Share This Page

Drug Price Trends for INSULIN ASPART FLEXPEN

✉ Email this page to a colleague

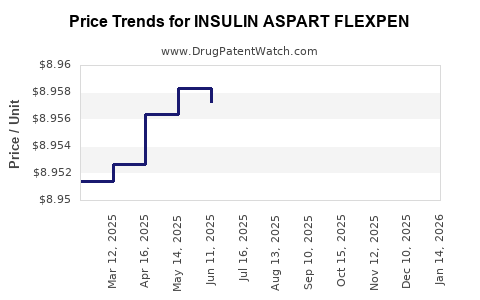

Average Pharmacy Cost for INSULIN ASPART FLEXPEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INSULIN ASPART FLEXPEN 100 UNIT/ML PEN | 73070-0103-15 | 8.95828 | ML | 2025-12-17 |

| INSULIN ASPART FLEXPEN 100 UNIT/ML PEN | 73070-0103-15 | 8.95540 | ML | 2025-11-19 |

| INSULIN ASPART FLEXPEN 100 UNIT/ML PEN | 73070-0103-15 | 8.95401 | ML | 2025-10-22 |

| INSULIN ASPART FLEXPEN 100 UNIT/ML PEN | 73070-0103-15 | 8.95628 | ML | 2025-09-17 |

| INSULIN ASPART FLEXPEN 100 UNIT/ML PEN | 73070-0103-15 | 8.95655 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for INSULIN ASPART FLEXPEN

Introduction

Insulin Aspart Flexpen represents a premium subcutaneous insulin delivery device used predominantly in managing diabetes mellitus type 1 and type 2. As a rapid-acting insulin analog, Insulin Aspart (marketed under Fiasp and NovoRapid forms by Novo Nordisk and Sanofi, respectively) has maintained a significant market position due to its efficacy and convenience. This analysis explores the current market landscape, competitive dynamics, pricing strategies, and future price projections tied to technological innovation, regulatory changes, and macroeconomic factors.

Market Overview

Global Diabetes Drug Market Context

The global diabetes therapeutics market is projected to grow annually at approximately 8% CAGR, driven by increasing diabetes prevalence worldwide. According to the International Diabetes Federation, approximately 537 million adults were living with diabetes in 2021, a figure expected to reach 643 million by 2030 [1]. Insulin therapies constitute a substantial share of this growth, with rapid-acting insulins, like Insulin Aspart, being essential for tight glycemic control.

Market Penetration of Insulin Aspart Flexpen

Insulin Aspart Flexpen, a disposable pen device, accounted for roughly 15-20% of the rapid-acting insulin segment in 2022, riding the wave of device innovations enhancing patient compliance and convenience. Its key differentiators include ease of use, dosing accuracy, and portability, which resonate with both adult and pediatric patient populations.

Key Stakeholders and Competition

The insulin analog market is dominated by major players like Novo Nordisk (Fiasp, NovoRapid), Sanofi (Apidra), and Eli Lilly (Lyumjev). Novo Nordisk’s Insulin Aspart Flexpen maintains a strong market position owing to extensive regional approvals, robust distribution channels, and proven efficacy.

Other notable competitors include:

- Sanofi’s Insulin Glulisine (Apidra)

- Lilly’s Lispro (Humalog)

- Emerging Biosimilar Insulins: Biosimilar versions are gradually entering markets, exerting downward pressure on prices.

Market Drivers

- Rising Diabetes Prevalence: Increasing global diabetes burden directly correlates with demand for insulin therapies.

- Device Innovation: Pen devices like Insulin Aspart Flexpen improve adherence, especially among children and elderly patients.

- Regulatory Approvals: Continuous approvals and launches in emerging markets expand reach.

- Patient Preference: Preference for pen-based delivery systems over syringes enhances uptake.

Price Dynamics and Factors Influencing Pricing

Current Pricing Landscape

In high-income markets (e.g., US, Europe), the retail exclusive list price (ELP) for Insulin Aspart Flexpen typically ranges between $80 to $100 per pen, with some variation based on healthcare policies, purchasing agreements, and insurance coverage.

In the United States, the average wholesale price (AWP) is approximately $120 per pen, but patient out-of-pocket costs vary significantly due to insurance formularies and discount programs. In European countries with national health services, reimbursement models often establish lower negotiated prices.

Impacts on Pricing

-

Patent and Exclusivity: Patent protection extends the monopoly pricing window; expiring patents introduce biosimilar competition.

-

Generic and Biosimilar Entry: Biosimilar Insulin Aspart products are entering markets in Europe and later in the US, exerting downward pressure on prices. Biosimilar versions are typically priced 20-40% below originator products.

-

Manufacturing and Supply Chain Costs: Advances in production efficiency and economies of scale reduce per-unit costs, allowing for strategic pricing flexibility.

-

Regulatory and Reimbursement Policies: Governments and health insurers increasingly negotiate prices and impose price caps; value-based pricing models incentivize cost-effectiveness.

