Share This Page

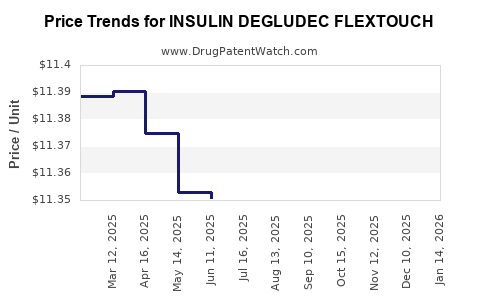

Drug Price Trends for INSULIN DEGLUDEC FLEXTOUCH

✉ Email this page to a colleague

Average Pharmacy Cost for INSULIN DEGLUDEC FLEXTOUCH

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INSULIN DEGLUDEC FLEXTOUCH 100 UNIT/ML PEN | 73070-0403-15 | 11.37205 | ML | 2025-12-17 |

| INSULIN DEGLUDEC FLEXTOUCH 200 UNIT/ML PEN | 73070-0503-15 | 22.72631 | ML | 2025-12-17 |

| INSULIN DEGLUDEC FLEXTOUCH 100 UNIT/ML PEN | 73070-0403-15 | 11.37009 | ML | 2025-11-19 |

| INSULIN DEGLUDEC FLEXTOUCH 200 UNIT/ML PEN | 73070-0503-15 | 22.74278 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Insulin Degludec FlexTouch

Introduction

Insulin degludec (marketed under the brand name Tresiba, among others) is a long-acting basal insulin used in managing type 1 and type 2 diabetes. Its formulation, available as FlexTouch pre-filled pen, offers extended duration and a stable profile, reducing hypoglycemia risk. As innovations in diabetes management accelerate and regulatory approvals expand, an in-depth market analysis and pricing forecast become essential for stakeholders including pharmaceutical companies, healthcare providers, insurers, and investors.

Market Landscape Overview

Global Diabetes Prevalence and Insulin Market Dynamics

The burgeoning global prevalence of diabetes—estimated at 537 million adults as of 2021—propels a sustained increase in insulin demand [1]. The International Diabetes Federation projects this number to reach 643 million by 2030. Basal insulin formulations constitute a significant segment, with long-acting insulins, including insulin degludec, gaining preference due to their pharmacokinetic advantages.

Key Players and Product Portfolio

Novo Nordisk dominates the basal insulin market with Tresiba, capturing significant market share owing to its pharmacological profile and patient convenience [2]. Eli Lilly and Sanofi also offer basal insulin analogs, intensifying competition.

Regulatory and Reimbursement Environment

Expanding approvals—such as recent authorizations in emerging markets—along with evolving reimbursement policies, directly influence market accessibility and pricing. For instance, increased adoption in countries like China and India reflects a growing demand for affordable, high-efficacy insulins.

Market Size and Growth Trajectory

Current Market Valuation

The global insulin market was valued at approximately USD 21 billion in 2021 [3], with basal insulin comprising nearly 60%. Insulin degludec’s segment valuation is estimated at USD 3.5 billion, driven by increased adoption and favorable pharmacodynamics.

Projected Growth Rates

Analysts forecast a compound annual growth rate (CAGR) of about 8-10% for the long-acting insulin segment until 2028, driven by:

- Rising diabetes prevalence.

- Extension of patent protections and pipeline products.

- Shifts toward analog insulins over human insulins.

Insulin degludec is poised to benefit from these trends, with expected market expansion to USD 6-7 billion by 2028 [4].

Market Drivers and Inhibitors

Drivers

- Enhanced Safety Profiles: Reduced hypoglycemia risks promoting patient compliance.

- Convenience: Once-daily dosing with FlexTouch pens enhances adherence.

- Broadening Indications: Expansion into pediatric and gestational diabetes management.

Inhibitors

- Cost and Accessibility: High pricing limits uptake in low-income markets.

- Generic Competition: Patent expirations threaten future exclusivity.

- Emerging Biosimilars: Increasing entry of biosimilar insulin degludec formulations could drive prices downward.

Pricing Analysis

Current Pricing Landscape

In developed markets:

- United States: The wholesale acquisition cost (WAC) of Tresiba FlexTouch averages around $500 per pen containing 300 units [5].

