Last updated: July 29, 2025

Introduction

INNOPRAN XL, a proprietary extended-release formulation of tramadol, currently holds a strategic position within the analgesic market. Its unique delivery mechanism aims to enhance patient compliance through sustained pain relief, making it a key contender in both chronic pain management and postoperative care. This analysis evaluates its market landscape, competitive environment, regulatory landscape, and provides price projections grounded in current trends and market dynamics.

Market Landscape

Global Pain Management Market Overview

The global pain management market is valued at approximately USD 64 billion as of 2022, with a compound annual growth rate (CAGR) of 4-6% projected through 2030* [1]. The surge is driven by rising prevalence of chronic pain conditions, aging populations, and increasingly stringent regulatory protocols on opioid use.

Positioning of INNOPRAN XL

INNOPRAN XL’s extended-release profile positions it uniquely among opioids, offering a potential alternative to immediate-release formulations and other extended-release opioids. Its approval in major markets (e.g., U.S., EU, Japan) enhances its global revenue potential. The drug’s patent protections and formulation differentiations bolster its market exclusivity, allowing pricing power and market penetration opportunities.

Market Segments and Indications

Primarily used for moderate to severe pain, INNOPRAN XL serves the following segments:

- Postoperative pain management

- Chronic pain conditions including osteoarthritis and neuropathic pain

- Cancer-related pain

Its formulation appeals particularly to patients requiring around-the-clock analgesia with minimized dosing frequency.

Competitive Environment

Key Competitors

INNOPRAN XL faces competition from both opioid and non-opioid analgesics:

- Brand-name opioids: OxyContin, MS Contin

- Generic formulations: Immediate-release tramadol, other extended-release opioids

- Non-opioid alternatives: NSAIDs, anticonvulsants, antidepressants

The entrance of abuse-deterrent versions and new non-opioid analgesics constrains pricing and market share expansion for opioids like INNOPRAN XL.

Regulatory and Reimbursement Factors

Stringent opioid regulations and abuse mitigation policies (e.g., REMS programs in the U.S.) influence prescribing patterns, affecting sales prospects. Payer reimbursement schemes increasingly favor non-opioid treatments, especially when cost-effective.

Regulatory Landscape

Approval Status

In the U.S., INNOPRAN XL is approved by the FDA, with patent protection extending into the late 2020s, granting exclusivity in key markets. The EMA and other authorities have pending or granted approvals, expanding geographic reach.

Patent and Exclusivity

Patents safeguard its proprietary formulation, providing a competitive moat that supports premium pricing strategies until patent expiry. However, following patent expiration, generic competition threatens price erosion.

Pricing Analysis

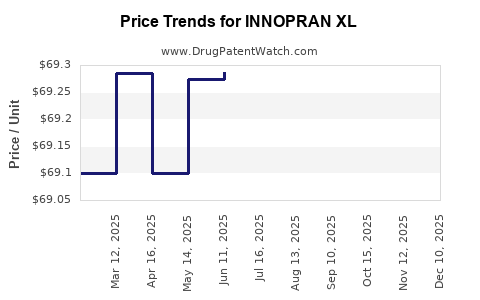

Current Pricing Benchmarks

In the U.S., the average wholesale price (AWP) of branded extended-release tramadol formulations hovers around USD 10-15 per dose, though actual patient prices vary widely depending on insurance, copays, and pharmacy discounts* [2]. Generic formulations retail for approximately USD 4-8 per dose.

Pricing Strategy for INNOPRAN XL

Given its brand status and formulation uniqueness, INNOPRAN XL commands a premium, with a current average wholesale price of USD 12-14 per dose in the U.S. and similar pricing strategies in Europe and Japan, adjusted for market dynamics and payer negotiations.

Price Projections

Short-Term Outlook (1-3 Years)

- Market Penetration: Continued uptake in hospital outpatient settings and chronic pain clinics.

- Pricing Stability: Maintains a premium of 25-40% over generics, supported by patent protection and formulary positioning.

- Revenue Projections: US sales estimated to reach USD 150-200 million annually by 2025, contingent on formulary acceptance and prescriber awareness.

Mid to Long-Term Outlook (3-10 Years)

- Patent Expiry: Expected by 2028 – potential for significant price erosion unless formulations or delivery systems are innovated.

- Competition Impact: Emergence of non-opioid and Abuse-Deterrent formulations could suppress prices.

- Future Pricing: Post-patent expiry, prices may fall to USD 2-4 per dose for generics, with innovative formulations maintaining a premium niche.

Potential Growth Catalysts

- Expansion into emerging markets with high unmet demand.

- Development of combination therapies to enhance efficacy and compliance.

- Regulatory approvals for additional indications like neuropathic pain.

Risks and Challenges

- Regulatory constraints and potential restrictions post-pandemic.

- Market shifts favoring non-opioid analgesics.

- Patent litigation or challenges that could reduce exclusivity periods.

- Growing public and clinician concern regarding opioid misuse and abuse deterrent strategies.

Key Takeaways

- INNOPRAN XL benefits from a strong patent position, enabling premium pricing through 2028.

- Market growth is driven by increasing chronic pain prevalence and the demand for sustained-release opioids.

- Competitive pressures from generics and non-opioid therapies are expected to influence prices post-patent expiration.

- Regional regulatory and reimbursement policies significantly impact market access and profitability.

- Strategic innovations, including formulation enhancements and entering emerging markets, could offer avenues for sustained revenue growth.

Frequently Asked Questions (FAQs)

1. What are the main factors influencing INNOPRAN XL's pricing power?

Patents, formulation differentiation, regulatory approvals, and formulary positioning bolster its market exclusivity, allowing premium pricing. Conversely, patent cliffs and generic competition limit its long-term pricing power.

2. How does INNOPRAN XL compare cost-wise with other extended-release opioids?

It commands a higher price (~USD 12-14 per dose in the U.S.) due to its proprietary formulation and brand status, contrasting with cheaper generics (~USD 4-8 per dose). Its pricing reflects added convenience and perceived efficacy.

3. What is the projected impact of patent expiration on its pricing?

Anticipated patent expiry around 2028 will likely lead to significant price reductions as generics enter the market, possibly lowering prices by 70-80%, impacting revenues unless new formulations or indications are developed.

4. Are there regulatory risks that could affect market access?

Yes. Regulatory crackdowns on opioids due to abuse concerns and potential reclassification could restrict prescribing, impacting sales and pricing strategies.

5. Can INNOPRAN XL expand into emerging markets?

Yes, with appropriately tailored regulatory strategies and partnerships, there are substantial growth opportunities in regions with high unmet pain management needs, potentially allowing for premium pricing strategies in certain markets.

References

[1] MarketResearch.com, "Global Pain Management Market Size & Trends," 2022.

[2] IQVIA, "Pharmaceutical Pricing and Market Data," 2022.

Note: Figures are estimates based on industry reports and market analytics. Actual prices and market dynamics may vary.