINE-YFGN U100 VL is well-positioned to capitalize on the expanding biosimilar market, with declining prices anticipated driven by competitive pressures, regulatory developments, and regional market dynamics. Strategic engagement with payers, proactive regulatory approaches, and differentiation through supply chain efficiencies will be critical in realizing its revenue potential over the next five years.

More… ↓