- European Union: Prices tend to be lower, approximately €150-€200 per pen, reflecting national tariffs and healthcare policies.

- Emerging Markets: Prices vary widely, often subsidized, ranging from $50 to $150 per pen.

Per-Unit Cost and Cost-Effectiveness

Considering typical dosing, a single pen (~300 units) provides approximately 30 days of therapy. Annual treatment costs can therefore escalate to roughly $6,000 in the U.S., positioning insulin degludec as a premium product.

Price Projections (2023–2030)

Factors Influencing Price Trends

- Patent Expiration: Expected around 2024–2025 in major markets, ushering in biosimilar competition.

- Cost-Containment Policies: Governments and payers striving to reduce expenditures may negotiate lower prices.

- Market Penetration of Biosimilars: Entry of biosimilars could reduce branded insulin prices by 20-40% within 3–5 years post-launch.

Forecasted Price Dynamics

- Short-Term (2023–2025): Stable or slight price reductions (~2-5%), driven by market stability and supply chain adjustments.

- Mid to Long-Term (2026–2030): Prices could decline by approximately 25-35%, with biosimilar products capturing 30-50% of the market share, especially in cost-sensitive regions.

Potential Pricing Strategies

Manufacturers might adopt tiered pricing models, offering discounts or subsidies in emerging markets, while maintaining premium pricing in developed regions based on differentiation and brand strength.

Regulatory and Market Impact on Pricing

The approval of biosimilar insulin degludec in the U.S. and EU is anticipated to hasten price declines. Regulatory pathways facilitating biosimilar approval, such as the FDA's abbreviated biosimilar pathway, are critical to market entry.

Furthermore, inclusion within formularies as preferred basal insulin will influence demand and pricing strategies. Reimbursement body decisions will ultimately shape affordability and accessibility.

Conclusion

Insulin degludec FlexTouch remains a premium, yet increasingly competitively pressured, product within the global insulin market. While current prices sustain high margins, patent expiry and biosimilar proliferation threaten downward pressure over the next decade. Market growth remains robust due to increasing prevalence; however, pricing will likely trend downward, especially in regions adopting biosimilar options. Stakeholders must strategize around patent protections, biosimilar entry, and evolving reimbursement landscapes to optimize profitability and market share.

Key Takeaways

- The global insulin market, especially for long-acting insulins like degludec, is projected to grow at a CAGR of 8-10%, driven by rising diabetes prevalence.

- Current pricing varies significantly across regions: approximately $500 USD per pen in the U.S., lower in Europe and emerging markets.

- Patent expiration beginning around 2024 is likely to usher in biosimilar competition, with forecasts indicating a potential 25-35% price reduction by 2030.

- Regulatory developments and formulary placements will significantly influence market penetration and pricing strategies.

- Pharma companies should prepare for increased market competition by innovating in formulation, delivery systems, and pricing models to retain market share.

FAQs

1. When will biosimilars for insulin degludec be available, and how will they affect prices?

Biosimilar insulin degludec approvals are expected around 2024–2025. Their entry will increase competition, likely reducing the retail price of degludec by 20–40% over subsequent years [4].

2. How does the pricing of insulin degludec compare with other basal insulins?

Insulin degludec typically commands a higher price than human insulins and some other analogs like insulin glargine U100, but similar or slightly higher than insulin glargine U300, justified by its longer duration and stability.

3. Which markets are most susceptible to price reductions for insulin degludec?

Emerging markets, including India and Africa, will experience more significant price drops due to biosimilar competition and cost-containment policies.

4. What factors could mitigate price declines for insulin degludec?

Strong brand positioning, expansion into new indications, patents, and limited biosimilar availability could sustain higher prices longer.

5. How can stakeholders capitalize on the growth of the insulin market?

Investing in biosimilar development, negotiating favorable reimbursement agreements, and expanding access in underserved regions can position stakeholders advantageously.

References

[1] IDF Diabetes Atlas, 9th Edition, 2019.

[2] Novo Nordisk Annual Report 2022.

[3] MarketWatch, "Global Insulin Market Size & Share Analysis," 2022.

[4] Frost & Sullivan, "Future of Long-Acting Insulin," 2021.

[5] GoodRx, "Cost of Tresiba," 2022.

More… ↓