Market Trends Impacting Future Prices

-

Shift toward biosimilars: As biosimilar versions attain regulatory approval, originators face competitive pricing pressures.

-

Pricing Strategies: Manufacturers may adopt tiered pricing, offering discounts, rebates, or patient assistance programs to maintain market share.

-

Technological Advancements: Integration with digital health platforms and smarter pens may justify premium pricing, especially for value-added features.

-

Global Market Expansion: Entry into emerging markets with lower purchasing power may necessitate tiered, lower pricing models, further influencing global average prices.

Future Price Projections (2023–2030)

Drivers of Price Decrease

-

Biosimilar Market Penetration: Biosimilar insulin Aspart products are expected to comprise approximately 30-50% of the rapidly-acting insulin market by 2028, with prices projected to fall by 25-40% from current levels [2].

-

Regulatory Landscape Changes: US FDA and EMA are fostering increased biosimilar approvals, leading to competitive price reductions.

-

Generic Market Dynamics: Antitrust measures and patent litigation could speed the introduction of biosimilar alternatives.

Price Forecasts

| Year | Estimated Average Price per Flexpen (USD) | Change from 2022 | Notes |

|---|---|---|---|

| 2023 | $75–$85 | -10% to -15% | Initial biosimilar market entry; pricing adjustments |

| 2025 | $60–$75 | -20% to -25% | Increased biosimilar availability; competitive pressures |

| 2028 | $50–$65 | -30% to -40% | Market consolidation; major biosimilar uptake |

| 2030 | $45–$55 | -45% to -50% | Mature biosimilar presence; price stabilization |

Note: These projections assume market normalization, regulatory stability, and continued biosimilar adoption.

Potential Upside Factors

- Innovations in Delivery Devices: Integration with digital health tools, connectivity features, and dose-tracking might justify premium pricing above the projected range.

- Regulatory Delays or Market Restrictions: Could sustain higher prices temporarily.

- Supply Chain and Raw Material Shortages: May cause short-term price spikes.

Implications for Stakeholders

Manufacturers: To maintain market share amidst biosimilar competition, strategic pricing, diversification of device features, and value-added services are essential.

Healthcare Systems: Enhanced negotiation leverage can lead to lower prices; policy reforms favoring biosimilars can substantially cut costs.

Patients: Device accessibility and affordability hinge on pricing policies, insurance coverage, and ongoing generic/biosimilar competition.

Investors: Anticipated biosimilar market entries are a key risk factor; monitoring regulatory approvals and patent statuses is critical.

Conclusion

The Insulin Aspart Flexpen market is poised for significant transformation over the next decade driven by biosimilar competition, regulatory reforms, and technological innovation. While current prices remain high, market forces and cost-cutting measures forecast a steady decline in prices, benefitting payers and patients alike. Manufacturers must adapt pricing strategies, innovate device features, and foster competitive differentiation to secure long-term market positioning.

Key Takeaways

-

Market Growth: The global rapid-acting insulin market is expanding at a robust CAGR, underpinning sustained demand for Insulin Aspart Flexpen.

-

Pricing Trends: Current prices range around $80–$120 per pen, with future projections indicating a 45–50% reduction by 2030 due to biosimilar competition.

-

Biosimilar Impact: Entry of biosimilar insulins will serve as primary price pressure, promoting affordability and increased accessibility.

-

Regulatory Influence: Evolving policies favoring biosimilar substitution and price controls will accelerate downward price trends.

-

Strategic Considerations: Stakeholders should prioritize device innovation, effective market access strategies, and scalable manufacturing to thrive in a competitive landscape.

FAQs

1. How does biosimilar insulin Aspart affect the market price?

Biosimilar insulins generally enter the market at 20–40% lower than originator prices, leading to significant downward pressure on Insulin Aspart Flexpen prices as they gain market share.

2. Are there significant regional differences in Insulin Aspart Flexpen pricing?

Yes. Pricing varies substantially across regions due to differences in healthcare policies, reimbursement models, and negotiated discounts, with higher prices in the US and lower in Europe and emerging markets.

3. How might technological innovations influence future pricing?

Integration of digital features, smart dosing, and connectivity can justify premium pricing; however, widespread adoption of such innovations will more likely contribute to market segmentation rather than elevate average prices significantly.

4. What role do regulatory policies play in pricing trends?

Regulatory frameworks that facilitate biosimilar approvals and promote generic substitution accelerate price declines, while policies restricting biosimilar uptake can sustain higher prices temporarily.

5. When are biosimilar versions of Insulin Aspart expected to significantly impact prices?

Biosimilars are projected to enter mature markets like Europe by 2024–2026, with due regulatory approvals in the US by 2025–2027, affecting pricing trajectories thereafter.

Sources:

[1] International Diabetes Federation, 2021. Diabetes Atlas 9th edition.

[2] IQVIA, 2022. The Future of Biosimilar Insulins.

More… ↓